Editor's PiCK

Ethereum Spot ETF, $5.4 Billion Net Inflow in July...Highest Since Launch

Summary

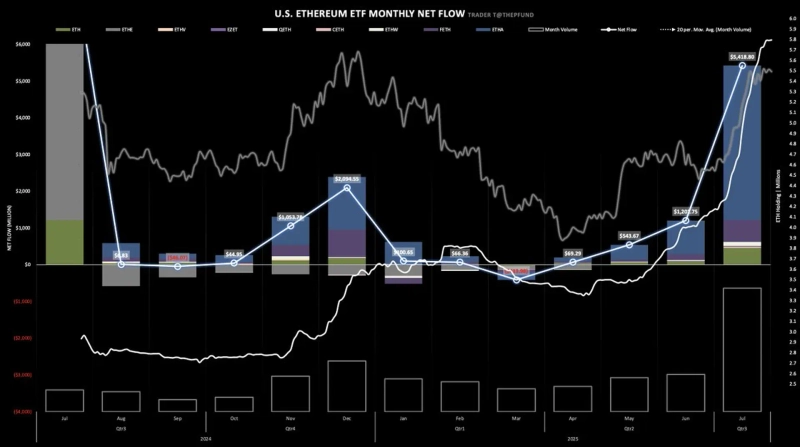

- The Ethereum (ETH) spot Exchange-Traded Fund (ETF) recorded a net inflow of $5.4 billion in July.

- In July, the Ethereum price soared by 49%, with accelerated capital inflow via spot ETFs cited as a key factor.

- 'ETHA,' operated by BlackRock, saw the largest single net inflow at $4.2 billion, accounting for 78% of the total.

The Ethereum (ETH) spot Exchange-Traded Fund (ETF) recorded a total net capital inflow of $5.4 billion in July. This marks the largest monthly figure since its launch, and is 2.6 times the inflow recorded in the second month after ETF approval.

Throughout July, Ethereum’s price surged by 49%, rising from $2,486 to $3,698. On a monthly basis, this formed the longest bullish candle since October 2021. The acceleration of capital inflows through spot ETFs played a decisive role in this sharp price increase.

The ETF with the largest inflow this month was 'ETHA', operated by BlackRock, which attracted $4.2 billion, accounting for 78% of the total inflow. Next was Fidelity, with $599 million, and the Grayscale Mini ETF with a net inflow of $459 million.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)