Bitcoin Spot ETFs See Net Inflow of $6 Billion in July — The Third Largest on Record

Doohyun Hwang

Summary

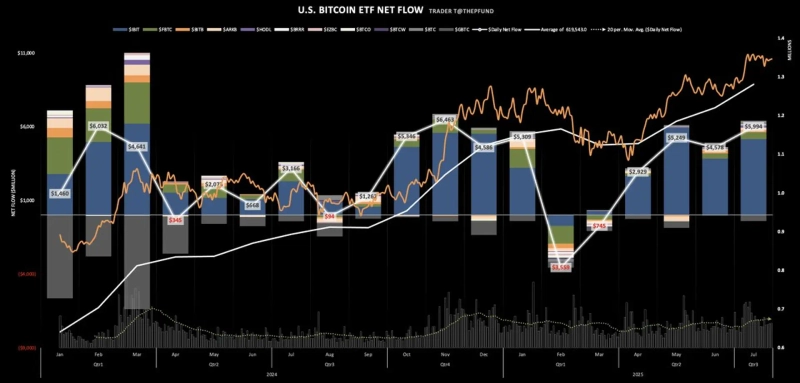

- A net inflow of $6 billion was reported for spot Bitcoin (BTC) ETFs over the month of July.

- During this period, the price of Bitcoin rose by approximately 8%, with institutional inflows through ETFs believed to be driving this increase.

- Notably, BlackRock's IBIT ETF accounted for about 87% of the total inflow, highlighting concentrated institutional interest.

Last month, spot Bitcoin (BTC) exchange-traded funds (ETFs) saw a total net inflow of $6 billion. This amounts to 52,000 BTC, marking the third-highest monthly inflow on record.

Over the same period, the price of Bitcoin rose approximately 8%, from $107,173 to $115,761. This is seen as institutional capital inflows via ETFs driving up the price.

The ETF with the largest inflow this month was BlackRock's 'IBIT,' which saw an inflow of 44,181 BTC (worth $5.2 billion), accounting for about 87% of the total. Fidelity saw inflows of $454 million, ARK Invest attracted $184 million, and VanEck and Bitwise followed with $147 million and $139 million, respectively.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)