Korean Individual Investors Favor Virtual Asset-Related Stocks Over Big Tech

Summary

- It was reported that preference for virtual asset-related stocks has increased among overseas stock investors.

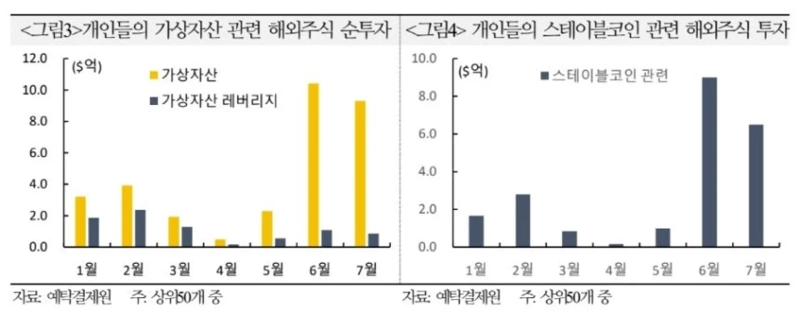

- Notably, with a focus on the stablecoin theme, the share of virtual asset-related stocks expanded sharply from 8.5% in January to 36.5% in June.

- In June, Circle Internet topped net buying, and in July, major net bought stocks included virtual asset exchanges such as Coinbase and companies holding Ethereum.

An analysis has revealed that virtual asset (cryptocurrency) related stocks are attracting attention among individual investors investing in overseas stocks.

According to the industry on the 11th, the International Financial Center stated in a report, "Driven by the passage of the GENIUS Act in the U.S., investments in virtual assets have expanded, centered around the stablecoin theme."

Overseas stock investments by individual investors known as 'Korean Ants' continued to record an average monthly net buying of $3.8 billion from January to April this year, but turned to a net selling of $1.29 billion in May and $390 million in June. Although last month (1st to 29th) saw a net buying of $490 million again, the scale has declined.

By stock, the net buying volume of the top 7 major Big Tech companies (M7) dropped from a $1.68 billion monthly average during January to April this year to $440 million in May, $670 million in June, and $260 million in July.

In contrast, the proportion of virtual asset-related stocks has expanded significantly.

This share was only 8.5% in January, yet rose to 36.5% in June and 31.4% in July, exceeding 30%.

In particular, in June, Circle Internet, issuer of the second-largest stablecoin by market capitalization, USDC, ranked first in net buying, and in July, 5 out of the 10 top net bought stocks were virtual asset exchanges such as Coinbase or Ethereum (ETH) holding companies like Bitmine.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)