"Everything will be encrypted"... New Jobs Emerging in the Crypto Industry [Korea Economic Daily Koala]

Summary

- The crypto industry, with its advanced core technologies such as Blockchain, digital assets, and tokenization, is emerging as a driver of national competitiveness.

- With the global crypto revolution led by the United States accelerating, the potential for large-scale job creation and industrial growth is significant if regulatory obstacles are removed and policy support is in place.

- As with past examples in Switzerland and Singapore, combining legal clarity with development policies can lead to major inflows of global capital.

Minseung Kim's ₿ficial

Let's Create Jobs with Crypto

Not long ago, even non-majors could become developers by learning coding at academies. For liberal arts students, becoming a developer was a beacon of hope. However, the situation is changing. It has not been long since artificial intelligence (AI) emerged, but hiring for developers is rapidly decreasing. Even graduates from prestigious domestic universities who would target "Naver, Kakao, Line, Coupang, Baedal Minjok, Danggeun Market, and Toss" are now greatly concerned about employment.

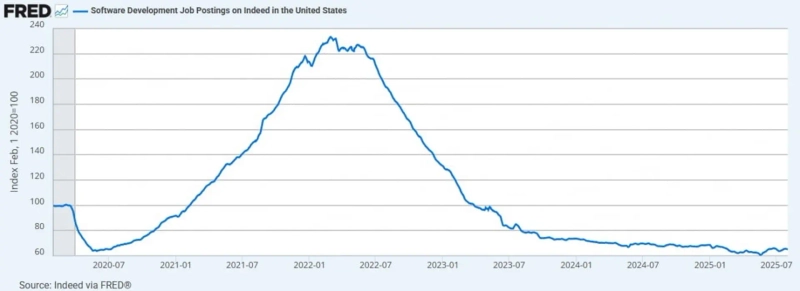

According to FRED data from the Federal Reserve Bank of St. Louis, the number of software developer job postings on Indeed, a famous U.S. job search service, peaked in 2022 and has since declined rapidly. Deteriorating economic conditions play a role, but the more fundamental reason is that the spread of AI is replacing the roles of junior and mid-level developers. Just as kiosks replaced sales clerks, AI has begun to substitute for many office-based knowledge workers, and for manual labor, physical AI—that is, robots—are likely to take over. The IMF warns that up to 40% of all jobs could be automated by 2030.

The AI industry is being monopolized by the U.S., and the robotics market will probably be dominated by China. In this situation, should we simply follow global trends and accept job losses and industrial downsizing? The answer is no. Fortunately, we still have options. Just as Admiral Yi Sun-sin had twelve ships left, there remain industries of strategic value. One of those is the crypto industry. (Crypto encompasses digital assets, virtual assets, cryptocurrencies, Blockchain, and decentralized identity verification (DID), among others.)

The crypto industry not only increases jobs but can also become a core sector of national competitiveness, like semiconductors or shipbuilding. It's not just about issuing and selling coins. As the advent of "computers" and the "internet" transformed all industries, the adoption of the distributed ledger that is "Blockchain" will also revolutionize all sectors beyond financial markets. Especially, the combination of AI and virtual assets will only accelerate this change.

Balaji Srinivasan, the former CTO of Coinbase, predicts that "All property becomes cryptography"—envisioning a future where more than 99% of all valuable assets, from physical items like digital door locks or car keys to financial assets, will be securely managed and traded on a Blockchain-based system. His argument is that, unlike legacy Web2 infrastructure which is perpetually exposed to hacking and attacks, public Blockchain is structurally far more secure.

Larry Fink, chairman of BlackRock, has long advocated for the "tokenization of all assets." If ETFs were the start of technological innovation, tokenization is the next stage. In practice, BlackRock is running its Treasury-based money market fund BUIDL as a tokenized product, and Robinhood is providing tokenized shares of popular companies like OpenAI and SpaceX to its European customers.

So, can the crypto industry be profitable? There are precedents abroad. During the ICO boom of 2017–2018, Switzerland and Singapore—having clear legal structures and regulations for conducting ICOs—each attracted $1.9 billion and $1.1 billion, respectively. More than ₩3 trillion in investment capital flowed in over a short period. This influx of global capital immediately boosted local employment in development, law, security, and marketing. Even now, the companies and foundations established at that time still operate globally, and both governments continue to collect taxes from them.

Crypto always had this much potential. It's just that during the ICO era, technology application was lacking, and COVID-19 stalled innovation. After the 2022 crypto crash, the Democratic Party and the Biden administration led a strong anti-crypto policy through the SEC, halting industry growth for around three years. However, with the inauguration of President Trump and the start of deregulation, crypto is once again emerging as a growth engine for the economy and industry. The market cap of virtual assets, which didn’t exceed $1 trillion in 2023, has now surpassed $4 trillion.

To the general public, the crypto industry may only be known for minting and trading coins, but over the past decade, cryptography technologies such as zero-knowledge proofs, fast and cheap Blockchain networks, and decentralized finance (DeFi) have rapidly advanced. Crypto is now becoming interconnected with many industries led by global companies and financial institutions. Through ETFs and Digital Asset Treasury (DAT) strategies, traditional capital markets are absorbing digital assets, and "tokenization" is bringing traditional assets onto blockchains.

This is not a change occurring only in financial markets. Numerous assets, such as characters and patents (IP), computing power, geographic data, and internet infrastructure, are being traded through crypto integrations. This means crypto professionals are needed not only in the crypto sector itself, but also in various other industries.

Now Korea stands at a crucial crossroads. Should we mistrust and regulate crypto and stifle it, as we did over the past eight years, or actively embrace it to create new jobs and develop it as an export industry? We are a country with world-class speed in absorbing digital trends. Even without a crypto-friendly policy environment, 10 million of our citizens are investing in digital assets directly. The Blockchain developer and corporate ecosystem may have reduced in size, but it remains alive. Now is the time to decide whether to nurture this spark or let it die.

When the Kim Dae-jung administration brought broadband internet nationwide, critics objected: "Are taxes being spent on games and adult content?" Yet, a quarter century later, Korea has become a global cultural powerhouse by growing esports, K-pop, webtoons, dramas, and animation—all riding on fast, universally accessible internet. The national brand has risen, and the number of foreigners studying Korean and Korean culture has exploded. Content and tourism industries now generate significant foreign currency.

Crypto will be no different. It is both a foundational technology capable of impacting all industries and a core of a new economic system. Just as personal computers and the internet started an information revolution that changed every industry, crypto is the starting point of the next revolution. Developing domestic crypto enterprises will not only create jobs at home but can also earn foreign exchange abroad on the global stage.

With a U.S.-led global crypto revolution just beginning, we are one of the few countries with all three elements—investors, developers, and companies—already in place. By providing legal clarity and national development policies, we can strategically foster high-quality, global advanced businesses, laying the foundation for us to leap forward as a "crypto advanced nation." The U.S. is leading in AI, China in robotics, and for the Republic of Korea to become a crypto powerhouse is not an impossible dream. It calls for an academic way of seeing problems and a merchant's sense of reality.

Minseung Kim, Head of Korbit Research Center...

He is a founding member and the current head of the Korbit Research Center. He specializes in explaining complex events and concepts from the Blockchain and digital asset ecosystem in an accessible way and helping people with diverse perspectives understand each other. He has experience in Blockchain project strategy planning and software development.

▶ This article is an external contributor’s column introduced to provide various perspectives for cryptocurrency investment newsletter subscribers, and does not reflect the opinion of the Korea Economic Daily.

Mihyun Jo, Reporter mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)