Record Highs in US and Japan... KOSPI Stuck in a Box Range for a Month

공유하기

- The domestic stock market has remained in a box range for the past month, contrasting with major markets such as the US and Japan, which have hit record highs.

- The main reasons for KOSPI’s sluggishness are the weak Q2 earnings, policy uncertainties such as the tax reform proposal, and a slowdown in foreign capital inflows.

- Q3 earnings and final policy direction are cited as the key variables for any future market rebound, and investors are advised to keep a close watch.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Fell from 1st Place to Lower Ranks in H1

S&P 500 up 3%, Nikkei up 8%

KOSPI only rises 0.3%

Poor Q2 Earnings of Listed Companies

Disappointment Over Possible Capital Gains Tax Tightening

Key to Rebound Lies in Earnings and Policy Direction

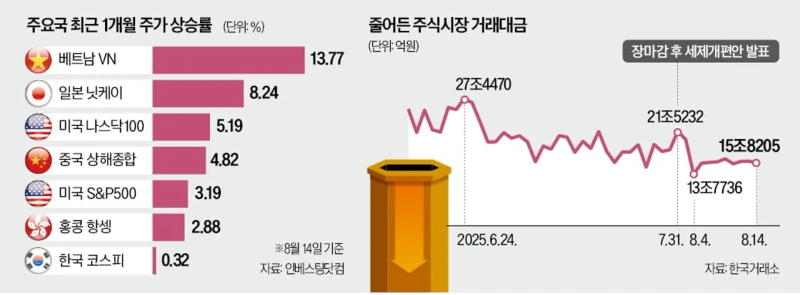

The domestic stock market, which had continued its upward trend since the start of the year, has become stuck in a box range this month. While global markets like the US and Japan have been hitting historic highs, the Korean market is being left out. After rapid gains in the first half and uncertainty over tax reform, the market has lost its momentum. Experts say that Q3 earnings and policy direction should be watched as key variables influencing the market's future direction.

◇Falling Behind Major Global Markets

According to the Korea Exchange on the 15th, the KOSPI Index has risen only 0.32% this month. In the same period, Japan's Nikkei Average rose 8.24% and the US S&P 500 climbed 3.19%, both reaching record highs. The KOSPI's rise was only 22nd out of 30 major markets during this period.

Trading value, which reflects the vitality of the stock market, has also been on the decline. Last month, the average daily trading value was ₩18.747 trillion, but this month it fell to ₩16.1674 trillion. On the 4th, it dropped to about ₩13 trillion. This is seen as a result of investor sentiment weakening after the tax reform proposal was announced on July 31. Lee Kyung-min, a researcher at Daishin Securities, evaluated, "The domestic market has been responding weakly to both good and bad news, and the wait-and-see attitude continues at the 3,200 level."

Until the first half of this year, the KOSPI Index had the highest growth rate among major markets. The passage of amendments to the Commercial Act and other strong government policies lifted expectations that Korea's 'discount' in global markets would be resolved. The turnaround happened at the end of last month, as the new tax reform plan was released. Measures such as the separate taxation on dividend income and the tightening of major shareholder criteria for capital gains tax fell short of investor expectations.

Secondly, the Q2 corporate earnings were lower than forecast by the securities industry, which negatively affected investor sentiment. According to Shinhan Investment Corp., KOSPI-listed companies posted a combined net profit of ₩36.5 trillion in Q2, 5.6% below expectations. While the financial sector outperformed expectations, underperformance in consumer goods, healthcare, and energy weighed on the results.

The pace of foreign capital inflow also slowed down. Foreign investors made net purchases of about ₩2-3 trillion monthly in the domestic market from May to July, showing strong demand. The faster capital inflow was driven by the won-dollar exchange rate falling in the first half. However, since last month, the won-dollar rate has edged up, and as a result, foreign net buying is only ₩600 billion so far this month. Since foreigners investing in emerging markets like Korea also factor in exchange rate gains, a continued strong dollar diminishes the attractiveness of Korean equities.

◇Q3 Earnings and Policy Direction 'in Focus'

Market analysis suggests that whether the domestic market can break out of its box range will depend on Q3 earnings and the ultimate direction of policy. Experts expecting a rebound point out that while Q2 results disappointed, Q3 earnings forecasts are being revised up.

Noh Dong-gil, a researcher at Shinhan Investment Corp., said, "With tariffs fixed at 15% to match the European Union and Japan, export volume to the US will be maintained," and added, "While Q2 earnings led to a short-term market correction, we expect a rebound after the earnings season ends."

The final direction of the tax reform is also considered an important variable for the market's future path. Among various policy factors, the biggest blow to sentiment was the plan for separate taxation on dividend income. Noh commented, "The new proposal not only has a higher tax rate but also applies more stringent standards for eligibility," and warned, "If the dividend tax rate remains at current levels, it could act as a barrier to new capital inflows."

The unfavorable macroeconomic environment in the second half is also a burden. Concerns are rising that persistently high inflation in the United States could weigh on global markets. Ko Tae-bong, head of research at iM Securities, commented, "Overall, the global equity market is overvalued, and long-term rates remain high," adding, "Korean exports may slow due to tariff impacts, making it likely that the domestic market will see stagnation in the second half."

Reporter Suji Na suji@hankyung.com

![New York Fed president "Monetary policy well positioned for 2026" [Fed Watch]](https://media.bloomingbit.io/PROD/news/2da39825-898f-4c9b-8ffd-e0e759e15eb3.webp?w=250)