Editor's PiCK

Korean New Listings and Meetup Craze: Korean Crypto Weekly [INFCL Research]

Summary

- Last week in the Korean market, ETH, XRP, and SOL—major Layer 1 tokens—recorded high trading volumes, reflecting continued investor interest.

- It was noted that emerging and platform-based tokens had concentrated trading volume on Upbit, while existing altcoins and stablecoins saw concentrated trading on Bithumb.

- Both Upbit and Bithumb showed pronounced price volatility in mid-cap and small-cap tokens, pointing to differences in risk appetite among their investors.

1. Market Overview

Last week in the Korean market, large asset trading was active, with new listings such as Cyber and Towns joining. ETH and XRP each recorded multi-billion dollar trading volumes, driving the total market activity significantly, while SOL and BTC also maintained high volumes. This demonstrates that major Layer 1 tokens and blue-chip tokens remain at the core of Korean trading activity.

At the same time, mid-cap tokens have taken on an increasingly important role. Newly listed assets such as CYBER and PROVE quickly attracted significant attention, while popular community tokens like ENA, PENGU, and SOON showed how user preference is split between emerging and established altcoins. The overall market displays a two-track structure: top cryptocurrencies absorb most of the liquidity, while select mid-caps provide active traders with high-beta opportunities.

2. Exchanges

2-1. Newly Listed Coins

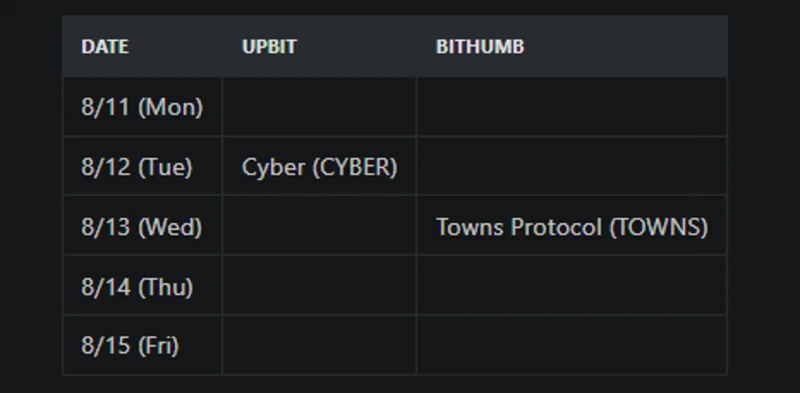

Last week, several new listings appeared on major Korean exchanges.

Key Marketing Strategies & Highlights

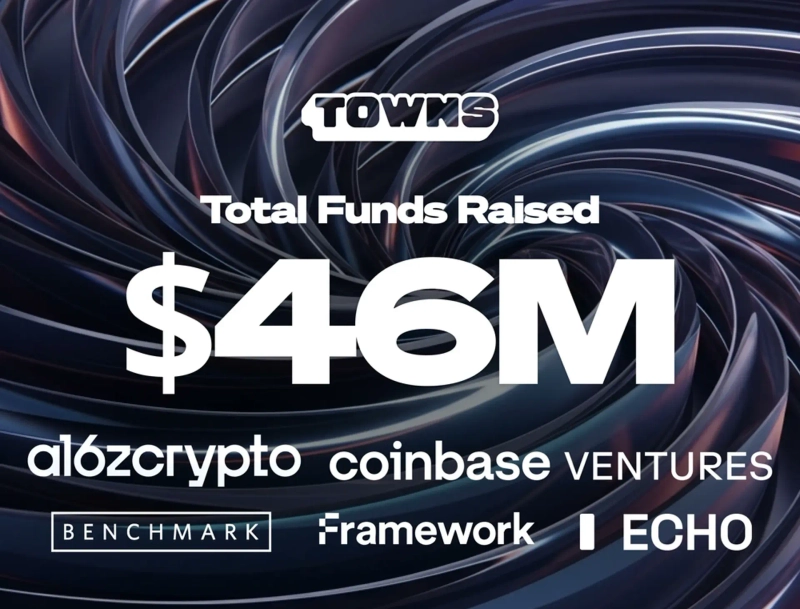

Town Protocol (TOWNS)

Towns is a project positioned as a decentralized Discord-like platform, onboarding a number of local KOLs for its marketing. Beginning with a lead investment by the popular a16z, it appears to have entered the Korean market early during its testing phase.

Towns allows each KOL to create their own town, enabling community members to interact with each other within the platform. By integrating elements necessary for daily interactions, the platform encourages ongoing engagement, with KOLs regularly guiding members to make use of the features.

Towns goes beyond simple platform participation, emphasizing and discussing the importance of community decentralization in depth. Through regular platform updates, improvements and additional features were shared in real-time.

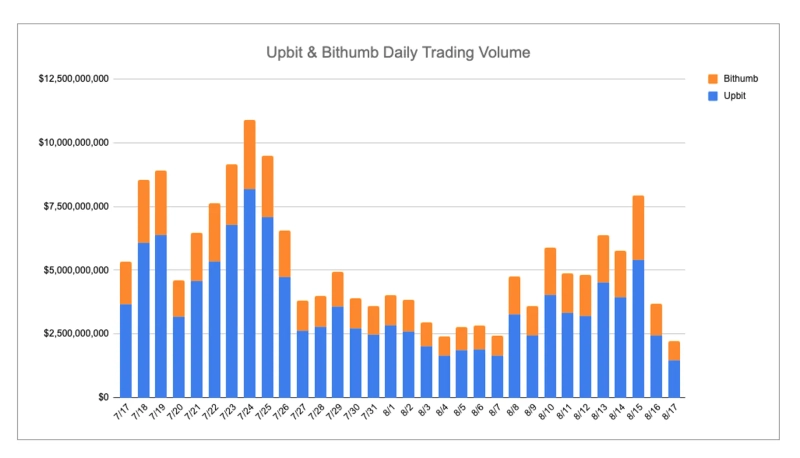

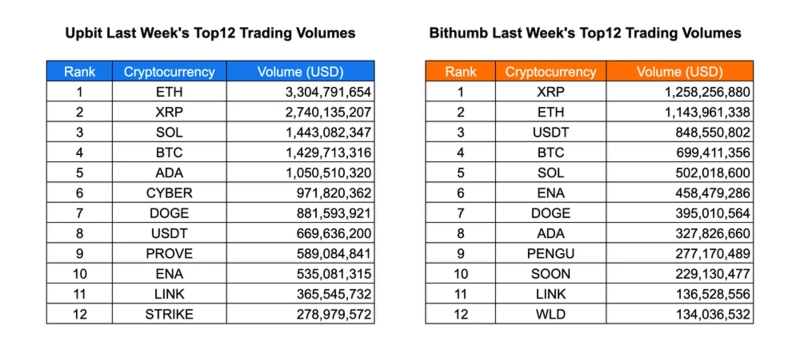

2-2. Trading Volumes

Last week, Upbit and Bithumb displayed distinct trading volume patterns across the top 12 cryptocurrencies. Upbit’s highest volume was in ETH ($3.3 billion), followed by XRP ($2.74 billion) and SOL ($1.44 billion), indicating intensive investments in top Layer 1 and utility tokens. In contrast, Bithumb's top volumes were recorded in XRP ($1.26 billion), ETH ($1.14 billion), and USDT ($848 million), reflecting a slight increase in stablecoin trading alongside popular altcoins.

On both exchanges, BTC maintained significant trading volume, ranking fourth with $1.43 billion on Upbit and $699 million on Bithumb, highlighting BTC’s persistent centrality in trading activity. Mid-cap tokens such as ADA, SOL, and DOGE remained in the upper ranks, while Upbit-exclusive high-volume tokens like CYBER and PROVE showed notable trading interest on specific platforms. Bithumb demonstrated a unique concentration of trading volumes in ENA, PENGU, and SOON, indicating diverse trading preferences among its user base.

The comparative analysis reveals that both exchanges prioritize liquidity in top cryptocurrencies; however, Upbit shows a greater inclination towards emerging and platform-based tokens, whereas Bithumb emphasizes high trading volumes in existing altcoins and stablecoins. These differences may affect short-term trading strategies and liquidity distribution among platform participants.

2-3. Top 10 Gainers

Last week, Upbit and Bithumb showed distinctive patterns among leading cryptocurrencies. On Upbit, MNT led the gains with a 26.79% increase, followed by ARB (+22.92%) and STRIKE (+21.65%), highlighting strong momentum in mid-caps and platform-focused tokens. ADA and LINK also rose by 19.79% and 19.55%, reflecting ongoing interest in major Layer 1 tokens.

Bithumb saw its biggest gainer in SKL, which spiked 72.84%, far outpacing other assets. CTSI jumped 47.71% and ORDER 23.49%, demonstrating steep rises for small-cap and DeFi-related tokens. MNT also performed well on Bithumb with a 21.84% gain, while ADA rose 16.22% and ARB 16.27%, showing some asset overlap in trends across the two exchanges.

Overall, Upbit's price changes were relatively moderate yet consistent among both mid-caps and major cryptos, while Bithumb experienced sharper fluctuations—especially among smaller and niche tokens. This indicates differences in trading behavior and investor risk appetite between the platforms.

*All information is provided solely for informational purposes and is not intended as the basis for investment decisions, nor as investment advice or recommendations. The content does not constitute legal, tax, or any other type of advice, and no responsibility is assumed.

INF Crypto Lab (INFCL) is a consulting firm specialized in blockchain and Web3, offering one-stop services for establishing corporate Web3 entry strategies, tokenomics design, and global market expansion. Backed by accumulated know-how and reference cases, INF Crypto Lab provides both strategy development and execution for major domestic and international securities firms, game companies, platforms, and global Web3 enterprises, driving sustainable growth within the digital asset ecosystem.

This report is independent of any editorial direction of the media outlet, and all responsibility for the information provided lies with the provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)