[Analysis] "Bitcoin Falls Below 30-Day Moving Average, Ethereum Rises Above… Solana and XRP See Increased Volatility"

Summary

- "Bitcoin" fell below the 30-day moving average due to profit-taking, macroeconomic uncertainty, and increased exchange deposits from short-term holders.

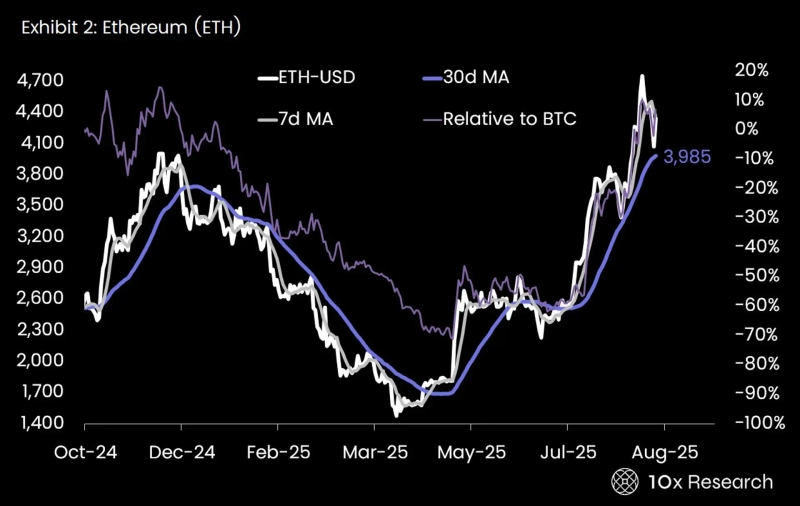

- "Ethereum" is experiencing continued institutional accumulation but faces simultaneous selling pressure from staking withdrawals and ETF fund outflows.

- "Solana" and "XRP" saw increased volatility due to inflation indicators, whale investor trades, and regulatory issues. After a short-term rally, their upward trends have subsided.

Major cryptocurrencies are moving in diverging directions.

On the 21st (local time), 10X Research reported, "Bitcoin (BTC) has dropped below the 30-day moving average, while Ethereum (ETH) has risen above it. Solana (SOL) and XRP have experienced sharp fluctuations due to macroeconomic variables and regulatory issues."

They continued, "Bitcoin declined near its all-time high due to profit-taking, macroeconomic uncertainty, and increased exchange deposits from short-term holders. Ethereum is seeing continued large-scale institutional accumulation, but also faces selling pressure from staking withdrawals and ETF fund outflows."

According to 10X Research, Solana plummeted after the release of inflation indicators, with volatility further increased by large transactions from whale investors. XRP saw a rally on expectations of resolving its lawsuit with the U.S. Securities and Exchange Commission (SEC), but its upward trend reversed due to profit-taking and a cooling derivatives market.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)