Summary

- According to Kaito’s Token Mindshare, Bitcoin and Ethereum have taken the top two spots, drawing heavy interest from investors.

- It is reported that a whale investor’s actions—selling Bitcoin then buying Ethereum, as well as additional Ethereum futures and staking—influenced the contrasting price trends of the two assets.

- Arthur Hayes drew attention to Hyperliquid’s growth potential; interest in Coinbase and Monad is also running high.

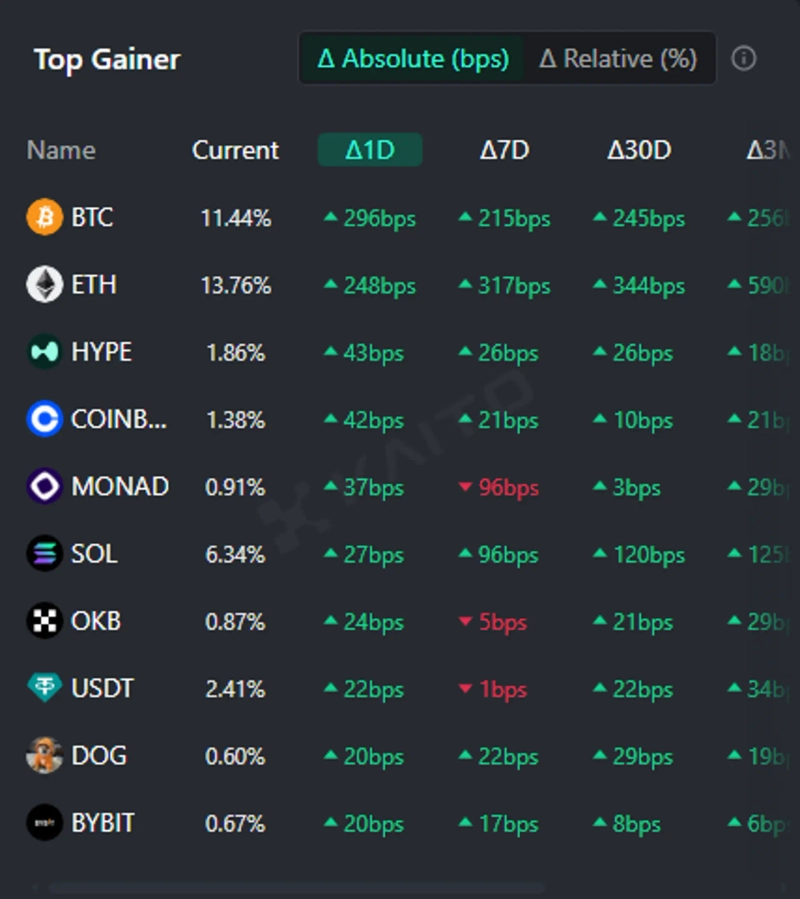

According to the Token Mindshare (a metric quantifying the influence of specific tokens in the virtual asset market, Top Gainer) from the AI-based Web3 search platform Kaito, as of the 25th, the top five virtual asset-related keywords capturing the most public attention are Bitcoin (BTC), Ethereum (ETH), Hyperliquid (HYPE), Coinbase (COINB), and Monad (MONAD).

The first and second places are held by Bitcoin, the leading cryptocurrency, and Ethereum, the leading altcoin. Investors are focusing on the divergent trends of these two assets. First, Bitcoin expanded its decline and gave up $113,000 during the session. After a post-Jackson Hole spike to $116,000, much of the gains were lost due to today's drop.

In contrast, Ethereum hit a new intraday high of $4,950 overnight. Although it was on the verge of surpassing $5,000, it did not break through that threshold. Ethereum recovered above the $4,800 level following the Jackson Hole meeting and has maintained a strong uptrend so far. As of 1:11 p.m. today, Ethereum is trading at $4,721, down 1.33% from the previous day.

The contrasting price moves of these two assets are thought to have been impacted by an anonymous whale’s 'Bitcoin sell, followed by Ethereum buy' transaction. According to analyst MLM, a longtime whale recently sold 18,142 BTC for $2,040,000,000. Using the proceeds, the whale bought Ethereum. So far, approximately 416,600 Ethereum have been purchased, along with the opening of 135,263 Ethereum perpetual futures long positions. Additionally, 275,500 Ethereum have already been allocated to staking.

Hyperliquid took third place. Arthur Hayes, co-founder of BitMEX, drew investor attention by stating that 'Hyperliquid could rise up to 126 times.' Participating at WebX Summit in Tokyo, Hayes explained, 'Hyperliquid’s stablecoin expansion strategy could be the key driver of its growth,' and projected that 'by 2028 the global stablecoin supply could reach $10 trillion, with Hyperliquid commanding a 26.4% share.'

Coinbase, a cryptocurrency exchange, ranked fourth.

Finally, Monad rounded out the top five. Monad, listed in the Kaito Yapfer project, likely owes its ranking to increasing proactive participation from Yapfer investors.

In addition, investors are also showing interest in Solana (SOL), OKB, Tether (USDT), DogeDog (DOG), and Bybit.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.![[Today’s Key Economic & Crypto Calendar] Atlanta Fed GDPNow, More](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] Rebound on bargain hunting in blue chips…Apple jumps 4%](https://media.bloomingbit.io/PROD/news/3710ded9-1248-489c-ae01-8ba047cfb9a2.webp?w=250)