Editor's PiCK

Bitcoin sideways this week… Ethereum steady · Solana strong [Lee Su-hyun's Coin Radar]

Summary

- This week Bitcoin moved sideways without a clear direction, with volatility increasing due to leveraged position liquidations and global economic factors.

- Ethereum showed stability after hitting an all-time high, but increased unstaking volume and seasonal weakness leave room for short-term correction, although year-end targets have been raised.

- Solana continued its rally supported by institutional investment and strategic capital inflows, with key support secured and ETF expectations providing room for further gains.

<Lee Su-hyun's Coin Radar> is a column that reviews the flow of the cryptoasset market over the week and provides in-depth explanations of the background. Beyond a simple listing of prices, it analyzes global economic issues and investor movements in three dimensions, offering insights to gauge the market's direction.

Major coins

1. Bitcoin (BTC)

Let's look at Bitcoin's trend this week. Bitcoin continued a downtrend since the 22nd and on the 25th intraday even fell below the $110,000 level for the first time in about two months. It then slightly rebounded and is currently trading around $111,000 on CoinMarketCap while fluctuating. In the short term, buying and selling pressures are intertwined, so it is moving sideways without a clear direction.

Last week, when Fed Chair Jerome Powell hinted at the possibility of rate cuts, the market briefly showed signs of relief. However, as time passed, expectations faded and Bitcoin failed to sustain its rebound.

In addition, a large number of leveraged positions in the crypto market were liquidated, expanding the decline. On the 25th alone, about $700 million worth of leveraged positions were forcibly liquidated, of which $627 million were long positions. This shows that investors still weighed Bitcoin's upside, but ultimately it acted as a factor that increased market volatility.

An interesting analysis also emerged. There appears to be a correlation between NVIDIA's earnings announcements and Bitcoin prices. Ali Martinez, a crypto analyst, said, "Bitcoin tends to weaken about five days before NVIDIA's earnings announcement and repeats weakness for two to three days after the announcement." Since NVIDIA symbolizes the AI craze and sits at the center of the tech rally, its earnings announcements are said to affect risk asset investor sentiment broadly.

Now the market's attention is on the U.S. July core Personal Consumption Expenditures (PCE) price index release. The market forecast is a 2.9% year-on-year increase. If inflation comes in higher than expected, inflationary pressure could re-emerge, increasing the likelihood of the Fed keeping rates unchanged. This would significantly affect crypto investor sentiment, and Bitcoin's sideways trend is likely to continue for the time being.

2. Ethereum (ETH)

Ethereum surpassed $4,900 on the 25th, recording an all-time high. Profit-taking followed and it underwent a short-term correction, but it quickly regained stability. It is currently trading around $4,300–$4,500 on CoinMarketCap, showing a relatively stable trend.

Analysts say large investors' capital movements were decisive in this trend. Jacob King, an analyst at WhaleWire, explained, "Bitcoin's plunge was caused by large investor selling, and those sold funds flowed into Ethereum purchases." According to CoinShares, over the past month Ethereum-based investment products saw net inflows of $2.5 billion, while Bitcoin investment products saw net outflows of $1 billion.

However, short-term correction risks remain. CoinGlass data shows Ethereum has tended to weaken repeatedly in September: in 2021 it surged 35% in August and then fell 12% in September. Considering seasonal patterns, the possibility of a short-term decline in Ethereum this coming September cannot be ruled out.

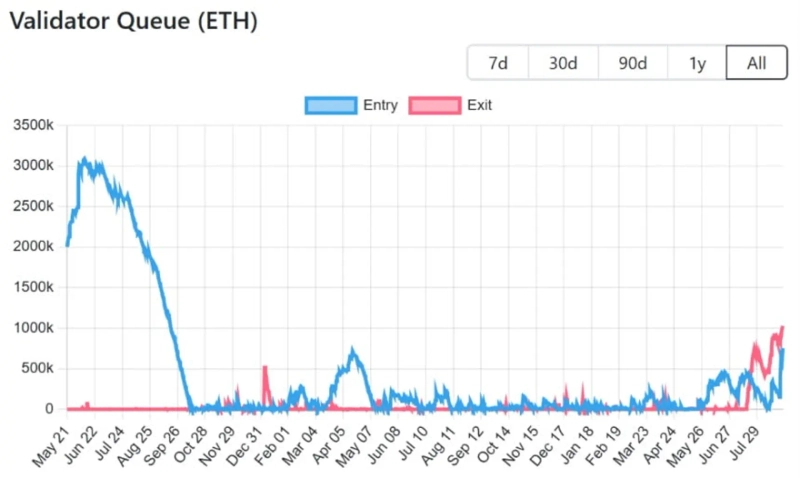

Another variable exists. As of the 28th, Ethereum unstaking (withdrawal) volume exceeded 1,000,000 tokens. That is worth about $4.96 billion at current value, approximately 6.89 trillion won. If this queued withdrawal volume actually enters the market, it could act as short-term selling pressure, analysts say.

But the mid- to long-term outlook is positive. Standard Chartered recently raised its year-end target for Ethereum to $7,500. Fundstrat projected Ethereum could reach $10,000–$12,000 by year-end.

3. XRP (XRP)

XRP fell below the $3 level as of the 25th. It attempted a rebound the next day but fell slightly again and is currently trading in the $2.8 range. With short-term rebound momentum weakening, investor sentiment has also contracted.

According to CoinGlass, XRP futures open interest fell from $11 billion to $7.7 billion in one month, a decline of about 30%. A decrease in open interest typically indicates reduced profit-seeking by leveraged investors and less speculation. In fact, in January under similar conditions XRP's price plunged more than 50%.

The short-term outlook is also negative. Foreign outlet Cointelegraph analyzed that if the decline in futures open interest continues, XRP could be pushed down to $2.33–$2.65 in the short term. However, there are elements that could reverse this move in the mid- to long-term. The approval of spot ETFs and the bank licensing result for Ripple Labs are expected to be announced around the same time. If both events yield positive results, XRP could regain upward momentum.

Notable coins

1. Solana (SOL)

Solana showed the most notable gains among altcoins this week. It rebounded on the 26th and broke above $210, rising more than 15% on CoinMarketCap over the week. It is currently trading at $208.5, continuing its strong trend.

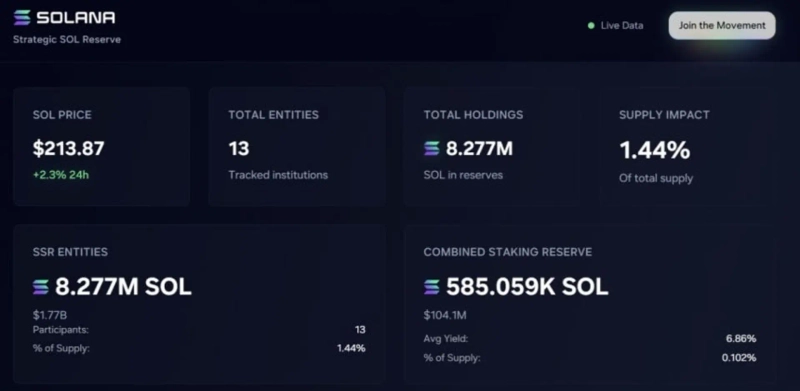

Institutional accumulation was decisive in this rally. Nasdaq-listed SharpTech made a $400 million strategic investment, and Galaxy Digital, Jump Trading, and Multicoin Capital pursued a combined $1 billion raise to buy Solana. Another Nasdaq-listed company, DeFi Development, secured Solana via a $130 million paid-in capital increase. Currently, 13 institutions hold a total of 8,277,000 SOL, about $1.77 billion in value. This represents 1.44% of Solana's total supply.

The outlook is also bright. Ali Martinez, a crypto analyst, said Solana has secured strong support in the $188–$206 range. Above that there is no clear resistance, so if buying pressure builds, further gains could gain momentum. Ryan Lee, chief analyst at Bitget, also said, "If $210 is stably breached, short-term targets are $250–$260, and with an ETF launch $300 is possible."

2. Cardano (ADA)

Cardano (ADA) showed a relatively stable trend over the same period. It has risen slightly since the 26th and is holding around $0.85.

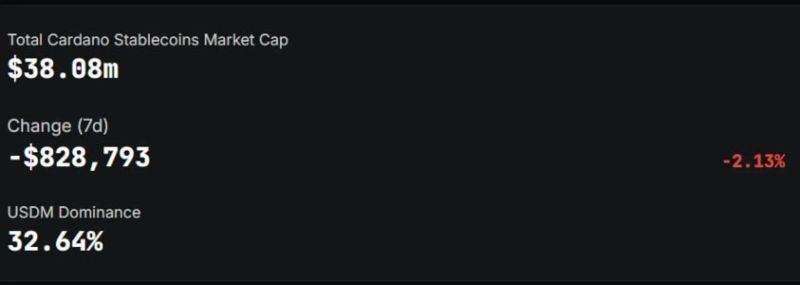

Cardano has attracted attention recently for expanding partnership with Ripple. A key point is whether Ripple's stablecoin RLUSD can be issued on the Cardano network. If realized, it could solve Cardano's long-standing shortage of stablecoin supply.

Comparing figures with other blockchains makes the gap more apparent. According to DeFiLlama, Cardano's stablecoin supply is currently only about $38 million. By contrast, Ethereum, Tron (TRX), and Solana hold stablecoins in the hundreds of millions to tens of billions of dollars. Therefore, if the stablecoin partnership with Ripple materializes, it could be a new growth catalyst for the Cardano ecosystem.

The outlook remains encouraging. The market views spot ETF approval as a potential positive for Cardano. If an ETF is approved and institutional funds flow in, a recovery to $1 is considered possible. In the short term, the $0.82–$0.85 range is analyzed as key support. If this range is defended, a move to break $0.90 could open up.

Lee Su-hyun Bloomingbit reporter shlee@bloomingbit.io

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)