Summary

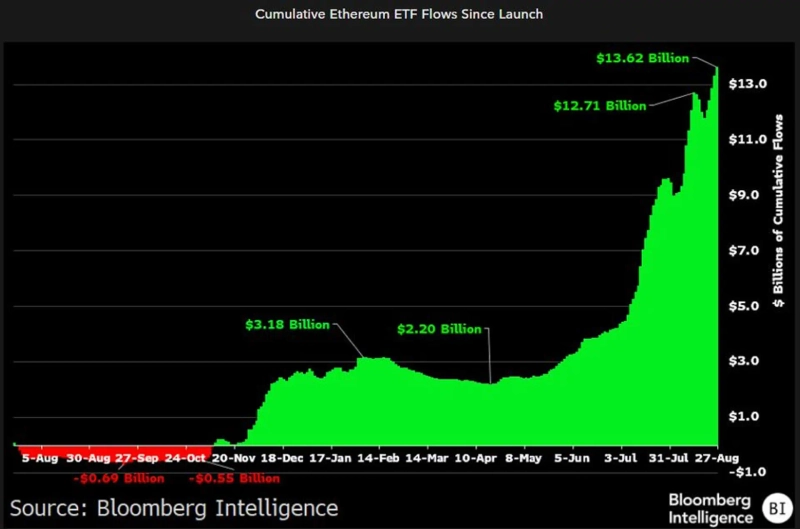

- It reported that Ethereum (ETH) spot exchange-traded funds (ETFs) have seen $10 billion inflows since July this year, bringing the total to $14 billion.

- It stated that Ethereum spot ETFs led the summer rally and posted outperformance compared to Bitcoin.

- It noted that Ethereum spot ETF assets remain below 20% of Bitcoin spot ETFs, so while long-term growth potential is large, it is advisable not to overinvest.

Funds are pouring into Ethereum (ETH) spot exchange-traded funds (ETFs).

On the 30th (local time), Bloomberg analyst James Seyffart said on X, "Since the launch of Ethereum spot ETFs, total inflows have reached about $14 billion, of which $10 billion came in since July this year."

In response, Bloomberg analyst Eric Balchunas explained, "Ethereum ETFs led the summer rally and outperformed Bitcoin, but they showed relatively weak performance during their first 11 months on the market."

He added, "Nevertheless, the current assets of Ethereum spot ETFs are still below 20% of Bitcoin spot ETFs," and "While long-term growth potential is significant, it is better not to overinvest," expressing a cautious stance.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)