Editor's PiCK

Korean virtual asset market, surge in trading volume…Led by Ethereum & XRP: Korean Crypto Weekly [INFCL Research]

Summary

- The domestic virtual asset market reported that Upbit recorded high trading volumes centered on ETH and XRP.

- Retail investor interest in mid-cap and emerging tokens increased, with PYTH and CRO standing out.

- The government's new economic growth strategy was announced, and changes in capital flows between the stock market and crypto could affect crypto market volatility.

1. Market overview

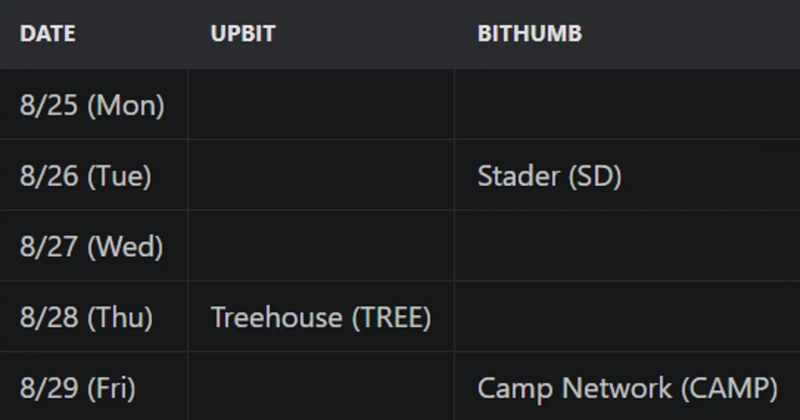

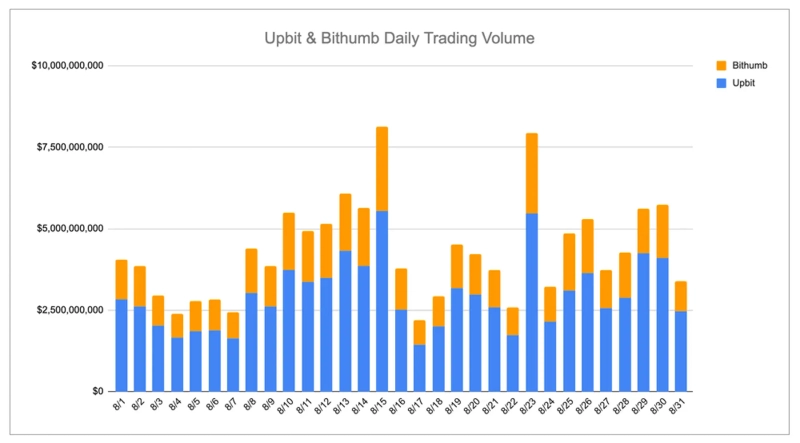

Last week, major domestic exchanges announced several new listings, including Upbit's Treehouse, Bithumb's Stader and Camp Network. Upbit was the region with concentrated trading volume; its daily trading volume often exceeded 5 billion dollars, and at times approached 7.5 billion dollars. Upbit's volume was far greater than Bithumb's, which was in the 1 billion~2 billion dollars range.

Both exchanges saw ETH and XRP leading trading volumes, each recording over 2.06 billion dollars on Upbit, with CRO, SOL, and BTC close behind. PYTH also stood out with weekly trading volume of 1.1 billion dollars, showing increasing interest from retail investors in new cryptocurrencies. Bithumb's rankings showed similar asset preferences: ETH, XRP, and USDT were active, while mid-cap tokens like ENA, CRO, and PENGU saw smaller but steady participation. With Korea Blockchain Week in September approaching, market volatility is expected to increase as side events and community activities pick up.

2. Exchanges

2-1. Newly listed coins

Last week, several new listings took place on major Korean exchanges.

Treehouse was listed on Upbit.

Stader and Camp Network were listed on Bithumb.

Key marketing strategies and main points

Camp Network (CAMP)

Camp's Korea-specific KOL marketing is used as a strong case study because it combined traditional Korean market practices with the latest marketing trends.

They emphasized the core keywords AI + IP and introduced the project's content, fundraising size, and ways for users to participate. This information was delivered to the Korean community through KOL channels.

Camp also leveraged the aspects of Story, a project already leading the market with the same keywords and IP, using elements such as investment highlights and value comparisons in its marketing.

Camp actively adopted more modern marketing trends such as social engagement. To encourage user participation, they not only operated a Kaito leaderboard but also provided weekly stablecoin rewards, allowed users to get on the whitelist through campaigns, and continuously promoted user engagement.

To further expand social activity, Camp introduced an exclusive reward pool for Korean users, a bold move that significantly increased visibility and participation.

Additionally, Camp held AMA and WL events with major KOLs and ran various events to operate and manage the Korean community.

2-2. Trading volume

Upbit dominated the Korean crypto trading market last week, consistently maintaining higher trading volumes than Bithumb. Upbit's daily trading volume often exceeded 5 billion dollars and sometimes reached a peak near 7.5 billion dollars. In contrast, Bithumb's trading volume was relatively modest, generally recording between 1 billion and 2 billion dollars per day.

By individual assets, ETH and XRP clearly held an advantage on both exchanges. On Upbit, ETH (2.06 billion dollars) ranked first, followed closely by XRP (2.06 billion dollars) and CRO (1.82 billion dollars). SOL (1.56 billion dollars) and BTC (1.21 billion dollars) also made major contributions, indicating sustained investor interest in large-cap tokens. Interestingly, PYTH also showed growth in the Korean market with weekly trading volume reaching 1.1 billion dollars.

On Bithumb, ETH (1 billion dollars) and XRP (923 million dollars) were strong, followed by USDT (708 million dollars) and SOL (663 million dollars). The distribution was similar to Upbit but on a much smaller scale. Mid-cap tokens such as ENA, CRO, and PENGU were also included in the list but recorded lower volumes than on Upbit.

Overall, the data supports Upbit's structural advantage as Korea's primary liquidity hub, with Upbit capturing a much larger share of retail and institutional trading. Meanwhile, Bithumb plays a secondary role with relatively lower volumes across both blue-chip and emerging tokens.

2-3. Top 10 gainers

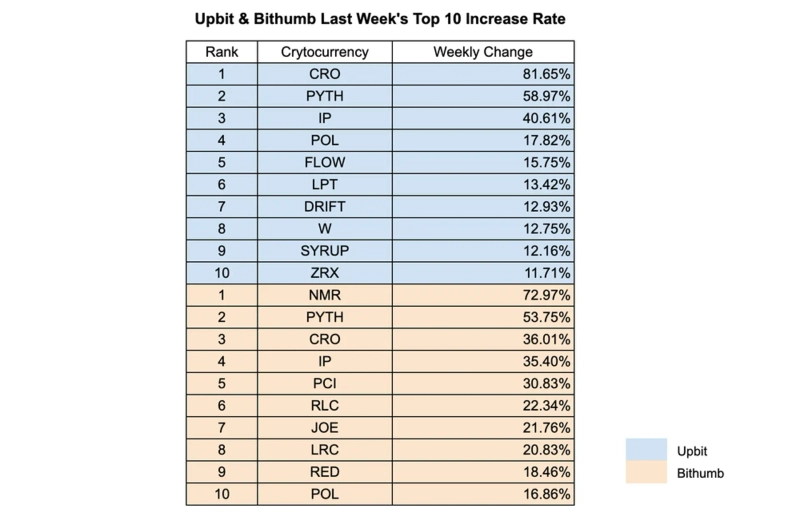

Last week’s top-gaining tokens showed notable differences between Upbit and Bithumb, and some tokens posted strong gains on both platforms.

On Upbit, CRO led the market with an astonishing increase of +81.65%, followed by PYTH (+58.97%) and IP (+40.61%). This reflects high interest in mid-cap and emerging tokens. Other major gainers included POL (+17.82%), FLOW (+15.75%), LPT (+13.42%), and tokens like DRIFT, W, SYRUP also recorded double-digit weekly growth.

On Bithumb, the top gainer was NMR (+72.97%), showing strong momentum this week. PYTH (+53.75%) and CRO (+36.01%) also showed steady gains across both exchanges. Others such as IP (+35.40%), PCI (+30.83%), and RLC (+22.34%) rose as well, and small-cap tokens like JOE, LRC, RED each posted gains of around 20% or more.

3. Korean community

3-1 Meetups within Korea

The Korean crypto community remains enthusiastic about the ongoing meetup meta. One user listed airdrops received from recent events such as Lagrange, Succinct, Eclipse, and Memecore; the confirmed reward amount was about 10,000 dollars, with the possibility of additional rewards. The post garnered over 15,000 views and sparked major discussion within the community.

Many commented, "You can just go to the meetup, so why work?" and were impressed by the large numbers, but others raised concerns about how sustainable this trend is. With KBW approaching, attention is focused on how Korea's meetup culture will evolve after the events and what strategies projects will adopt going forward.

3-2 Korea-U.S. summit

The recent Korea-U.S. summit ran longer than scheduled, lasting 2 hours 20 minutes instead of the planned 1 hour 45 minutes. The two leaders focused on North Korea and economic cooperation. President Trump mentioned the possibility of meeting Chairman Kim Jong-un again, and President Lee Jae-myung requested stronger U.S. involvement to maintain peace on the Korean Peninsula.

On the economic front, the summit announced that 11 agreements worth 150 billion dollars across strategic sectors including shipbuilding, nuclear power, aerospace, and energy had been signed. Korean companies agreed to participate in the U.S. MASGA project to help revitalize the American shipbuilding industry. However, issues such as agricultural imports, steel and aluminum, and semiconductor tariffs remain unresolved, raising debate about whether these agreements will deliver tangible benefits.

Despite the cooperative tone of the summit, the crypto community also reacted, and the market declined during the announcements, sparking discussion about whether geopolitical developments are overshadowing macroeconomic conditions.

3-3 KOSPI vs. crypto traders

The Korean government recently announced a new economic growth strategy emphasizing "productive finance" and shifting capital flows from real estate to the stock market. While there was no specific mention of the previous government's KOSPI 5000 target, the plan aims to strengthen Korea's standing and address the so-called "Korea discount."

Crypto investors have been watching KOSPI movements closely because the stock index often affects sentiment in the Korean crypto market. A recent rise in the stock market could increase retail investors' risk appetite and expand participation in mid-cap tokens and altcoin trading, but the opposite could also happen. As capital flows into traditional markets, investor attention may shift away from crypto, which could dampen trading activity in highly volatile assets.

*All content is prepared for information delivery and provision and is not intended as a basis for investment decisions or as investment recommendations or advice. The text assumes no responsibility for any investment, legal, or tax matters.

INF Cryptolab (INFCL) is a consulting firm specialized in blockchain and Web3, providing one-stop services such as corporate Web3 entry strategy, token economy design, and global market expansion. We provide strategy formulation and execution services to major domestic and international securities firms, game companies, platform companies, and global Web3 firms, and lead sustainable growth of the digital asset ecosystem with accumulated know-how and references.

This report is independent of media editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)