Summary

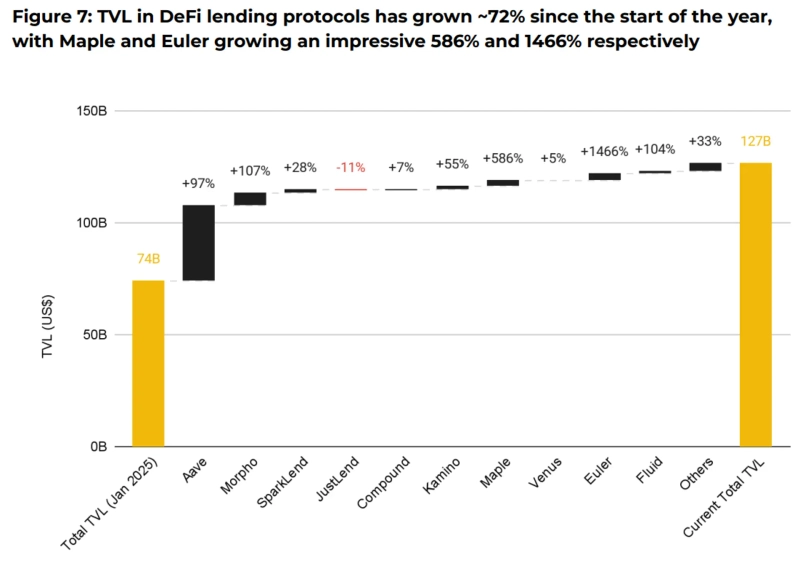

- It said the TVL of DeFi lending protocols reached $127 billion, up 72% year-to-date.

- It said the increased entry of institutional investors into the stablecoin and real-world asset (RWA) markets contributed significantly to the TVL rise.

- It said Maple Finance's and Euler's TVLs increased by 586% and 1466% respectively, cited as major drivers of lending protocol growth.

The total value locked (TVL) of decentralized finance (DeFi) lending protocols has grown 72% compared to the start of the year ($52 billion).

On the 3rd (local time), Cointelegraph reported that Binance Research said in a report, "The TVL of DeFi lending protocols has exceeded $127 billion," adding, "this represents a 72% surge compared to the start of the year." The outlet said, "Institutional investors have actively entered the stablecoin and real-world asset (RWA) markets, causing lending TVL to rise significantly."

In particular, Maple Finance (SYRUP) and Euler (EUL) led the growth of lending protocols. Maple Finance's and Euler's TVLs rose 586% and 1466% respectively over the same period.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)