Editor's PiCK

From CRCL to FRAX: Finding the Beneficiaries of the GENIUS Act [Four Pillars Research]

Summary

- Circle (CRCL) recorded strong interest after listing on the New York Stock Exchange, supported by the passage of the GENIUS Act and U.S. crypto regulatory easing.

- Frax Finance's frxUSD strictly complies with the GENIUS Act and, through a vertical integration strategy, is leading the future of the stablecoin trinity (money, frontend, backend).

- Institutionalization of the stablecoin industry and policy changes have increased market interest in related publicly listed companies and protocols.

1. Circle's successful debut — what was the secret?

1.1 The victory of the stablecoin industry

On June 5, 2025, Circle listed on the New York Stock Exchange (NYSE) under the ticker CRCL. The offering price was $31 per share, which was revised upward from the previously expected $27–28, raising approximately ~$1.1B in capital. On its first trading day the open and close prices were $69 and $83, and as of August 25, 2025 the share price was around $135, making Circle one of the most successful IPO cases.

Circle's NYSE listing carries implications beyond a simple milestone for Circle. It served as a signal that crypto firms can enter the regulated financial markets, driven by the passage of the GENIUS Act, regulatory easing by the SEC, and the Trump administration's crypto-friendly stance. Moreover, the market's strong reception of Circle in public markets boosted confidence that stablecoin infrastructure can operate within traditional finance.

In other words, Circle's listing was not just Circle's success but a success for the stablecoin industry as a whole.

1.2 Circle's vertical integration strategy

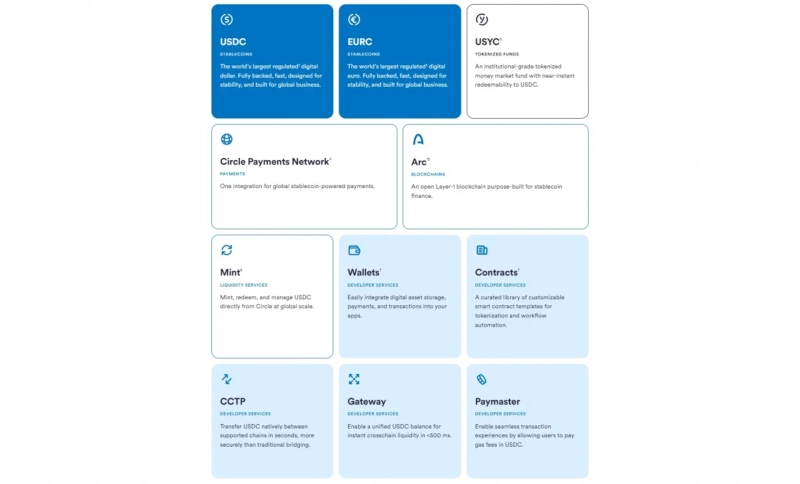

Circle is one of the largest stablecoin issuers in the world, issuing the dollar-pegged stablecoin USDC and the euro-pegged stablecoin EURC. In addition, Circle is building a new internet financial system and provides a variety of products as follows:

- Circle Payments Network (CPN): Circle's global funds transfer standard, aiming to perform the role of traditional SWIFT using blockchain. Financial institutions and corporations using CPN can efficiently handle cross-border transfers and settlements via Circle's infrastructure and various public blockchains. Readers interested in CPN can refer to "[CPN: Towards Digital Native SWIFT]".

- Circle Mint: Circle Mint is integrated with traditional banking rails such as wire and SEPA, enabling corporate and institutional users to mint USDC and EURC instantly and redeem them 1:1 for fiat. Note that Circle Mint is the only official channel to directly issue USDC.

- Circle Wallets: Circle's wallet SDK service that allows Web2 companies to easily integrate blockchain-based wallets into their services. It provides not only simple wallets but also account abstraction features, MPC-based security, RPC nodes for transaction submission, compliance options, multi-chain support, and more.

- CCTP: USDC is already natively supported on more than 20 networks, which can cause liquidity fragmentation. Circle's cross-chain messaging protocol, CCTP, enables safe transfer of USDC across different blockchains via a burn-mint mechanism.

- Circle Paymaster: Circle Paymaster is Circle's ERC-4337-based account abstraction feature. Whereas users originally had to pay fees in tokens like ETH to use blockchains, Circle Paymaster allows users to pay blockchain fees in USDC or enables fee sponsorship so customers can enjoy zero fees.

- USYC: Circle acquired Hashnote, the issuer of USYC, at the end of 2024 and incorporated USYC into its product suite. USYC is a tokenized money market fund consisting of U.S. short-term bonds and reverse repos. Institutional customers holding USYC can access stable on-chain yields and use it as margin collateral on CEXs like Deribit and Binance.

- Arc: Arc is a USDC-specialized L1 network that Circle announced in August, providing a high-performance consensus layer to enable users to use USDC easily and efficiently. Readers interested in Arc can refer to "[Circle Unveils Arc: A Similar Yet Different Playbook from Tether]".

Thus, Circle is building not only stablecoin issuance but also the infrastructure that makes stablecoins easy to use for both institutions and retail users. From issuance to wallet infrastructure, cross-chain bridges, an L1 network, account abstraction, and institutional solutions, Circle's product lineup is a strong example of vertical integration from a product perspective.

From a user-experience standpoint, Circle's product lineup is powerful. If a company uses Circle's products, it can mint and redeem USDC 1:1 instantly via Circle Mint, enable customers who are unfamiliar with Web3 to access stablecoin features using Circle Wallet, Paymaster, and CCTP, use the Arc blockchain to utilize USDC most easily and efficiently, and use CPN for transactions and settlements with other financial institutions and companies.

The core of stablecoins is not issuance but utility. While it is important to issue stablecoins safely considering collateral composition and regulatory frameworks, issuance is useless without use cases. Circle's vertically integrated product roadmap provides the foundation for stablecoins to be widely used both in the real world and on-chain.

1.3 Why Circle is in the spotlight

So how did Circle attract such intense attention not only from the blockchain industry but also from traditional financial markets? Besides product factors, several elements play a role, including the current political environment and Circle's business model:

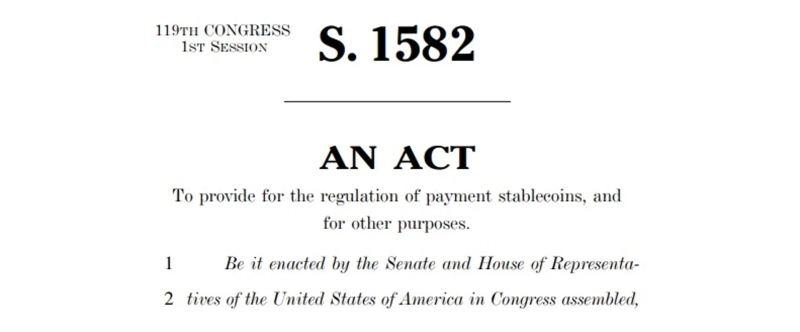

- Passage of the GENIUS Act: The GENIUS Act, the first federal bill to clearly regulate dollar-based stablecoins in the U.S., was the single most direct factor affecting Circle and the stablecoin industry. It mandates the legal status of stablecoins, issuer obligations, consumer protection rules, and provides legal basis for institutions and companies in the U.S. to issue stablecoins, effectively codifying many of Circle's internal operating principles and conferring legitimacy and lawfulness to Circle.

- Trump administration's pro-crypto policy: The Trump administration declared strong support for cryptocurrencies even before taking office, and on July 30, 2025 the President's Working Group on Digital Asset Markets released a 160-page crypto policy report. The report lays out a concrete roadmap to position the U.S. as the world's crypto capital.

- SEC: The SEC's new chairman, Paul Atkins, has also shown a pro-crypto stance and, unlike Gary Gensler, has taken a relatively deregulatory position. Following the White House's crypto policy roadmap announcement, the SEC quickly announced a crypto initiative named Project Crypto, making regulation in the U.S. crypto industry much clearer.

- Market share: Circle issues USDC, the second-largest stablecoin globally. USDC's circulating supply is around $63B, accounting for about 30% of total stablecoin issuance. Given that USDT cannot comply with the GENIUS Act due to, among other things, its collateral composition, USDC is the largest stablecoin that complies with U.S. regulation.

- Business model: Circle's main revenue is generated by investing USDC reserves in bonds, repos, and similar instruments. In Q2 2025, Circle's revenue was $658M and adjusted EBITDA was $126M, presenting an attractive revenue structure and decent operating margins.

The current U.S. political environment is optimal for Circle to be in the spotlight, and it lays the groundwork for the rapid growth of the stablecoin industry as a whole.

1.4 Korean investors, charge!

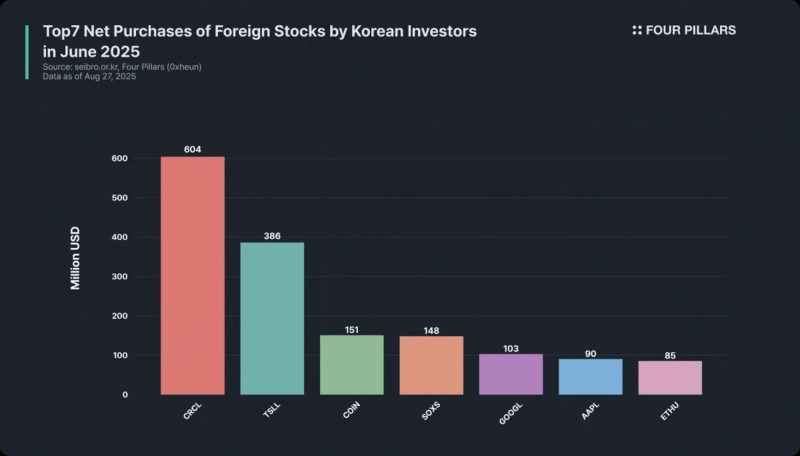

Interestingly, Circle's popularity was strong not only in the U.S. but also in other countries. In June 2025, Circle (CRCL) was the most purchased foreign stock by Korean investors, with net purchases exceeding $600M. This exceeded the 2nd-place Tesla 2X ETF and 3rd-place Coinbase by 1.6x and 4x respectively, and far outpaced Alphabet ($100M) and Apple ($90M).

Why was interest in Circle particularly strong in Korea? While many Koreans invest in U.S. stocks, a more fundamental reason is that Korea itself was experiencing a hot wave around stablecoins. In June 2025, President Lee Jae-myung took office and strongly endorsed legislation for stablecoins, which became a major catalyst for Korean investors' interest in the stablecoin industry.

Of course, Korea faces significant entry barriers before a won-pegged stablecoin can be fully legalized due to strict foreign exchange laws, the Bank of Korea's conservative approach, and the small size of the short-term bond market. Nevertheless, interest in stablecoins is intense across both the blockchain industry and general stock investors, with instances where a company's stock surged after filing trademarks related to stablecoins.

2. Find the next GENIUS winner

2.1 Who is next after CRCL?

Circle's successful debut naturally drove companies and investors to pay close attention to the stablecoin industry and search for companies and protocols that could be the biggest beneficiaries of the GENIUS Act after Circle. Coinbase was frequently mentioned as a beneficiary because Circle shares roughly half of the income from its USDC reserves with Coinbase. In Q2 2025, Circle's total reserve income was $634M, of which more than half, $332.5M, was paid to Coinbase.

Aside from companies that benefit indirectly like Coinbase, are there any publicly listed companies that directly issue GENIUS Act–compliant stablecoins like Circle? Unfortunately, no. Among listed U.S. companies, none issue a GENIUS Act–compliant stablecoin, and Paxos, the second-largest U.S.-based stablecoin issuer, is private.

2.2 Opportunities found on-chain

Don't be discouraged if you can't find the next Circle in the public markets. On-chain there are stablecoin protocols issuing dollar-based stablecoins that meet the GENIUS Act. Currently, there are exactly two stablecoin issuance protocols in the market that comply with the GENIUS Act: one is Ethena and the other is Frax Finance.

Ethena offers two types of stablecoins, USDe and USDtb. Since USDe's reserves are based on delta-neutral positions in the futures market, it does not comply with the GENIUS Act. However, USDtb's reserves consist of MMF funds like BUIDL and stablecoins, and Ethena has been preparing to comply with the GENIUS Act by transitioning issuance of USDtb from the previous BVI-based issuer to Anchorage Digital Bank in July 2025.

Frax Finance issues the frxUSD stablecoin, whose reserves are also composed of various dollar-denominated MMF tokens and U.S. bond fund tokens. Notably, Frax Finance founder Sam Kazemian was one of the key figures who worked to help bring the GENIUS Act into existence.

Sam met with Senator Cynthia Lummis, a co-sponsor of the GENIUS Act, in March this year and provided advice and assistance in drafting the bill, contributing to the successful establishment of a legal framework for a digital dollar.

Unlike other protocols, Frax Finance not only built products to advance its core business but also actively led regulatory discussions and engaged in intense debate with lawmakers to help establish regulatory frameworks. This is a proper example of policy entrepreneurship, and because the founder directly assisted in drafting the bill, Frax Finance had deep knowledge of the GENIUS Act and could design frxUSD accordingly.

3. frxUSD, the first GENIUS Act–compliant stablecoin

3.1 Frax's stablecoin OS

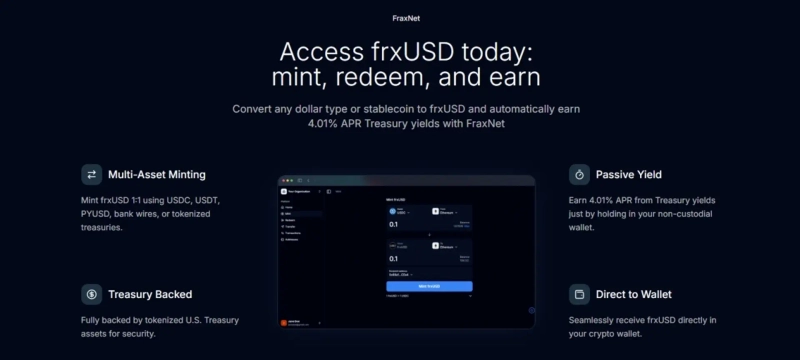

Frax Finance's goal is to issue stablecoins stably and build scalable infrastructure that enables wide usage. To that end, Frax Finance presents a stablecoin OS composed of three core elements: frxUSD, FraxNet, and Fraxtal.

- frxUSD: A GENIUS Act–compliant stablecoin and the core asset of Frax ecosystem liquidity.

- FraxNet: A platform where users can mint/redeem frxUSD in various ways and earn stable yields in a GENIUS Act–compliant manner from non-custodial holdings of stablecoins.

- Fraxtal: A high-performance EVM L1 blockchain for frxUSD that uses the governance token FRAX as the gas token.

Issuance is important, but utility is much more important for stablecoins. Frax Finance not only issues frxUSD in compliance with regulation but also provides FraxNet as a user-friendly frontend and Fraxtal as an ecosystem dedicated to frxUSD. In this way, frxUSD acts like money, FraxNet like fintech/banking, and Fraxtal like the financial system backend; the three products together form the core engine of the frxUSD ecosystem.

Frax Finance also offers various services such as Fraxswap for trading, Fraxlend for lending, and frxETH for Ethereum liquid staking, building a full-stack stablecoin/DeFi ecosystem. We will cover the story of the Frax Finance ecosystem and its growth to its current position in the next article.

3.2 frxUSD, the first GENIUS Act–compliant stablecoin

Frax Finance founder Sam Kazemian participated in drafting the GENIUS Act, so Sam and the Frax team have a deep understanding of the law. Based on this regulatory knowledge, Frax Finance began issuing a GENIUS Act–compliant frxUSD stablecoin [in February this year]. But what are the qualifications to be a GENIUS Act–compliant stablecoin? Is frxUSD truly GENIUS Act–compliant?

The full text of the GENIUS Act is available online, but since it is lengthy we summarize the main points below. To issue a GENIUS Act–compliant stablecoin, the following requirements must be considered as mandatory.

(There are additional operational requirements such as external audits by accounting firms, capital requirements, AML compliance, and seniority in bankruptcy, but we will not discuss those internal operational matters here.)

3.2.1 Issuer eligibility

Issuers must be authorized in the U.S., and there are three permitted types: (1) a bank or credit union subsidiary, (2) an institution approved by the OCC, and (3) an entity approved by the state banking regulator.

Frax Finance transferred all responsibilities for frxUSD issuance, reserve management, and regulatory compliance to FRAX Inc. via the passage of [FIP-432 governance proposal], and FRAX Inc. is a Delaware-registered corporation that must obtain an OCC or state banking regulator approval to issue a GENIUS Act–compliant stablecoin. According to FIP-432, FRAX Inc. is preparing to obtain a stablecoin issuer license.

3.2.2 Reserve requirements

The GENIUS Act's core reserve principle is 1:1 full backing. That is, the total supply of issued stablecoins must be backed at a minimum 1:1 by reserves. Reserve composition is restricted to the following ultra-liquid asset categories:

1. U.S. currency or balances in Federal Reserve accounts

2. Demand deposits / on-demand withdrawable deposits or insured deposits / credit union shares

3. Treasury securities with remaining maturities of 93 days or less at issuance

4. Overnight repos entered into as seller by the issuer (collateral: treasury securities with remaining maturity ≤ 93 days)

5. Overnight reverse repos entered into as buyer by the issuer (collateral: U.S. Treasuries)

6. Registered government money market funds or securities registered under the Investment Company Act of 1940 that hold only underlying assets listed in (i)–(v)

7. Other assets issued directly by the U.S. federal government that have similar liquidity and stability to the enumerated asset classes

8. Tokenized forms of the assets in (i), (ii), (iii), and (vi)

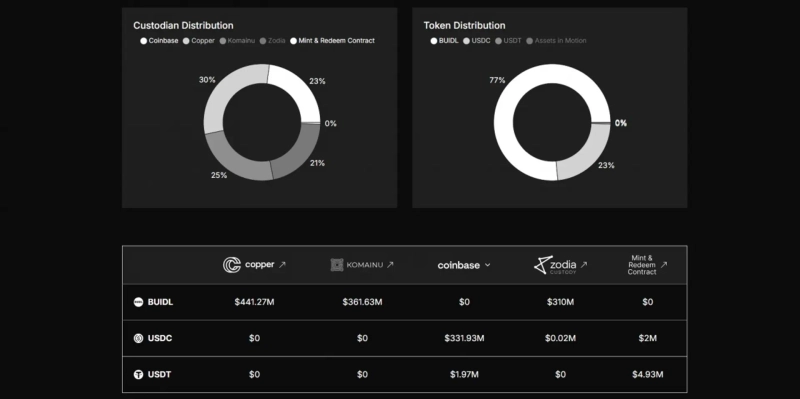

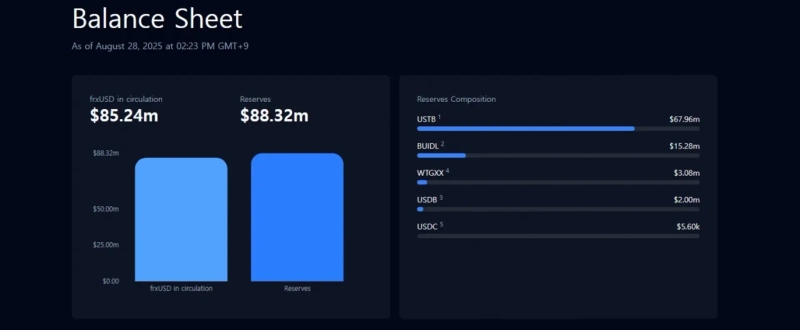

Frax Finance's frxUSD reserves are entirely composed in tokenized form. The RWA tokens that make up frxUSD's reserves are as follows:

- USTB: A tokenized form of the Superstate Short Duration US Government Securities Fund, which invests in U.S. short-term bonds. Issued through Superstate under Reg. D Rule 506(c) and Investment Company Act 3(c)(7).

- BUIDL: A tokenized form of the BlackRock USD Institutional Digital Liquidity Fund, which invests in U.S. Treasuries, cash-like assets, and repos, tokenized via Securitize. Issued under Reg. D Rule 506(c) and Investment Company Act 3(c)(7).

- WTGXX: A tokenized WisdomTree Government Money Market Digital Fund investing in U.S. government short-term securities and agency securities, directly tokenized by WisdomTree. Issued based on Investment Company Act 2a-7 as an officially registered government money market fund.

- USDB: A stablecoin issued by Bridge, now acquired by Stripe.

- USDC: A stablecoin issued by Circle.

In short, frxUSD's reserves are tokenized forms of (i) and (vi) per (viii), and because they hold more than 100% overcollateralization they can satisfy the GENIUS Act's reserve requirements and maintain stable value.

3.2.3 Paying interest?

Under the GENIUS Act, issuers of stablecoins are prohibited from paying holders interest (yield) simply for holding or using the stablecoin. This clause aims to prevent stablecoins from being treated like deposits and to avoid confusion with investment products, thereby preserving financial stability.

Because frxUSD complies with the GENIUS Act, holders of frxUSD cannot earn interest merely by holding it. However, if a user holds frxUSD on FraxNet, they can receive stable yields derived from bonds. At first glance this might appear to violate the GENIUS Act, but it does not. How is this possible?

This is possible because it is not the issuer directly paying interest to stablecoin holders; rather, the distribution platform provides rewards. FraxNet is operated by Frax Network Labs Inc., a Delaware entity separate from the issuer, so FraxNet can provide interest rewards to users who hold frxUSD on FraxNet.

Of course, MetaMask-like personal wallets or exchanges that support frxUSD cannot pay interest to holders under the GENIUS Act. This structure is already used without issue by Circle USDC, PayPal PYUSD, and others.

Coinbase, for example, pays about 4.1% interest to users holding USDC within the Coinbase app, and PayPal pays about 3.7% interest to users holding PYUSD within the PayPal app. This is permissible because Coinbase and PayPal are legal entities separate from stablecoin issuers Circle and Paxos.

4. FRAX — a déjà vu of CRCL?

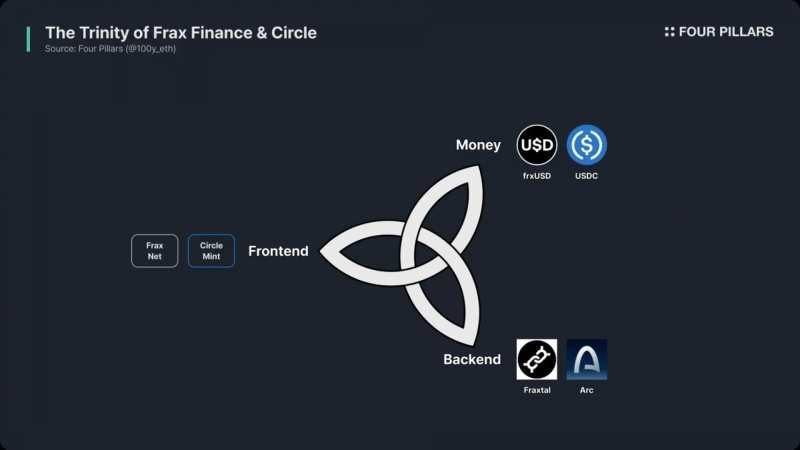

So far we have examined how Circle achieved a successful debut and frxUSD at Frax Finance. Did you feel a déjà vu while reading the Frax Finance section? Frax Finance's direction in building a stablecoin ecosystem appears very similar to Circle's.

4.1 First déjà vu: the money

The first déjà vu is the issuance method. Both Circle and Frax Finance aim to issue GENIUS Act–compliant stablecoins backed by stable reserves composed of cash, short-term U.S. Treasuries, and repos. These issued stablecoins maintain stable value and act as the lubricant for the next-generation financial system.

Regarding the use of interest from reserves, Frax Finance has more scope to build an ecosystem flywheel compared to Circle. Circle retains all reserve interest income, whereas frxUSD reserve interest is used for FraxNet frxUSD holders and team operations, and leftover funds are distributed to FRAX stakers, the core token holders of the Frax Finance ecosystem.

This structure can create a virtuous cycle where more frxUSD issuance grows the Frax Finance ecosystem, which in turn increases frxUSD issuance.

4.2 Second déjà vu: the frontend

Circle provides user-friendly frontends such as Circle Mint (makes minting and redemption easy), Circle Wallet (easy wallet integration), and Circle Gateway (multi-chain balance management), enabling USDC holders to use USDC easily.

Frax Finance likewise provides a user-friendly frontend called FraxNet to make various financial activities easy for frxUSD holders:

- Multi-asset issuance: Users can mint frxUSD using stablecoins such as USDC, USDT, PYUSD, USDB, bank wires, and even RWA tokens like USTB and WTGXX. This function is similar to Circle Mint.

- Embedded wallet: Users can log in to FraxNet with methods like Google accounts, and a blockchain wallet is automatically created for them. This allows users unfamiliar with blockchain to access frxUSD easily, similar to Circle Wallet.

- Dashboard: FraxNet displays various assets across many networks in a single dashboard and enables easy transfers. This feature is similar to Circle Gateway.

- Passive yield: Users holding frxUSD on FraxNet automatically earn stable bond yields. Much like earning interest on USDC held in the Coinbase app, Frax Finance can provide yields to frxUSD holders on FraxNet.

Although multi-asset issuance and passive yield are powerful features, the four features above are in some sense basic functionalities that modern financial services should provide. FraxNet goes further with a roadmap that aims to provide even stronger vertical integration products and user experiences than Circle Mint:

- Virtual Visa card: In collaboration with Stripe and Bridge, FraxNet plans to issue a virtual Visa card linked to the Visa network so users can use FraxNet assets for real-world payments.

- Virtual bank account: Frax Finance is partnering with Lead Bank to provide virtual bank accounts to users, enabling deposits and withdrawals via the banking system. Connecting existing infrastructure will improve user onboarding.

- FraxNet mobile: FraxNet plans to launch a mobile app in 2026 to provide users with a mobile banking experience.

The goal is for stablecoin issuance protocols to not only offer wallet, trading, monitoring, and yield services but also support cards, banking, and mobile services for full user lifecycle interactions in real life.

4.3 Third déjà vu: the backend

As important as the frontend in financial systems is the backend. No matter how user-friendly the frontend is, if the backend that moves actual money is inefficient, the user experience will suffer.

To achieve this, Frax Finance launched its own high-performance blockchain network, Fraxtal, in February 2024. Fraxtal is optimized for the Frax ecosystem to serve as the rails for frxUSD.

Providing an ecosystem-optimized backend puts Frax Finance ahead in the industry. Since Fraxtal's launch, many stablecoin projects have unveiled their own blockchains optimized for their stablecoins:

- Converge: Ethena is developing the high-performance Converge chain in collaboration with Securitize to fuse DeFi and TradFi around ENA and USDe.

- Stable, Plasma: Tether has made strategic investments in Stable and Plasma, blockchain networks specialized for USDT transfers and payments.

- Arc: Circle has announced Arc, a network optimized for USDC.

Ultimately, Frax Finance foresaw where the industry was heading. Fraxtal's launch was not merely another blockchain release but a pioneering move pointing to the future of financial infrastructure.

4.4 The stablecoin trinity

The three components of the financial system we use today are money, frontend, and backend. We access complex payment, securities, and remittance backends through convenient frontends provided by fintech firms.

From an evolution perspective, today’s complex and inefficient financial backends will gradually transition to blockchain. In the blockchain-based design of financial systems, the three most important elements are stablecoins, frontends, and blockchain networks. This is the stablecoin trinity, and Frax Finance is one of the few projects building all three elements and presenting a vertically integrated direction.

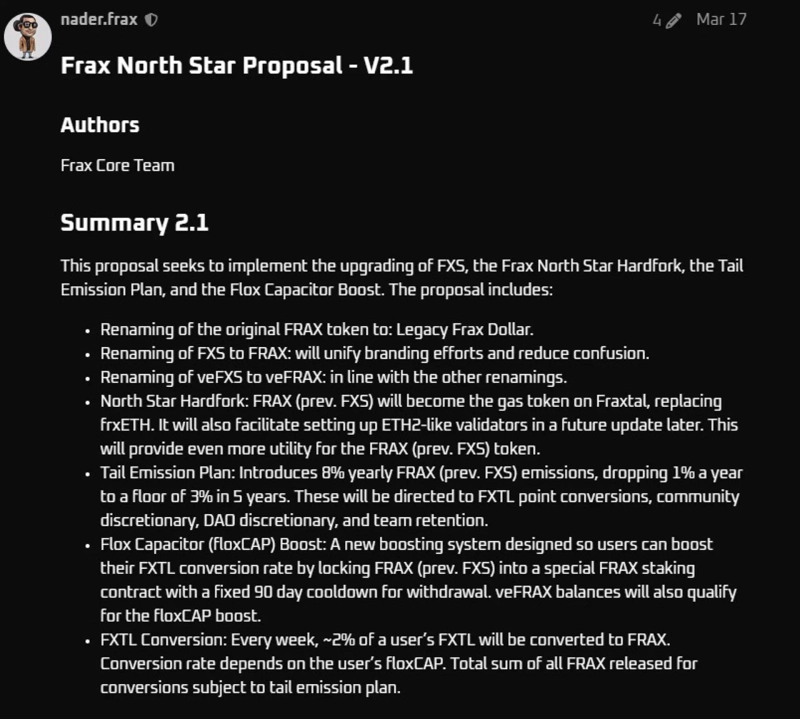

5. Toward the north star

Since March this year, Frax Finance has been preparing GENIUS Act–aligned protocol changes via a north star upgrade. This includes rebranding legacy Frax protocol tokens FRAX and FXS to frxUSD and FRAX respectively, switching Fraxtal's gas token from frxETH to FRAX, and making other important adjustments such as token incentive changes.

Frax Finance is at a major inflection point for the next chapter. From the founder's political leadership in engaging directly with the GENIUS Act's drafting to the vertical integration direction through a stablecoin OS, and the large-scale protocol shift via the north star upgrade, Frax Finance is meticulously preparing for the future shaped by the GENIUS Act.

Some may say Frax Finance is merely following Circle's roadmap, but in fact FraxNet as an all-in-one frontend and Fraxtal as a blockchain presented earlier indicate that Frax Finance has been proactively proposing the industry's direction in terms of stablecoin frontend and backend.

Like navigators following the North Star to find their way, Frax Finance is using the north star upgrade to indicate the industry's path. This is more than an upgrade; it establishes a new coordinate for the entire industry to reference, and Frax Finance may come to be seen as a leading beacon like the North Star.

Four Pillars is a global blockchain research firm composed of experts with years of practical experience, providing research services to global clients. Since its founding in 2023, it has conducted research on over 100 protocols and companies across stablecoins, decentralized finance, infrastructure, tokenomics, and more, aiming to reduce information asymmetry across the industry and support practical adoption and growth of blockchain.

Disclaimer

This article was independently researched by the author and sponsored by Stable. It is intended for general informational purposes and does not constitute legal, business, investment, or tax advice. Do not base investment decisions on this article or use it as accounting, legal, or tax guidance. Mentions of specific assets or securities are for informational purposes only and do not constitute investment recommendations. The opinions expressed herein are the author's personal views and may not reflect the views of related institutions, organizations, or individuals. Opinions in this article may change without prior notice.

This report is independent of media editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)