Editor's PiCK

Bitcoin rebound, September is the watershed… Solana · Dogecoin on the rise [Lee Su-hyun's Coin Radar]

Summary

- Bitcoin: Expectations of a September rate cut and focus on U.S. employment data are acting as catalysts for investor sentiment, and recovery to 114,000 dollars is the key condition for further gains.

- Ethereum has secured support at 4,300 dollars due to Bitcoin whale money flows and institutional buying, but global economic conditions and uncertainty over rate cuts are variables for breaking through 5,000 dollars.

- Solana and Dogecoin have risen, respectively fueled by protocol upgrades and expectations of institutional inflows, and trends in institutional participation, such as ETF approval, could be decisive for future investment flows.

<Lee Su-hyun's Coin Radar> is a column that reviews the week's virtual asset market flows and provides an in-depth explanation of their background. Beyond a simple listing of prices, it analyzes global economic issues and investor movements in a multidimensional way, offering insights to gauge the market's direction.

Major coins

1. Bitcoin (BTC)

Bitcoin fell below 110,000 dollars last week but successfully rebounded this week. As of the 5th, Bitcoin is trading around 112,000 dollars.

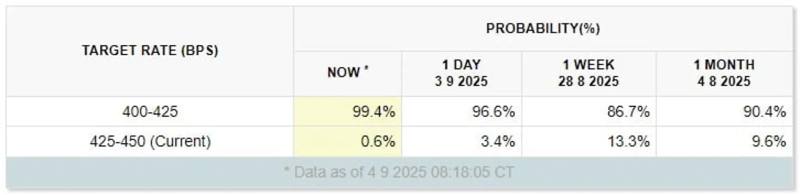

This rebound was decisively driven by expectations of a September rate cut. According to CME FedWatch on that day, the probability that the Federal Reserve (Fed) will cut rates by 25bp at the Federal Open Market Committee (FOMC) meeting held on the 17th is 99.4%, making a rate cut virtually certain. Christopher Waller, a Fed governor considered a candidate for the next Fed chair, also directly stated, "The next meeting should begin cutting rates."

In addition, the U.S. Department of Labor's July Job Openings and Labor Turnover Survey (JOLTS), released on the 3rd (local time), showed 7,181,000 job openings, below expectations, suggesting a slowdown in employment and further fueling expectations of a rate cut.

Now the market's attention is focused on the U.S. August employment report to be released tonight. If the data show a deterioration in the labor market, the outlook for a rate cut will gain more traction, which could act as a positive catalyst for Bitcoin investor sentiment. The market currently expects U.S. nonfarm payrolls to increase slightly to 75,000 from 73,000 the previous month, and the unemployment rate to rise to 4.3% from 4.2% the previous month. If the figures are not far from market expectations, the expectation of a September rate cut is likely to be maintained.

However, for the rebound to continue, recovery to 114,000 dollars is key. Glassnode diagnosed, "Bitcoin needs to recover the 114,000~116,000 dollars range to gain further upward momentum." On the other hand, K33 Research warned of September volatility due to seasonal factors. In fact, Bitcoin's average September return is -4.6%, the only negative month of the year.

2. Ethereum (ETH)

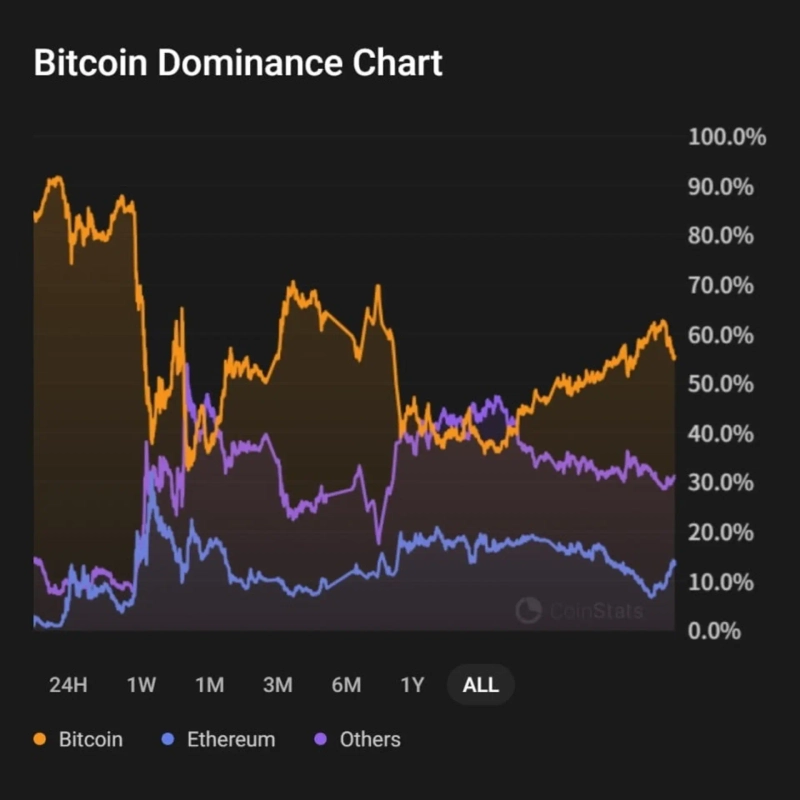

Ethereum began rebounding on the 2nd and briefly approached 4,500 dollars on the 4th, then moved around 4,300 dollars on the 5th per CoinMarketCap, maintaining a relatively stable trend. This movement was influenced by funds moving from Bitcoin to altcoins. The Block analyzed, "Bitcoin dominance has fallen from 62% to 55%, raising the possibility of an upcoming altcoin bull market."

In particular, Ethereum is steadily absorbing funds from both institutional and retail investors. In fact, cases of Bitcoin whales moving holdings into Ethereum have been observed. According to Cointelegraph, a recent whale sold about 2,700,000,000 dollars worth of BTC and bought ETH, and another whale sold about 4,000,000,000 dollars worth of BTC and purchased Ethereum.

Institutional buying also continues. This week, Bitmain bought about 14,665 ETH through Galaxy Digital, and Sharplink Gaming added more than 39,000 ETH. As a result, exchange-held supply fell to 17,400,000 units, marking the lowest level since 2022.

In the short term, analysis suggests the 4,300 dollar support will remain stable. Coinglass data shows that leveraged long position liquidations exceeded 340,000,000 dollars, weakening investor sentiment, but because short positions did not surge, the 4,300 dollar support was strengthened.

However, uncertainty remains about breaking through 5,000 dollars. Analysts say macroeconomic variables such as a global economic slowdown and uncertainty over rate cuts could delay Ethereum's reaching 5,000 dollars. Cointelegraph diagnosed, "Ethereum derivatives indicators suggest resilience, but as investors focus on macroeconomic data, it may take longer than expected to reach 5,000 dollars."

3. XRP (XRP)

XRP recovered to the 2.8 dollar level after rebounding on the 2nd. However, it failed to recover to 3 dollars. On the 5th, XRP was trading at 2.81 dollars on CoinMarketCap, down 0.62% from the previous day.

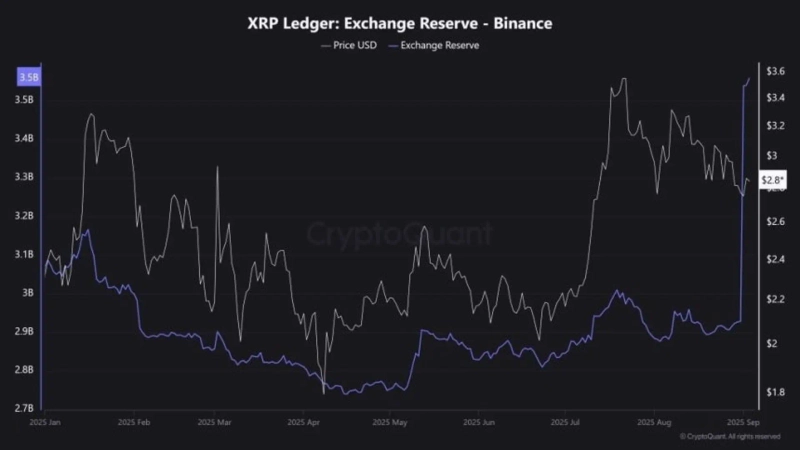

First, an increase in exchange holdings is acting as selling pressure. According to CryptoQuant, XRP holdings increased at 9 out of 11 major exchanges over the past week, with Binance holdings in particular surging from 2,900,000,000 to 3,600,000,000.

In addition, whale selling continues. Whale Alert reported, "A whale moved more than 35,000,000 in a single day to Coinbase, and long-term holders are also selling out of concern that the bull market may peak in September~October."

Technical indicators also point to weakness. Coingape analyzed, "XRP is staying below the 50-day moving average (3.09 dollars), and the Relative Strength Index (RSI) has fallen to 43, suggesting the possibility of further declines." Virtual asset analyst Ali Martinez warned, "If it fails to hold the key support at 2.74 dollars, it could be pushed down to 2.35 dollars." However, conversely, if it breaks above 2.90 dollars and recovers 3 dollars, there is also a view that it could rebound to 3.70 dollars.

Notable coins

1. Solana (SOL)

Solana has shown clear strength over the past week. Solana, which began rebounding on the 2nd, briefly surpassed 212 dollars on the 4th and is currently holding around 206 dollars.

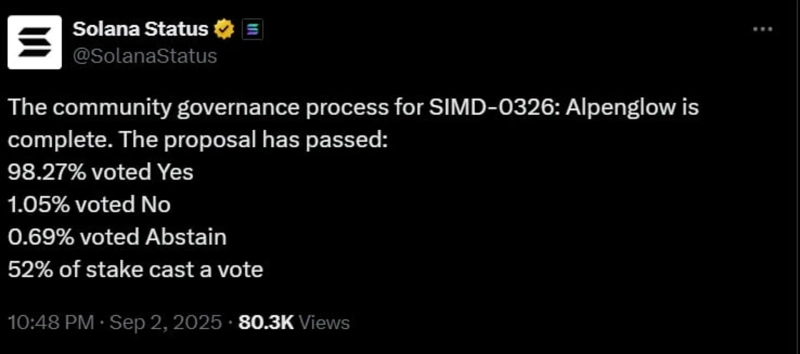

There are two main factors behind the rise. First, the 'Alpenglow' upgrade, a consensus protocol that improves transaction confirmation speed by 100 times, has effectively entered the passage stage. With the vote deadline on the 27th approaching, the approval rate has already exceeded 98%. Second, institutional buying and expectations of ETF approval. This week, institutions such as Galaxy Digital and DeFi Development each added 500,000 SOL and 400,000 SOL respectively, and large asset managers such as Fidelity, VanEck, and Grayscale updated their spot ETF filings, raising expectations.

The outlook is also positive. Crypto-focused investment firm Arca said, "Since Solana's price has risen 33% since early August, it may follow Ethereum's 200% surge." Virtual asset analyst Lach Davis also forecasted, "Increased institutional interest, reserve purchases, and expectations for ETF launches will continue Solana's strength."

2. Dogecoin (DOGE)

Dogecoin continued its rebound from the 2nd, at one point rising from around 0.20 dollars to around 0.22 dollars. It is currently maintaining a relatively stable trend and trading around 0.21 dollars.

There were two noteworthy pieces of news this week. First, NYSE-listed CleanCore Solutions announced it would raise 175,000,000 dollars to invest in Dogecoin, increasing expectations of institutional inflows. Second, it was reported that Alex Spiro, a close associate of Elon Musk, will take the chairmanship of the newly established Dogecoin investment company. The company plans to raise at least 200,000,000 dollars and is expected to receive support from the Dogecoin Foundation's 'House of Doge.'

This raised market speculation that Musk may be directly or indirectly involved in the new investment firm, stimulating investor sentiment. In the short term, whether it breaks the 0.22 dollar resistance line is key. CoinDesk projected, "If it breaks the 0.22 dollar line, it could rise to 0.25~0.30 dollars." However, in the long term, ETF approval and continued whale accumulation are considered important variables.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)