Summary

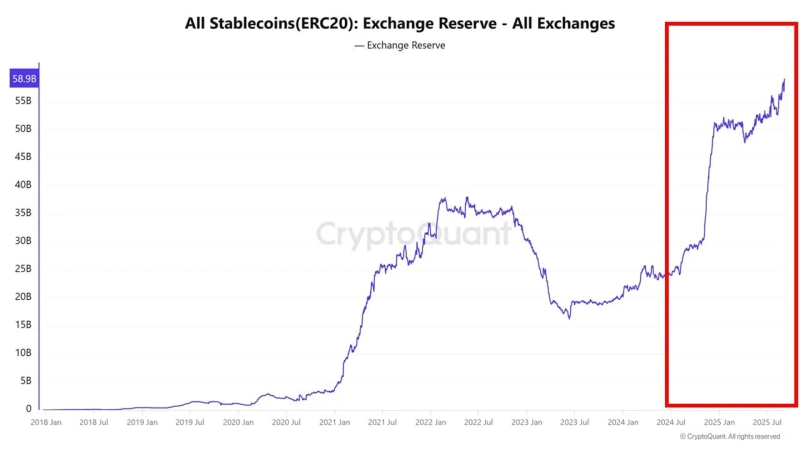

- Reported that exchange stablecoin deposits have reached a record high of 59 billion dollars.

- Stated that a surge in stablecoin deposits suggests investor trading sentiment is becoming active and that a bull market may arrive.

- Reported that the stablecoin supply ratio (SSR) relative to Bitcoin's market capitalization is at its lowest in years, indicating dollar liquidity is abundant.

Exchange deposits of stablecoins (virtual assets whose value is linked to fiat currency), the core liquidity of the virtual asset (cryptocurrency) market, have surged.

On the 7th (Korea time), CryptoQuant contributor 'XWIN Research Japan' wrote in a report, "As of September, exchange-held stablecoins are at a record high of 59 billion dollars," and analyzed, "A sharp rise in stablecoin deposits means a high likelihood that a bull market will arrive."

Stablecoin flows in the market are used as a useful indicator for gauging investors' trading sentiment. An increase in net inflows to exchanges indicates that investors are preparing to trade virtual assets. Conversely, an increase in net outflows of stablecoins indicates a move into decentralized finance (DeFi·DeFi) or payments.

The contributor explained, "The SSR indicator, which represents the stablecoin supply ratio relative to Bitcoin (BTC) market capitalization, is at its lowest level in years," adding, "This means dollar liquidity is abundant."

He added, "Since liquidity is currently accumulated at a record high, it suggests the possibility of a bull market arriving in the future."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)