Summary

- Standard Chartered said it expects a September big cut (50bp rate cut) by the Federal Reserve.

- It said the current US policy rate is at the 4.25~4.50% level.

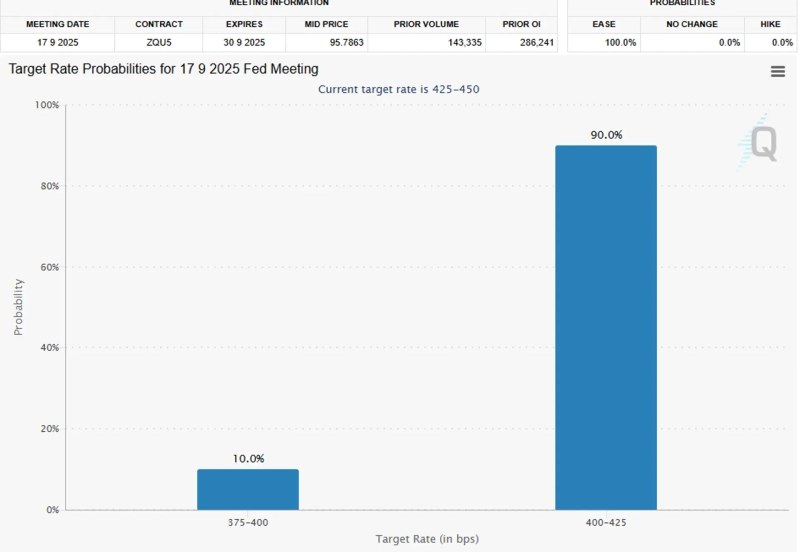

- According to the Chicago Mercantile Exchange FedWatch, the market views the probability of a September rate cut as high.

With global financial markets focused on a potential rate cut by the Federal Reserve (Fed) in September, opinions have emerged that the Fed may carry out a big cut (cutting rates by 50bp).

On the 8th (Korean time), Jinsi News reported that Standard Chartered forecast the Fed would cut rates by 50bp (0.50% points) at the Federal Open Market Committee (FOMC) meeting on September 17 (local time). The current US policy rate is 4.25~4.50%.

According to the Chicago Mercantile Exchange (CME) FedWatch tool, the market is pricing in a high probability of a September rate cut. The probability of a 25bp cut is 90%, and the probability of a 50bp cut is 10%.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)