Editor's PiCK

Many Ethereum treasury companies are insolvent…"Concerns about selling pressure"

Summary

- It reported that among major Ethereum (ETH) treasury companies, four have seen their net asset value ratio (mNAV) fall below 1.

- An mNAV below 1 means that the companies' market capitalization does not measure up to the total amount of crypto assets they hold.

- The DeFi Investor explained that if this situation persists, selling pressure on Ethereum could occur.

Ethereum (ETH) treasury companies that designated Ethereum as a reserve asset have seen their market-to-net-asset-value ratio (mNAV) fall below 1. mNAV is the company's market value divided by its net asset value (NAV).

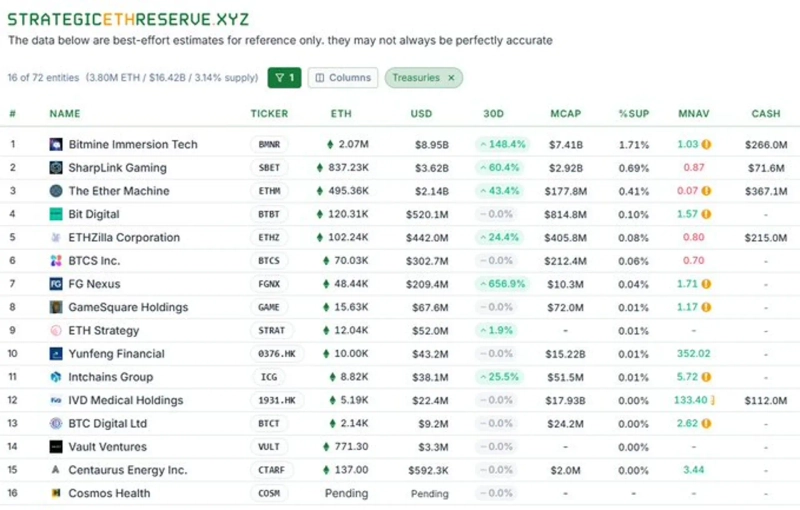

On the 9th (Korea time), The DeFi Investor reported that among six companies holding more than 50,000 Ether, four have mNAVs below 1.

The largest Ethereum holder, Bitmine Immersion Technologies, maintained an mNAV of 1.03, a healthy level. By contrast, SharpLink Gaming (0.87), The Ether Machine (0.07), Etherzilla Corporation (0.80), and BTCS (0.70) all have mNAVs below 1.

mNAV is an indicator of how the market values a company. In other words, a treasury company with an mNAV below 1 has a market capitalization that does not even cover the total amount of crypto assets it holds.

The DeFi Investor explained, "If this situation continues, the Ether reserve strategies of these companies could be compromised," adding, "In extreme cases, they may have to sell Ether."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)