Editor's PiCK

World Liberty Financial, Redstone and Other Altcoins in Focus: Korean Crypto Weekly [INFCL Research]

Summary

- Last week, major altcoins including World Liberty Financial (WLFI) and Redstone (RED) were newly listed on Upbit and Bithumb, showing high trading volumes and volatility.

- Upbit showed steady growth centered on mid-cap tokens, while Bithumb displayed aggressive trading patterns toward speculative assets, highlighting differences in platform-level investment strategies.

- Investors should closely monitor real-time issues and volatility, such as FOMO from the WLFI listing and Bithumb's system downtime.

1. Market Overview

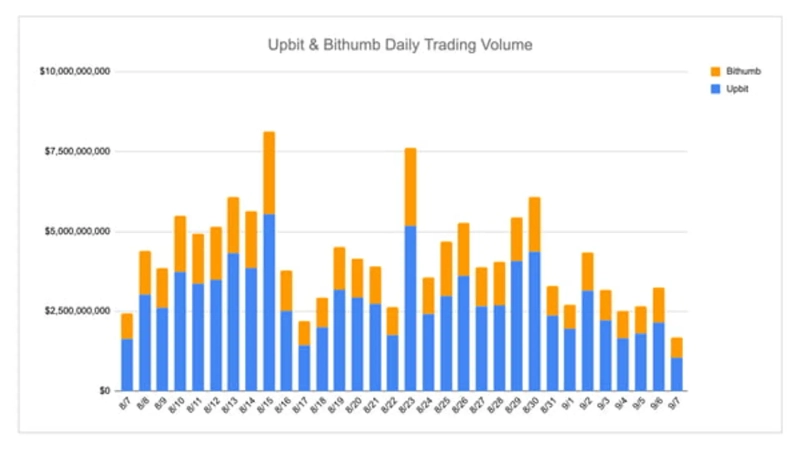

Last week, World Liberty Financial (WLFI), USD1, and Redstone (RED) were listed on Upbit, while WLFI, USD1, and Euler Finance (EULER) were listed on Bithumb. Trading volume remained strong, with Ethereum (1.4 billion dollars) and XRP (1.28 billion dollars) leading on Upbit, followed closely by World Liberty Financial (1.17 billion dollars), Bitcoin (740 million dollars), and Solana (674 million dollars). Bithumb highlighted a greater reliance on stablecoin-centered trading by ranking Tether (877 million dollars) first, ahead of XRP (683 million dollars) and Ethereum (639 million dollars). Meanwhile, altcoins such as ENA, DOGE, SOL, and PENGU maintained robust activity across both exchanges, demonstrating steady retail investor interest beyond the major exchanges.

Price movements across platforms diverged sharply. On Upbit, mid-cap tokens led gains, led by ENA (+17.2%), IP (+16.4%), and WAL (+12.8%). MANA, TREE, and BCH also recorded solid single-digit gains, indicating renewed interest in established ecosystems. In contrast, Bithumb showed much higher volatility, with RED (+75%) and NMR (+49%) surging, and TOWNS, SOON, and EIGEN also showing strength. These contrasting patterns reflect different trading behaviors: Upbit favored steady growth in liquid mid-cap tokens, while Bithumb attracted speculative inflows into high-beta assets.

2. Exchanges

2-1. Newly Listed Coins

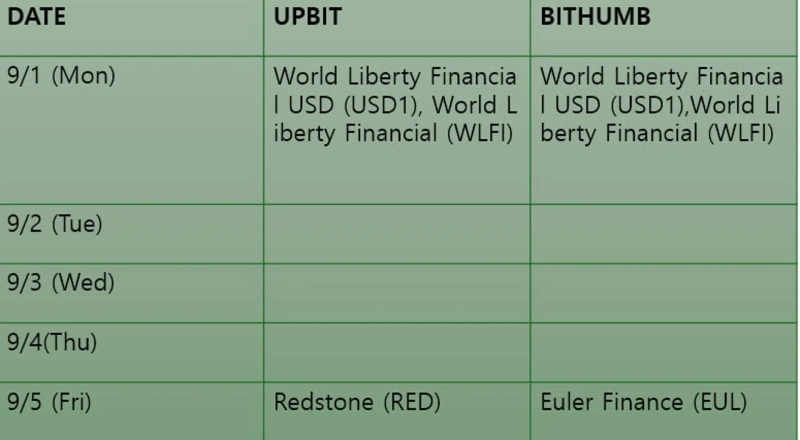

Last week, several new listings occurred on major Korean exchanges.

Upbit listed World Liberty Financial USD1, World Liberty Financial (WLFI), and Redstone (RED).

Bithumb listed World Liberty Financial USD1, World Liberty Financial (WLFI), and Euler Finance (EULER).

Key Marketing Strategies and Highlights

World Liberty Financial (WLFI)

Although USD1, WLFI, and Euler were included in last week's domestic listings, it appears there was little marketing activity specifically targeting the Korean market.

WLFI and USD1, supported by the Trump family, are a special case worth monitoring to see how such projects spread in the Korean market. WLFI, a DeFi platform established in September 2024 by the Trump family, was widely publicized after President Trump—who has pushed pro-crypto policies—officially announced it via Truth Social. The news spread quickly through Telegram channels known for rapid updates, making WLFI known across the Korean crypto community.

Shortly thereafter, in October 2024, WLFI announced a token sale. At the time it was considered significant news, but the direct connection to Trump became unclear, and many hesitated due to complex token sale terms shared within the community. As a result, many Korean communities ultimately decided not to participate.

In hindsight, given WLFI's strong price performance and value since TGE, the decision to sell is largely viewed as a sale that should never have been missed.

Attributing this entirely to the uniqueness of the Korean market may be an exaggeration, but it underscores an important point: market impact is often heavily influenced by positioning and perception.

2-2. Trading Volume

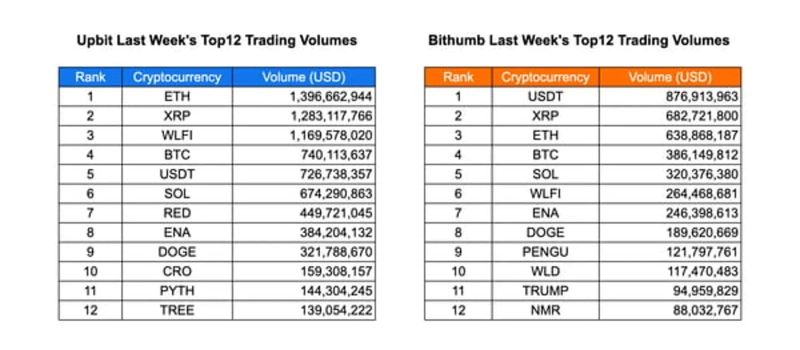

Last week on Upbit, ETH had the highest volume at 1.4 billion dollars, followed by XRP at 1.28 billion dollars and WLFI at 1.17 billion dollars. BTC and USDT recorded approximately 740 million dollars and 727 million dollars respectively, while SOL showed high interest across both large-cap and emerging tokens with 674 million dollars. Small-cap tokens such as RED, ENA, DOGE, CRO, PYTH, and TREE also saw high volumes ranging from 139 million dollars to 450 million dollars, reflecting diverse trading activity across sectors.

On Bithumb, USDT ranked first last week with 877 million dollars, surpassing ETH and XRP which recorded 639 million dollars and 683 million dollars respectively. BTC followed with 386 million dollars, and SOL and WLFI also maintained active volumes at 320 million dollars and 264 million dollars respectively. Other tokens such as ENA, DOGE, PENGU, WLD, TRUMP, and NMR recorded moderate volumes between 88 million dollars and 246 million dollars, showing a mix of stablecoin-centered trading and interest in emerging tokens.

Comparing the two exchanges, ETH and XRP consistently recorded high volumes on both platforms. USDT showed a dominant advantage on Bithumb but ranked fifth on Upbit, indicating exchange-specific preferences. WLFI saw active volume and ranked third on Upbit, but had relatively lower volume on Bithumb. SOL, ENA, and DOGE maintained high volumes on both exchanges, demonstrating continued investor interest alongside established market-leading coins.

2-3. Top 10 Gainers

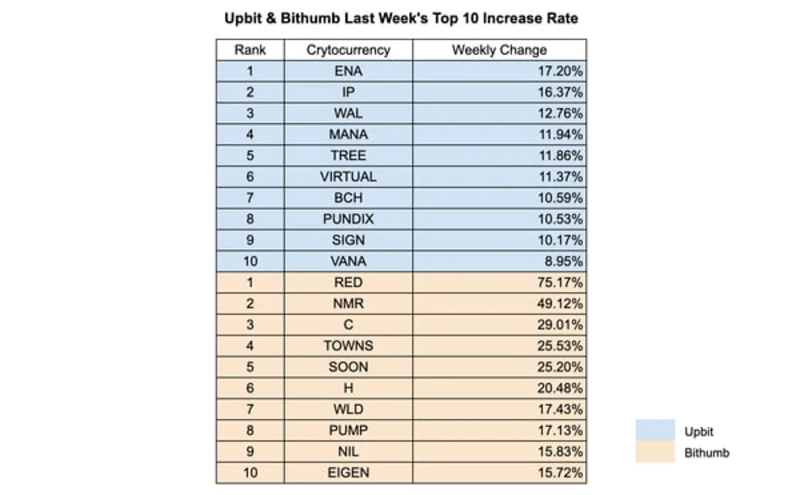

Last week, the Upbit market showed strong momentum among mid-cap and emerging tokens. ENA led gains with a 17.20% increase, followed by IP at 16.37% and WAL at 12.76%. MANA, TREE, VIRTUAL, BCH, PUNDIX, SIGN, and VANA also recorded weekly gains between 8.95% and 11.94%, reflecting active trading and investor interest in growth-oriented altcoins.

On Bithumb, weekly rallies were even more pronounced, with RED surging 75.17%, NMR up 49.12%, and C up 29.01%. TOWNS, SOON, H, WLD, PUMP, NIL, and EIGEN also rose between 15.72% and 25.53%, showing large rallies across both established and new tokens. This indicates high speculative activity and strong volatility.

Comparing the two exchanges, Upbit's top gainers were generally mid-cap tokens showing moderate growth, whereas Bithumb exhibited extreme short-term volatility, particularly with very high rises for RED and NMR. This contrast highlights differences in investor behavior and market dynamics across platforms: Upbit shows steady altcoin growth while Bithumb exhibits aggressive trading patterns toward high-momentum assets.

3. Korean Community

1. Pudgy Penguins Take Over Seoul Ahead of KBW

Ahead of Korea Blockchain Week, Pudgy Penguins is strengthening its presence in Korea. A branded bus featuring the penguin is running from Incheon Airport to Gangnam, and penguin videos are being displayed on digital billboards at Gangnam Station. They have also launched an official Korean-language Telegram announcement channel and a Naver Cafe to quickly onboard users. Community members have begun identity verification under founder Luca Netz's name. Many are watching to see whether Pudgy Penguins' cute IP can lead to true mainstream adoption in Korea.

2. Korean Traders Flock to WLFI

With WLFI listed on major Korean exchanges, retail investors' expectations surged. Traders actively compared WLFI's market cap (30 billion dollars) with major domestic companies such as KB Financial, Celltrion, and Doosan Enerbility in community discussions. It turned out that WLFI was actually larger than some well-known companies. From pre-listing positioning to cross-chain arbitrage between ETH, BSC, SOL, and Korean exchanges, savvy traders posted cases of substantial profits. WLFI's listing triggered strong FOMO and became one of the most talked-about listings this season.

3. Bithumb Emergency System Downtime

Around 11:30 PM on September 2 (Korean time), Bithumb conducted an unexpected emergency system maintenance that lasted about 1 hour and 30 minutes. Order processing delays completely halted trading services, leaving many users unable to access the platform. Although concerns were raised about potential losses during the downtime, Bithumb immediately announced it would compensate for all damages caused by the incident. Community reactions were mixed, with some praising the quick response and others expressing concerns about stability given the surge in trading volume during KBW.

*All content is provided for informational purposes only and does not constitute a basis for investment decisions or investment advice. The content is not liable for any investment, legal, or tax matters.

INF Cryptolab (INFCL) is a consulting firm specializing in blockchain and Web3, offering a one-stop service for corporate Web3 market entry strategy, token economy design, and global market expansion. We provide strategy development and execution support to major securities firms, game companies, platforms, and global Web3 companies, leveraging accumulated know-how and references to lead sustainable growth in the digital asset ecosystem.

This report is independent of media editorial directions, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)