[Analysis] "Bitcoin options market, volatility stabilizes ahead of FOMC… Q4 outlook positive"

Summary

- The Bitcoin options market's implied volatility is reported to be stable despite the Fed's benchmark rate decision.

- The market has already priced in a 25bp rate cut, keeping volatility expectations low.

- Market participants are more positive about the Q4 outlook, which is favorable for investor sentiment.

Implied volatility in the Bitcoin (BTC) options market appears to be showing a stable trend.

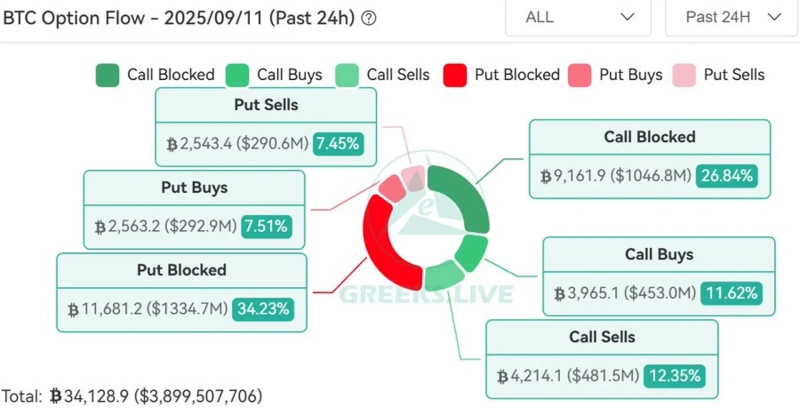

On the 11th (local time), Greeksdotlive said, "Despite the upcoming decision on the U.S. Federal Reserve (Fed) benchmark interest rate next week, implied volatility in the Bitcoin options market has slightly decreased and is maintaining a stable trend."

It went on to analyze, "The market has already priced in a 25bp rate cut, and future volatility expectations are also being set low. Overall volatility expectations remain suppressed, so despite short-term uncertainty, investor sentiment is relatively stable."

Greeksdotlive also added, "Market participants are more positive about the Q4 outlook than about the latter part of this month," noting, "This will act favorably on Bitcoin investment sentiment toward the end of the year."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)