[Analysis] "Avalanche, futures trading volume overheated… suggests possibility of short-term adjustment"

Uk Jin

Summary

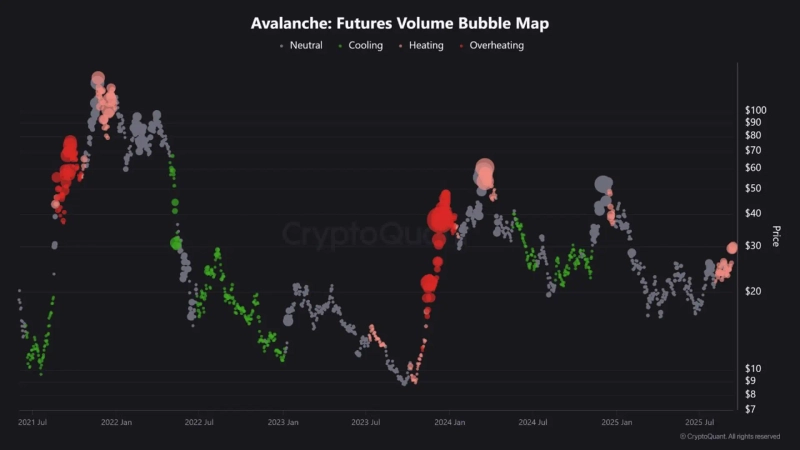

- Avalanche (AVAX) may enter a short-term adjustment, the analysis reportedly stated.

- According to the report, futures trading volume has entered an overheated phase and leveraged positions are rapidly accumulating.

- It stated that in past cases, when futures market overheats, cascading liquidations can increase downward pressure.

Avalanche (AVAX) may enter a short-term adjustment, according to analysis.

On the 15th (Korean time), Burak Kesmesi, a CryptoQuant contributor, wrote in a report, "Looking at the Avalanche futures trading volume bubble method, it appears to have entered an overheated phase," and analyzed, "leveraged positions are accumulating rapidly."

The contributor added, "Looking at past data, Avalanche has entered a short-term adjustment when overheating occurred in the futures market," and "even a small price decline can trigger cascading liquidations and increase downward pressure."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)