Editor's PiCK

Surge in New Listings on Korean Exchanges: Korean Crypto Weekly [INFCL Research]

Summary

- Last week, major exchanges such as Upbit and Bithumb reported a surge in new listings and active trading of various mid- and small-cap tokens including WLFI and OPENLEDGER.

- Upbit recorded high volumes in large assets like XRP and ETH, while Bithumb saw higher volumes in stablecoins and AI-related assets such as USDT and WLD, indicating differing investor preferences by exchange.

- Assets such as MOODENG, ATH, and F recorded high returns, highlighting continued investor interest in altcoins and emerging projects and underscoring market volatility.

1. Market Overview

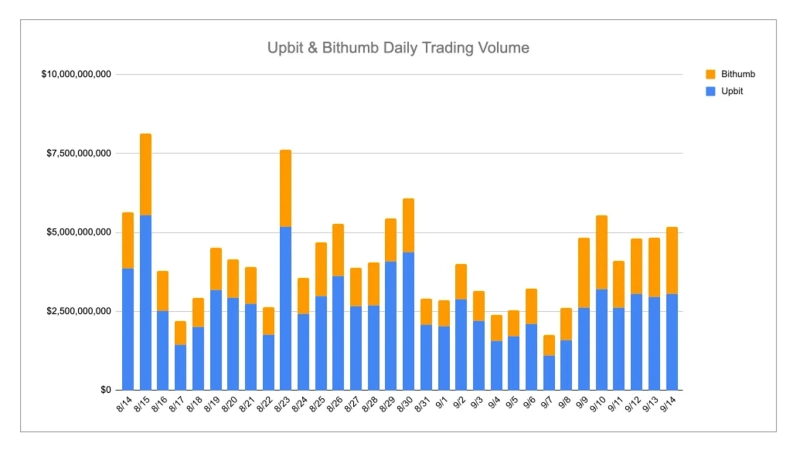

Last week, WLFI, USD1, and Redstone were listed on Upbit, and WLFI, WLFI USD, and Euler Finance were listed on Bithumb. Trading volume remained robust, with ETH ($1.4 billion) and XRP ($1.28 billion) leading on Upbit, followed by large tokens such as WLFI ($1.17 billion), BTC ($740 million), and SOL ($674 million). Bithumb highlighted a greater reliance on stablecoin-centric trading, with USDT ($877 million) surpassing XRP ($683 million) and ETH ($639 million) to take first place. Meanwhile, altcoins such as ENA, DOGE, SOL, and PENGU maintained strong activity on both exchanges, showing steady retail investor interest beyond major exchanges.

Platform price movements diverged sharply. On Upbit, mid-cap tokens led the gains, driven by ENA(+17.2%), IP(+16.4%), and WAL(+12.8%). MANA, TREE, and BCH also recorded solid single-digit gains, suggesting renewed interest in existing ecosystems. In contrast, Bithumb showed much higher volatility, with RED(+75%) and NMR(+49%) surging, and TOWNS, SOON, and EIGEN also strengthening. This contrast reflects different trading patterns: Upbit favored steady growth of liquid mid-cap tokens, while Bithumb attracted speculative inflows into high-beta assets.

2. Exchanges

2-1. Newly Listed Coins

Last week, several new listings occurred on major Korean exchanges.

Upbit listed Plok, Worldcoin, OpenLedger, Linea, HoloWorld, and PumpFun.

Bithumb listed OpenLedger, Linea, and PumpFun.

Key marketing strategies and highlights

OpenLedger (OPEN)

OpenLedger's marketing in Korea can be described as a comprehensive strategy preparing for 2025. It would not be an exaggeration to say they executed nearly every possible plan, from KOL marketing to AMAs, offline meetups, and campaigns. Details on the activities that had the greatest impact are as follows.

1. Offline meetings

OpenLedger held several public and private offline meetups. In its early market entry in Korea, OpenLedger introduced the project in greater detail and built closer relationships through private meetings with local KOLs. Sharing an iconic octopus dish left a strong impression on attendees. The real highlight, however, was the public community meetup. As reported previously, Korean offline events increasingly provide token airdrops to attendees. OpenLedger also offered generous rewards at meetups during this period. As a result, more than 1,500 people registered, and due to venue capacity, about 600 attended on the day. While not held alongside KBW, the country's largest blockchain event, it was one of the largest satellite events in Korean history in terms of attendance. In addition, all attendees received an $OPEN airdrop after the TGE.

2. Campaigns

To ensure sustained user engagement, OpenLedger ran numerous campaigns in Korea. Unlike most projects that end after one or two campaigns, OpenLedger leveraged a broad range of KOLs to run multiple rounds to maximize exposure to Korean users. The most notable case was the "Paldo campaign." While 99% of domestic blockchain meetups are held in Seoul, OpenLedger launched regional campaigns to encourage participation from users outside the metropolitan area, filling that gap. This campaign drew over 100,000 participations.

This was a smart strategy that leveraged Korea's relatively small but segmented Telegram ecosystem.

3. AMAs

Like its campaigns, OpenLedger did not limit AMAs to a few KOLs. Instead, it collaborated with multiple KOLs and institutions to ensure broad exposure as well as the delivery of more detailed project updates.

4. Kaito

Korean users often grow fatigued when "Kaito shill" content is posted repeatedly, since a few posts quickly become stale. However, OpenLedger continuously provided new content through campaigns and events, promoting sustained Kaito social activity. An exclusive reward pool for Korean users also played an important role in maintaining participation.

2-2. Trading Volume

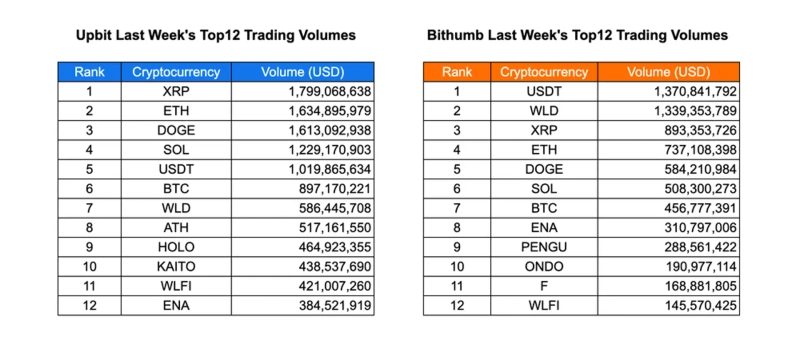

Last week on Upbit, XRP led trading volume at $1.8 billion, followed closely by ETH at $1.63 billion and DOGE at $1.61 billion. SOL, USDT, and BTC also maintained high volumes above $800 million. Small- and mid-cap tokens including WLD, ATH, HOLO, KAITO, and WLFI showed solid liquidity, demonstrating broad investor participation across major and smaller assets.

On Bithumb, USDT topped the chart at $1.37 billion, followed by WLD at $1.34 billion. This indicates high trading interest in stablecoins and AI-related projects. XRP, ETH, DOGE, and SOL maintained high market caps on both exchanges, and tokens such as ENA, PENGU, ONDO, and WLFI entered the top 12, showing growing interest in emerging tokens and new listings.

Overall, trading activity on Upbit and Bithumb showed distinct differences in exchange preference. Upbit favored XRP and ETH, while Bithumb showed higher volumes in USDT and WLD. The inclusion of both major cryptocurrencies and niche tokens in the top ranks suggests continued participation from retail and institutional investors, supporting a diversified trading environment.

2-3. Top 10 Gainers

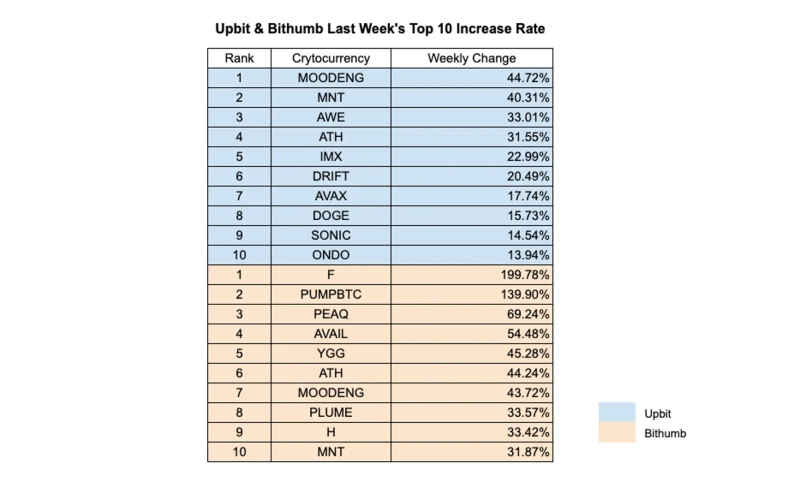

Last week on Upbit, MOODENG led price gains, rising 44.72%, followed by MNT up 40.31% and AWE up 33.01%. ATH, IMX, and DRIFT also recorded strong gains above 20%, showing continued investor interest in mid-caps and emerging tokens. AVAX, DOGE, SONIC, and ONDO showed sustained momentum across both meme-based and utility-based projects, placing in the top 10.

On Bithumb, F surged 199.78%, while PUMPBTC and PEAQ rose 139.90% and 69.24% respectively, revealing speculative spikes and high volatility in niche assets. AVAIL, YGG, and ATH also showed notable gains, and MOODENG, like on Upbit, rose 43.72%, indicating cross-exchange investor participation. PLUME, H, and MNT entered the top 10, highlighting a mix of established tokens and newly spotlighted projects.

Overall, the top performers across both exchanges illustrate diversified market dynamics, with both major cryptocurrencies and small emerging projects driving weekly gains. The overlap of rising assets such as ATH and MOODENG across multiple platforms suggests strong investor sentiment, while the sharp rally of single tokens like F on Bithumb points to increased speculative activity impacting the short-term market environment.

3. Korean Community

1. Upbit presents future vision at UDC 2025

At this year's Upbit D Conference (UDC 2025), Upbit expressed its ambition to evolve from a digital asset exchange into a full-fledged blockchain infrastructure company shaping the future of finance. The launch of the GIWA chain and GIWA wallet received the most attention. "GIWA" stands for Global Infrastructure for Web3 Access. The metaphor of a roof tile covering Korea symbolizes the GIWA chain's mission to securely protect and layer on-chain data.

The Korean crypto community reacted with excitement. Some users said, "I want to explore the GIWA mainnet," while others joked about "finding the legendary honeypot." A past Tiger Research report suggesting that Korean exchanges might launch their own mainnets resurfaced, and keen KOLs rushed on Twitter to secure the official GIWA account. Admiration and playful envy spread across the community.

2. Penguins take over Korean streets

Fuzzy Penguin continued to dominate Korean fans' mindshare by sponsoring the Series.L concert, which featured Korea's top artists last week. KOLs who purchased tickets held giveaways for their followers, and Telegram and Twitter were flooded with concert photos and posts after the event. The Fuzzy Penguin claw machine was a particular sensation. Meanwhile, the penguin's presence expanded offline through an airport bus brand, Gangnam subway ads, and ongoing street marketing. A Korean crypto media outlet even ran a headline saying, "Chubby Penguin will inherit Disney's throne." Amid this aggressive push, many community members speculated whether the cute IP of the chubby penguin could actually drive mainstream adoption in Korea.

3. WCT's one-year memoir

We Crypto Together (WCT), one of Korea's top KOLs attending UDC 2025, shared personal thoughts on the past year. The post quickly spread and surpassed 217,000 views on Twitter. In the post, he compared his feelings from a year ago to now, sharing his journey and candid thoughts on the Korean crypto market. The post was widely shared among community members and KOLs, and many recommended it as a must-read for anyone interested in Korea's web3 industry. Because it was written in Korean, overseas readers may need a translation, but it has already circulated widely as a reference showing the mindset of one of Korea's most influential retail industry figures.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)