Eric Balchunas "With the U.S. SEC's adoption of general listing standards… crypto asset ETFs will flood the market"

Summary

- The U.S. SEC has approved general listing standards for spot-based exchange-traded products (ETPs).

- Analyst Eric Balchunas said this approval makes it likely that more than 100 crypto asset ETFs within 12 months will be launched.

- He said that crypto assets that have had futures trading on the Coinbase Derivatives Exchange for more than six months will be automatically approved for ETF listing without separate review.

The U.S. Securities and Exchange Commission (SEC) has approved general listing standards for spot-based exchange-traded products (ETPs), and accordingly there are projections that more than 100 crypto asset (cryptocurrency) ETFs will be launched within one year.

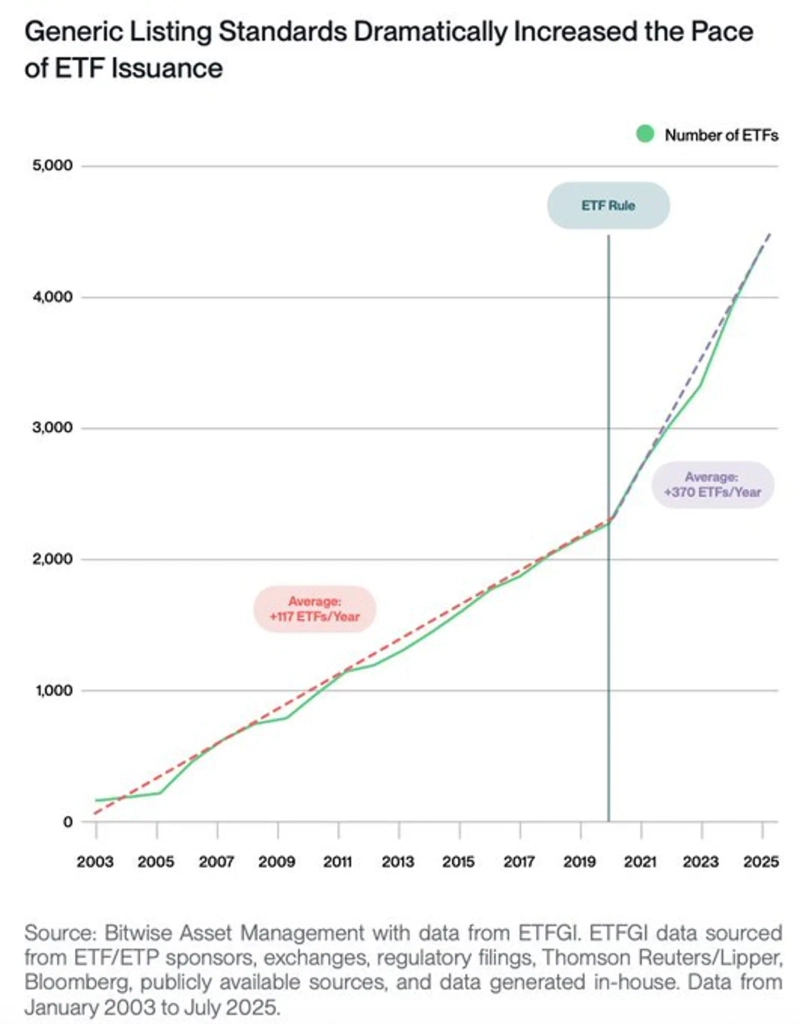

On the 18th (local time), Bloomberg analyst Eric Balchunas said on X, "The approval effect of general ETF listing standards could be replicated in the crypto asset market. In the past, when the same system was introduced for ETFs based on traditional finance such as stocks and bonds, there was a precedent of new ETF launches tripling."

He added, "This measure makes it highly likely that more than 100 cryptocurrency ETFs will flood the market within the next 12 months."

Earlier, the SEC approved general listing standards for ETPs holding spot commodities, including crypto assets. Accordingly, crypto assets that have had futures trading on the Coinbase Derivatives Exchange for more than six months will be automatically approved for ETF listing without separate review.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)