Editor's PiCK

Surge in New Token Listings…Signs of Market Structure Change : Korean Crypto Weekly [INFCL Research]

Summary

- Last week, major Korean exchanges saw a surge in new token listings, indicating diversification of investor demand and signs of market structure change.

- Upbit and Bithumb recorded sharp price rises and high volumes for certain tokens such as AVNT, ORDER, and PUMPBTC, highlighting continued speculative asset investment sentiment in the market.

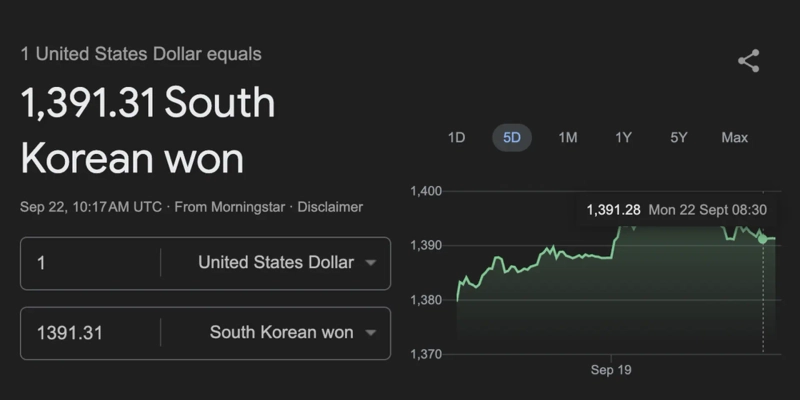

- Alongside a rise in the KRW/USD exchange rate, USDT (Tether) has remained strong, with domestic investors increasingly hedging against won risk by favoring crypto assets.

1. Market Overview

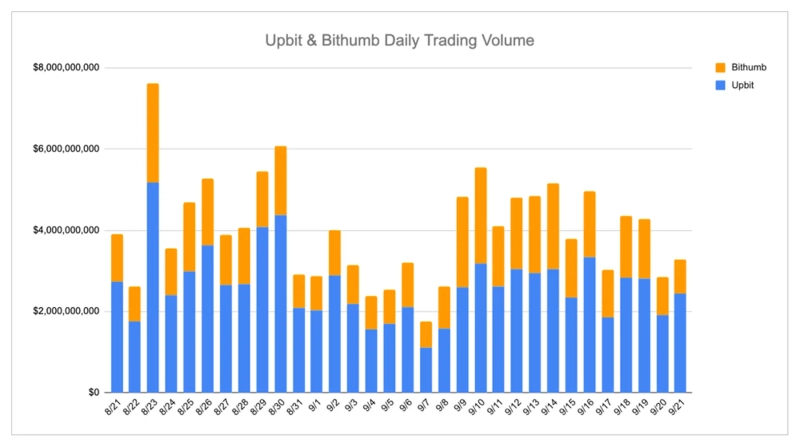

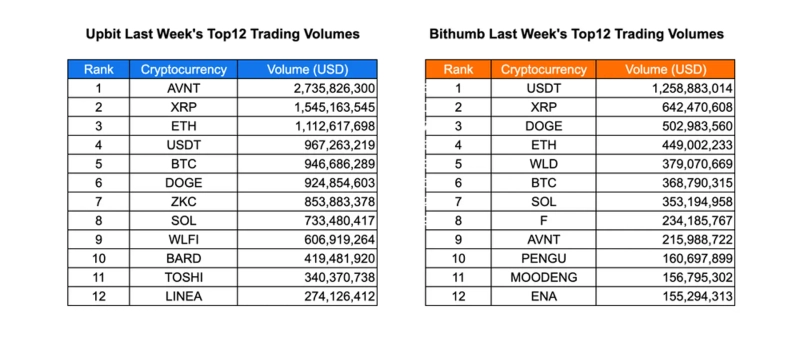

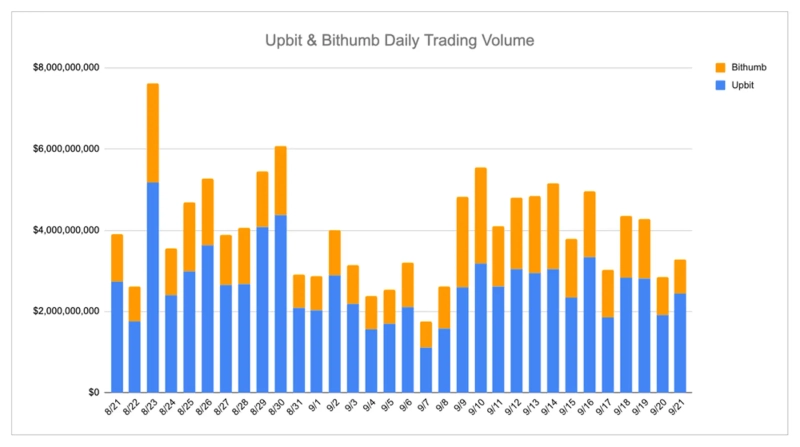

Last week, Korean exchanges showed an unusually high flow of listings. Upbit listed Avantis, Boundless, Toshi, Lagrange, Lombard, EtherFi, Resolv, Initia, and Spark, while Bithumb listed Avantis, Boundless, Toshi, Holoworld AI, Lombard, Bittensor, and Kamino Finance. Trading activity reflected this momentum. On Upbit, AVNT led volume with 2.74 billion dollars, far surpassing XRP (1.55 billion dollars) and ETH (1.11 billion dollars). Major cryptocurrencies such as USDT, BTC, and DOGE each approached 1 billion dollars. Mid-tier coins like ZKC, WLFI, TOSHI, and LINEA also recorded notable volumes. On Bithumb, USDT led with 1.26 billion dollars, followed by XRP (640 million dollars) and DOGE (500 million dollars). Meanwhile, WLD, AVNT, and PENGU emphasized retail-driven trading across new and emerging assets.

Price movements further highlighted differences between the two exchanges. On Upbit, AVNT surged 85.7% while IP (+43.6%), ME (+29.2%), OMNI, DRIFT, and W each rose over 20%, reflecting steady mid-cap momentum. By contrast, Bithumb was characterized by sharp speculative rallies, with AVNT (+136%), ORDER (+127%), and PUMPBTC (+124%) driving extreme gains alongside strong moves in MERL, THE, and SUN. The overlap of winners like AVNT and IP shows broad conviction, but the scale of Bithumb's spikes underscores a higher-risk environment compared with Upbit's more measured altcoin growth.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges announced several new listings.

Upbit listed Avantis, Boundless, Toshi, Lagrange, Lombard, EtherFi, Resolv, Initia, and Spark.

Bithumb listed Avantis, Boundless, Toshi, Holoworld AI, Lombard, Bittensor, and Kamino Finance.

Lombard (BARD)

Lombard emerged as one of the early bitcoin deposit projects shortly after Babylon, which enabled DeFi activity using bitcoin, was launched.

As a new DeFi concept that generates yield through bitcoin deposits was introduced, many users actively participated in these deposit-based opportunities.

Lombard was regarded as one of the representative platforms for bitcoin deposits at the time, and there was active participation from the Korean community.

As Lombard expanded its user base, it began to actively pursue KOL marketing in the Korean market. Recognizing that many users perceived Lombard merely as a bitcoin deposit, Lombard focused on communicating the breadth of its activities.

At the same time, it highlighted data points such as TVL, market share within BTCFi, DeFi adoption of LBTC, and user growth.

As the TGE approached, Lombard promoted a token sale on the Buidlpad platform through KOL channels and ultimately raised approximately 94 million dollars. This exceeded the initial target by 1,403%.

Lombard has since continued to raise awareness within the Korean community by sharing updates on ecosystem expansion and new partnerships. In particular, the announcement of a partnership with KODA, the country's leading institutional custody service provider, shows Lombard is aligning with the growing institutional demand in the Korean market.

2-2. Trading Volume

Last week on Upbit, AVNT led with 2.74 billion dollars in volume, followed by XRP (1.55 billion dollars) and ETH (1.11 billion dollars). Core assets such as USDT (970 million dollars), BTC (950 million dollars), and DOGE (920 million dollars) also maintained strong liquidity, while SOL (730 million dollars) and ZKC (850 million dollars) supported demand beyond top tokens. Mid-tier tokens including WLFI, BARD, TOSHI, and LINEA showed significant volume, indicating steady investment activity across both major and smaller assets.

On Bithumb, USDT ranked first with 1.26 billion dollars in volume, followed by XRP (640 million dollars), DOGE (500 million dollars), and ETH (450 million dollars). WLD (380 million dollars) and BTC (370 million dollars) also attracted attention, and SOL (350 million dollars) remained actively traded among large caps. The presence of tokens such as F, AVNT, PENGU, MOODENG, and ENA among the top 12 underscores growth in newly listed and retail-driven assets.

Overall, trading activity showed distinct exchange preferences. Upbit relied heavily on AVNT and other mid-cap tokens, while Bithumb showed strength in USDT and newly listed items. That both high-quality cryptocurrencies and speculative tokens appear in the rankings indicates diversified market participation from both retail and institutional investors.

2-3. Top 10 Gainers

Last week on Upbit, AVNT led price gains with an 85.66% increase, followed by IP (43.61%) and ME (29.16%). OMNI, DRIFT, and W also posted solid gains of over 20%, showing strong momentum across mid-caps and emerging tokens. SIGN, IMX, NEAR, and LINEA entered the top 10, reflecting continued investor interest across infrastructure and ecosystem tokens.

On Bithumb, AVNT surged 136.48%, with ORDER (126.63%) and PUMPBTC (124.00%) close behind, highlighting speculative rallies in niche assets. MERL (65.12%), THE (64.00%), and SUN (57.04%) also recorded weekly gains, and IP (40.86%) continued momentum on both exchanges. BB, PEAQ, and H made the top 10, indicating growing interest in newly listed projects and community-driven initiatives.

Overall, this week's top gainers were a mix of established tokens and speculative assets, driving market activity. The overlap of AVNT and IP across Upbit and Bithumb suggests strong investor conviction across exchanges, while sharp rises in tokens like ORDER and PUMPBTC point to increased volatility and expanded short-term trading opportunities.

3. Korean Community

3-1. Endless Listings, Growing Fatigue

3-2. Kaito Launchpad Controversy

Last week, Kaito's allocation for Boundless became a heated controversy despite generating a twofold return relative to principal. The core issue was the structure. Instead of a proportional allocation, a hard cap of 250,000 dollars was applied, frustrating whale investors. Moreover, even after the sale ended, the platform distributed tokens on a first-come, first-served basis, which many investors viewed as unfair and absurd. Fuel was added to the fire when Kaito unilaterally increased the sale amount without updating disclosures, rendering previous investment data meaningless. Along with ongoing complaints about past distribution and claim issues, this launchpad round left many community members skeptical despite initial profitability.

3-3. KRW/USD Exchange Rate Nearing 1,400…Tether Remains Strong

With the KRW/USD exchange rate approaching 1,400, domestic crypto traders holding significant amounts of USDT are closely watching currency fluctuations. Despite the absence of a strong kimchi premium, tether prices have remained firm, supported by dollar strength and expectations of a second round of government support and other domestic stimulus measures. Opinions like "holding won is risky" have become widespread, increasing risk-aversion toward the won. Tether's strong defense indicates traders are hedging against domestic currency risk and linking crypto positions to macroeconomic concerns.

*All content is written for information delivery and provision and is not intended as a basis for investment decisions or as investment advice or recommendations. The content is not responsible for any investment, legal, tax, or other matters.

INF Crypto Lab (INFCL) is a consulting firm specialized in blockchain and Web3, providing one-stop services such as corporate Web3 entry strategy, token economy design, and global market entry. It offers strategy and execution services to major domestic and international securities firms, game companies, platform companies, and global Web3 firms, leveraging accumulated know-how and references to lead sustainable growth of the digital asset ecosystem.

This report is independent of media editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)