Editor's PiCK

Min Byung-deok · Lee Jun-seok "Won stablecoin, combined with Korean IP, will lead financial innovation"

Summary

- Lawmaker Min Byung-deok emphasized that a won stablecoin combined with Korean IP could have independent competitiveness in the global market.

- Leader Lee Jun-seok mentioned the payment innovation potential of won stablecoins, stating that depegging prevention and stable collateral operation are key.

- Panelists said that market preemption and rapid institutionalization, along with policy support from financial authorities and the National Assembly, are important variables for investment success.

Origin Summit hosted by IP Blockchain Infrastructure Story

Min Byung-deok "Combined with Korean IP, it can beat dollar stablecoins"

Lee Jun-seok "Financial innovation possible... risk management must be proactive"

There is a view that if a won stablecoin is combined with Korean intellectual property (IP), it could become a new paradigm that reorganizes national competitiveness beyond mere financial innovation. Analysts say that if won stablecoins become the payment and settlement infrastructure amid the global spread of K-pop and the content industry, it could strengthen Korea's digital currency sovereignty and secure next-generation growth engines.

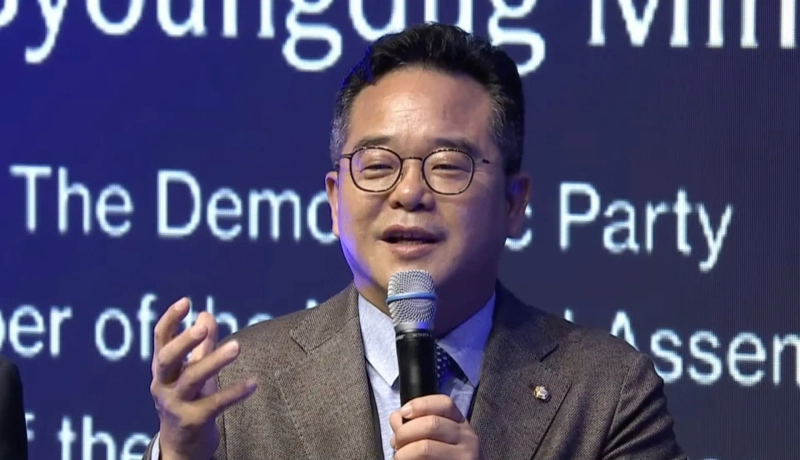

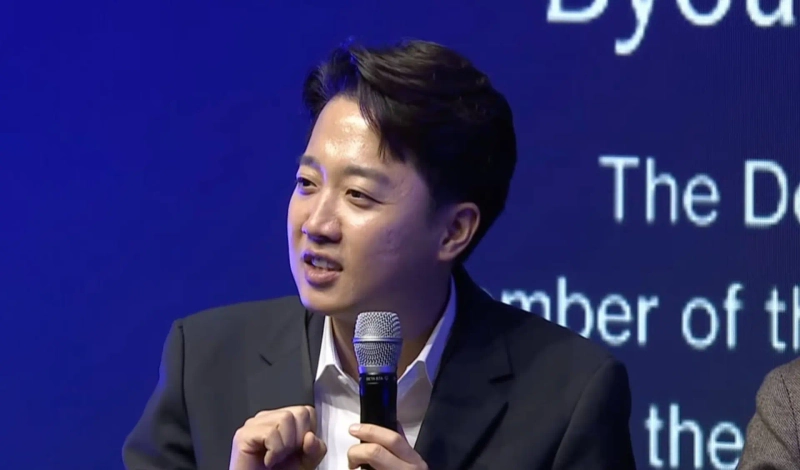

On the 23rd at Andersons Seongsu in Seongdong-gu, Seoul, at the global blockchain conference 'Origin Summit', Min Byung-deok of the Democratic Party of Korea and Lee Jun-seok, leader of the Reform New Party, spoke in a panel discussion titled 'Won Stablecoin: Building a Korean-style Digital Dollar', jointly stating, "Won stablecoins can open a new financial paradigm by combining with Korean IP and payment infrastructure," and adding, "For this, stability and the establishment of institutional foundations are important."

Min Byung-deok "Won stablecoin combined with Korean IP, a weapon to expand economic territory"

Lawmaker Min stressed the need to institutionalize won stablecoins and emphasized their strategic value. He said, "The dollar-based stablecoin craze has already swept the world like a tsunami," and added, "We should ride that wave rather than be swept away by it. Won stablecoins are not just a defensive measure but a weapon to expand Korea's economic territory."

In particular, Min predicted that won stablecoins could gain independent competitiveness in the global market when combined with Korean IP. He said, "In the future, various won stablecoin models specialized for certain industries and content could emerge," and added, "If sector-specific stablecoins are created for areas such as healthcare, performances, and K-pop fandoms, Korea can secure an advantage different from the United States. If that happens, we can beat dollar stablecoins, the so-called 'dalsco'."

He also emphasized the speed of institutionalization of stablecoins and the importance of market preemption. He said, "People were unfamiliar with the Internet in its early days, but now the Internet is an essential element of our lives," and added, "Ultimately, habituation is important. That way, one can preempt the market." He continued, "Financial authorities should take responsibility for stability," and added, "To avoid missing this opportunity, rapid institutionalization and development led by innovative companies are important."

He also mentioned the role of the National Assembly. He said, "It is our duty to quickly proceed with institutionalization for the issuance of won stablecoins," and added, "The National Assembly will exert institutional leadership to support the market, such as converting already circulating local currencies into won stablecoins."

Lee Jun-seok "Won stablecoin will innovate payments... preventing depegging is key"

Lee Jun-seok agreed on the need to institutionalize won stablecoins but emphasized the importance of risk management. He noted, "Although negative perceptions of stablecoins spread after the Terra-Luna incident, collateral-backed stablecoins are clearly more stable than algorithmic ones," but he cautioned, "That does not guarantee that depegging will never occur."

He carefully examined issues of collateral management and reserve requirements. Lee said, "Traditional banks manage risk through reserve requirements, but for stablecoins problems can arise at any time depending on the criteria for recognizing collateral," and stressed, "For won stablecoins to settle within the institutional framework, stable collateral operation and depegging prevention mechanisms are essential."

Regarding the value of won stablecoins, he analyzed that they have the potential to revolutionize the payment and settlement structure across Korean industries. He said, "Existing credit card and debit card payment networks have long settlement cycles, passing exchange rate risk onto consumers. If won stablecoins are introduced, real-time exchange and settlement by the minute will be possible, directly reducing costs," and added, "If a won stablecoin-based payment system takes root in areas like K-pop merchandise and global IP sales, it will bring enormous advantages to the Korean content industry."

He continued, "New financial models that provide incentives depending on specific use cases are also possible. New services could emerge in areas such as municipal welfare spending, fandom staking, and IP-based rewards," and added, "If the National Assembly and the government clearly define the institutional status of stablecoins, innovation will occur without market confusion."

Hwang Doo-hyun, Bloomingbit reporter cow5361@bloomingbit.io

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)