Average 32,000% loss?…'Zero-Day Options' become a bomb in the investment market [Global Money X-File]

Summary

- Recently in the U.S., the trading share of zero-day options (0DTE) has surged, expanding market liquidity.

- The Bank for International Settlements and others noted that the product's average loss rate is -32,000%%, and that sharp market volatility could increase systemic financial risk.

- Korean investors are also directly investing in U.S. 0DTE options, so U.S. market volatility could directly shock Korean household assets.

Recently, demand for so-called "zero-day options (0DTE)" financial products has surged, mainly in the United States. 0DTE are ultra-short-term derivatives with less than 24 hours to expiration. They are hailed as an innovative product that supplies massive liquidity to global financial markets. However, some warn they could act as a fuse that might collapse the entire financial system if a small financial crisis occurs.

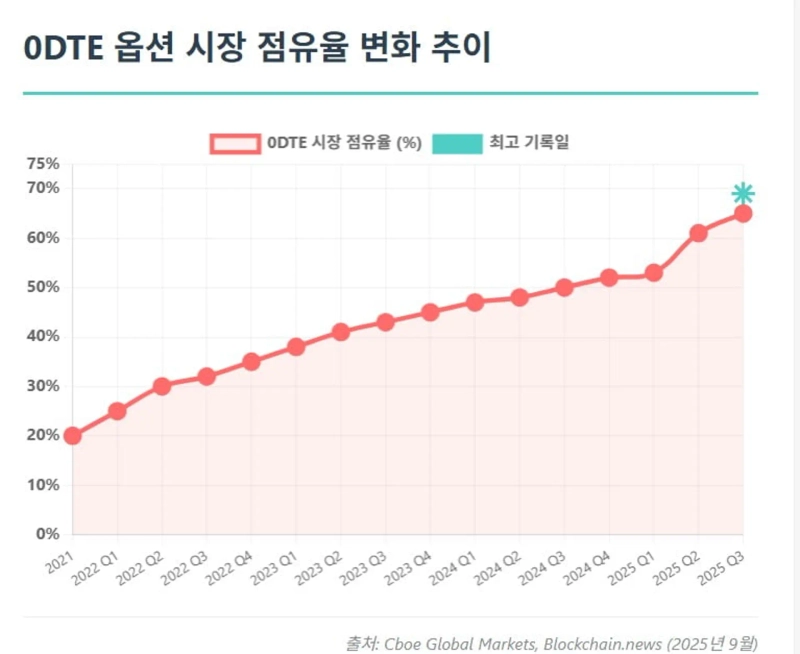

Account for more than 60% of the U.S. options market

On the 24th, according to the latest data Cboe Global Markets released on the 2nd, 0DTE trading accounted for 62.4% of the SPX options market, the key indicator of the U.S. stock market, setting a record high. That amounts to an average of about 2.4 million contracts per day being executed on their expiration day.

0DTE is an abbreviation of "Zero Days to Expiration." It refers to options that expire on the same day. The trading day is the expiration day, so the option's time value rapidly decays and only intrinsic value remains. Because they expire in one day, they are suited for ultra-short-term directional trading, betting on news events, quick profit taking, and risk management. They can be used to maximize returns and for leverage effects (but losses also occur quickly).

There are three main participants in the 0DTE market: retail investors, institutional investors, and high-frequency trading (HFT) algorithms, forming a complex ecosystem of interaction. The biggest driver of 0DTE volume is retail investors. According to analysis by Cboe Global Markets, 53% of last month's SPX 0DTE volume came from small retail investors. Most of them invest in this market because they see a "lottery-like payoff" structure where very large gains are possible with very low probability. The key lure is that a low premium can produce hundreds of times leverage.

But reality is not easy. A related study from the University of Münster in Germany found that as much as 75% of retail investors' S&P 500 options trading was concentrated in 0DTE, and they have been showing substantial losses. According to the Bank for International Settlements (BIS) report "What Explains the Recent Decline in the VIX?", 0DTE buying strategies showed an astronomical average annualized loss of -32,000%. In rare successful cases, extreme distributions recorded up to 79,000%.

Heiner Beckmeyer, a professor at the University of Münster, pointed out, "Retail investors love 0DTE options but they shouldn't. Our analysis shows they systematically lose money, and their behavior resembles lottery purchasing. Trading costs, in particular, account for a large portion of the total losses."

Institutional investors mainly participate in the market for hedging purposes. Analysts say they use 0DTE as an efficient hedging tool to precisely manage short-term volatility risk. They mainly buy related products around specific events such as Federal Reserve rate decisions or major economic data releases.

High-frequency trading (HFT) firms play a core infrastructure role in this market. Representative firms include Citadel Securities, Virtu Financial, and Susquehanna. They are liquidity providers that earn steady profits from bid-ask spreads amid huge trading volumes. At the same time, they often act as the primary sellers of options bought predominantly by retail investors.

Investors chasing lottery-like wins

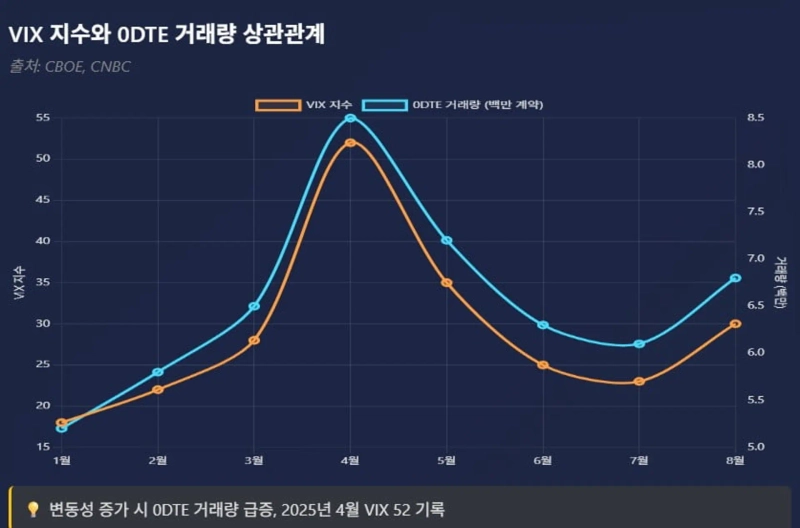

Analysts say the explosive growth of the 0DTE market is due to multiple factors. Exchanges like Cboe listing options that expire every day have created structural supply. Commission-free brokerage apps like Robinhood offering index options trading have increased retail investor access. The market environment, where intraday volatility has expanded due to the greater impact of macroeconomic news such as benchmark rate decisions, has further highlighted the appeal of short-term speculation and hedging.

Some argue this market is not a simple zero-sum game. It is a complex ecosystem maintained by symbiotic yet unbalanced relationships among participants. Retail investors consistently invest in high-risk, lottery-like products. Sophisticated algorithmic market makers get the opportunity to reliably harvest the premiums they pay. The market makers' profits from this process provide a strong incentive to supply massive liquidity and tight quotes.

This abundant liquidity provides several ancillary benefits to institutional investors who need to execute large hedges efficiently. Therefore, while retail investors' speculative fervor may lead to individual losses, it serves as an important "fuel" that maintains the overall 0DTE liquidity ecosystem. If retail investor interest disappears, the trading environment for all market participants could deteriorate.

Exchanges and HFT are in a golden age

The direct beneficiaries of the 0DTE boom are options exchanges and HFT firms. They are generating profits in the new market environment and reshaping the financial industry's landscape. Cboe Global Markets has been reporting record-breaking performance day after day thanks to 0DTE growth. In the second quarter, Cboe's quarterly net revenue was $587.3 million, an all-time high. Revenue from derivatives (mainly options) increased 17% year-on-year.

HFTs and market makers are also enjoying the benefits of volatile markets. U.S. HFT and market-making firm Virtu Financial said in its Q2 earnings report, "Favorable market conditions drove adjusted net trading income to $568 million for the quarter, a 50% increase year-on-year."

Citadel Securities, the top market maker by options market share, posted record quarterly results in Q1 with net trading revenues of $3.4 billion and quarterly profits of $1.7 billion, a 70% increase from a year earlier. They explained that expanded market volatility and increased trading volumes were the main reasons for the profit surge.

Concerns about 0DTE market growth have also been raised. The core argument that 0DTE could threaten financial stability revolves around a mechanism called the "dealer hedge loop." Because 0DTE options expire in less than a day, they have an "extreme gamma" characteristic where option prices change sharply even with small price moves. As a result, dealers who intermediate option trades must sell S&P 500 futures to neutralize positions and reduce their loss risk. When this happens, the amount of futures they must sell can increase abnormally fast even with a small market move. In other words, a small market change can create large selling pressure.

This selling pressure can in turn accelerate market declines, which may trigger further futures selling, forming a vicious cycle. If such a "feedback loop" becomes uncontrollable, a small market drop could be amplified into a major crash.

Risk of triggering a global financial crisis

Former JPMorgan strategist Marco Kolanovic said, "If the market moves significantly so that option buyers become in-the-money, those who sold the options will suddenly face large losses. If those who cannot bear these losses rush to unwind their positions (forced liquidations), huge amounts of capital could flow in one direction in the market at once." He warned, "This could make the market fall very quickly; what started as a 5% drop could instantly plunge 25% in an extreme scenario."

The European Central Bank (ECB) also noted, "Risks arising from the U.S. 0DTE market can transmit to Europe through global financial market interconnectedness," calling it "an international financial stability challenge, not a problem of a single country."

The International Monetary Fund (IMF) warned, "Non-bank financial institutions (NBFIs) that use high leverage may sell assets quickly to reduce debt when markets suddenly shake. This can push asset prices down faster and spread risk across the financial market. A sharp adjustment in U.S. financial markets could lead to chaos where market order completely breaks down."

U.S. financial regulators have decided to prepare for risks that could arise from the recent surge in ultra-short-term option (0DTE) trading. The Options Clearing Corporation (OCC) has created a new system called the "Intraday Risk Charge (IRC)." It began being implemented in phases from the 2nd of this month. From the 1st of next month, all members will be required to follow it.

The core purpose of this system is to require firms that trade options to post collateral in advance in case their intraday risk increases dramatically. Specifically, the additional margin is determined based on the average of the most risky moments between 11:00 and 12:30 each day of the previous month. If an intraday margin is triggered, firms will be asked to post the additional margin around noon each day, and members must pay the requested amount in cash within one hour.

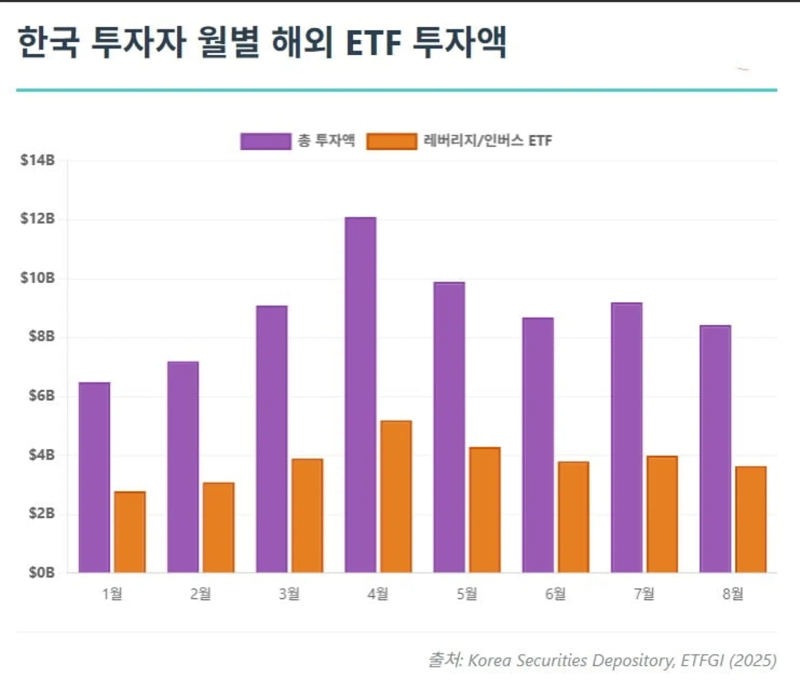

Korean 'Seohak Gaemi' also invest

The growth of the 0DTE market is not unrelated to Korea. Domestic investors can also directly trade U.S. 0DTE options. Korean investors are investing large amounts in similar high-risk products. Critics say this investment behavior has become a channel through which U.S. market volatility transmits direct shocks to Korean household assets.

Analysis by the Korea Capital Market Institute of Korea Securities Depository data shows that as of the end of June this year, leveraged and inverse products accounted for 43.2% of Korean investors' overseas-listed ETF holdings. In particular, 3x leveraged products, which are banned from sale domestically, accounted for 22.2%. The 0DTE issue is no longer a problem "across the river." Tens of trillions of won of Korean household assets are directly exposed to sudden volatility events in the U.S. financial market.

[Global Money X-File examines important but little-known flows of global money. If you want to comfortably receive necessary global economic news, please subscribe to the reporter page]

Reporter Kim Ju-wan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)