Summary

- Over the past month, China tech stock ETFs recorded high returns approaching 22%%, driven by advanced industry growth and an inflow of retail investor funds.

- US AI- and infrastructure-focused ETFs also posted high returns around 10%%, but concerns about an AI bubble and market overvaluation pose risks.

- By contrast, India ETFs saw reduced profitability due to tariffs and visa issues, which could weaken investment sentiment.

Diverging overseas ETF returns

Alibaba, Baidu and other tech stocks surge

China ETFs approach 22% monthly returns

US active ETFs soar in the 10% range

India weak amid visa and tariff impacts

"IT profitability likely to decline for a while"

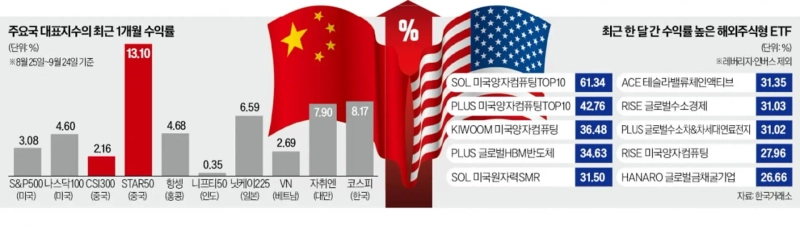

Over the past month, exchange-traded funds (ETFs) investing in benchmark indices of China and the United States posted high returns. This was thanks to rallies by artificial intelligence (AI) tech stocks leading those markets. By contrast, emerging market ETFs lagged. In particular, India, hit by US tariffs and then by issues with the H-1B professional visa, recorded negative returns.

China tops returns as tech stocks surge

According to the Korea Exchange on the 25th, 21 ETFs listed on the domestic KOSPI that track representative indices of the China and Hong Kong markets rose an average of 10.24% over the past month (Aug. 22–Sept. 24). That was the highest return among ETFs tracking overseas benchmark indices. Giant tech stocks such as Alibaba and Baidu, as well as emerging tech names like SMIC and Cambricon, surged and pushed up the equity indices.

ETFs investing in the STAR Market (KeChuangBan), known as "China's Nasdaq," and ChiNext performed well. 'ACE China STAR Market STAR50' returned 22.34% over the same period, and 'KODEX China Shenzhen ChiNext (Synthetic)' returned 21.04%. The STAR Market STAR50 index is composed of the top 50 companies by market capitalization listed on the Shanghai STAR Market, where innovative firms are listed. The ChiNext index includes 100 new growth companies on the Shenzhen exchange. ETFs tracking the CSI300 index, which is mainly composed of large-cap stocks in Shanghai and Shenzhen, and the Hang Seng index for the Hong Kong market also rose 5–7%.

Analysts said that in addition to massive government support that helped advanced industries grow quickly, a large inflow of funds from Chinese retail investors pushed the market higher. However, some voices warned to be cautious about investing given China's weak economic fundamentals.

Seong Yeon-ju, a researcher at ShinYoung Securities, said, "Domestic demand such as China's real estate and consumption remains weak," and added, "However, as investment in advanced technologies and exports increase and the Chinese government's semiconductor self-reliance policyw continues, tech stock earnings are expected to improve further."

India grimaced under tariffs and visa shock

The 45 ETFs tracking US benchmark indices posted an average one-month return of 6.36%. AI software and infrastructure-related stocks, including chipmaker NVIDIA as well as Oracle and Bloom Energy, all rallied.

Thanks to the strength of the New York market, passive ETFs tracking US benchmark indices achieved 5–7% returns, while active ETFs—where fund managers change stocks and weightings—stood out. 'KoAct U.S. Nasdaq Growth Companies Active' rose 16.02% during the period, and 'TIMEFOLIO U.S. Nasdaq 100 Active' rose 15.42%.

However, concerns about an AI bubble have emerged as a variable. After remarks by Jerome Powell, chair of the US central bank (Fed), about market overvaluation, the New York market has shown weakness. Han Sang-hee, a researcher at Hanwha Investment & Securities, said, "In the short term, memory and equipment stocks may take a breather, so it may be time to manage risk by moving to big tech stocks that had relatively low recent returns."

Emerging market ETF returns have struggled to rebound. 'ACE Vietnam VN30 (Synthetic)', the only domestic listed ETF investing in the Vietnamese market, fell 1.03% over the month. India ETFs also fell an average of 1.05%. Representative examples include 'TIGER India Nifty50' (-0.9%), 'KODEX India Nifty50' (-0.85%) and 'KIWOOM India Nifty50 (Synthetic)' (-0.63%).

India ETFs, which had drawn attention for high returns through last year, have stumbled under the second Trump administration. A high tariff rate of 50% was imposed, and the fee for professional visas was increased 100-fold, which had negative effects. Since 70% of H-1B visa holders are from India, analysts say Indian tech firms in the US are inevitably being hit. Kim Geun-ah, a researcher at Hana Securities, said, "India companies' personnel dispatch costs increase, reducing profitability, and new projects in the US are likely to be delayed," adding, "Until the visa issue is resolved, investment sentiment for Indian information technology (IT) is likely to weaken."

Reporter Yang Ji-yoon yang@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)