Kim Gap-rae "Naver vs Kakao… The stablecoin battleground depends on the 'redemption structure'"

Summary

- Kim Gap-rae, director at the Korea Capital Market Institute, said the battleground of the stablecoin market ultimately depends on the direction of regulatory proposals.

- He stated that the redemption structure is a key factor that will determine the landscape of the domestic stablecoin market.

- He said that if the redemption obligation rests with the issuer, Kakao would have the advantage, whereas an exchange-centered redemption structure would give the Naver consortium the upper hand.

Competition in the fintech industry over stablecoins (virtual assets whose value is linked to fiat currency) is intensifying, and opinions suggest that ultimately the winner depends on the direction of regulatory proposals.

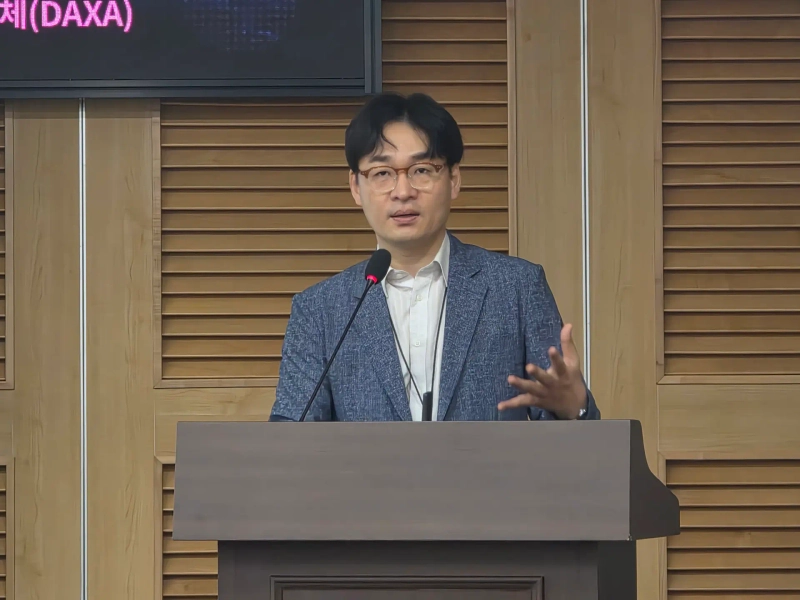

Kim Gap-rae, director at the Korea Capital Market Institute, attended the 'Digital Asset Market: From Institutionalization to Globalization' forum at the National Assembly in Yeouido, Seoul on the 26th and said, "The winner in the market will be determined depending on the direction of stablecoin institutionalization."

Kim said, "In regulatory proposals for stablecoins, defining a clear concept of stablecoins is the most important," and emphasized, "It is necessary to study the Genius Act, Ilbop's Payment Settlement Act, and the European Union (EU)'s MiCA to align with global standards."

He then cited three key elements related to stablecoins: △ maintaining a 1:1 reserve asset, △ verification and disclosure of assets, △ the redemption structure. Among these, he saw the redemption structure as determining the domestic market landscape. Kim explained, "If redemption obligations are imposed on issuers, Kakao, which owns a bank, would have the advantage; if an exchange-centered redemption structure is established, Naver's consortium together with Upbit would have the upper hand."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)