Summary

- It reported that global tech companies are concentrating investment and infrastructure-building efforts to secure the stablecoin ecosystem.

- It stated that large funds have recently flowed into companies related to stablecoin infrastructure, and collaboration and investment with traditional financial firms are also active.

- It reported that voices are calling for the establishment of an open and scalable Korean-style stablecoin market by utilizing the technological capabilities of tech companies domestically.

Blurring the finance·tech boundary

PayPal·Shopify·Google·Meta, etc.

All-out push to seize the stablecoin ecosystem

To build a 'KRW payments' market

Combination of traditional finance and tech firms is essential

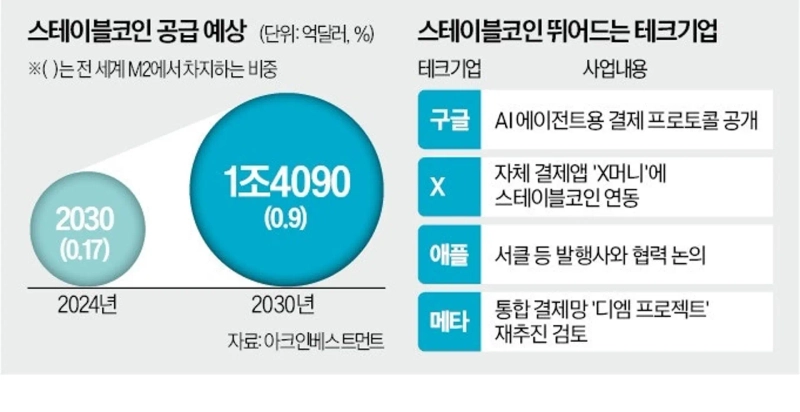

Global tech companies are increasingly entering the regulated financial sector by leveraging stablecoins. As the boundary between traditional finance and the digital asset market is erased, large investments are also flowing into technology firms that provide related infrastructure. There are calls that, to compete with global companies that are rapidly building their positions, banks and others domestically should actively utilize the technological capabilities of tech companies.

◇Money flows into payment technologies

On the 26th, according to the investment industry, Bastion, a U.S. company that operates a platform allowing companies to issue their own stablecoins, secured an investment of US$14.6 million (about KRW 20.6 billion) on the 24th from Coinbase Ventures, Sony, Samsung and others. Rain, which launched a Visa card that can be used to pay with stablecoins, recently raised US$58 million (about KRW 81.9 billion). In February, global payments company Stripe acquired digital asset infrastructure firm Bridge for about US$1.1 billion (about KRW 1.5543 trillion).

A platform industry official said, "The key to building a stablecoin ecosystem will be how the capabilities of technology companies are utilized," adding, "Companies with real-time payment systems or transparent verification technologies are gaining attention in terms of stability and trust." Just as fiat currencies operate on 'digital infrastructure' such as bank accounts, card networks and security authentication, stablecoins also require technical infrastructure such as custody (asset storage), wallets (user interface), payment gateways (currency exchange/bridges), and AML·KYC (anti-money laundering·identity verification).

Core technologies such as real-time secure payments give tech companies an edge over traditional financial firms like banks. To prevent illegal transactions such as hacking, data analysis and AI-based anomaly detection as well as cloud security technologies are also necessary. Overseas, ecosystems centered on fintech companies are already being built. Global payment platform PayPal launched its own stablecoin PYUSD in 2023 and began supporting remittances and online payments. PayPal supports payments in over 100 virtual assets.

◇The 'financial boundary' breaks down

U.S. e-commerce giant Shopify also introduced USDC payments in June through cooperation with crypto exchange Coinbase. If customers pay with USDC using a crypto wallet, merchants receive settlement in local currency without exchange fees. Meta, Apple, X, Airbnb, Google and others are also discussing stablecoin adoption.

In the past, virtual assets were viewed as an unstable investment outside regulation. Recently, global fintech firms have been accepting regulation and integrating into the institutional system. Circle, the issuer of USDC, has formed partnerships with traditional financial firms like BlackRock and Visa. It established a structure that invests reserve assets in government bonds and MMFs and uses the generated interest to reward users.

Digital asset infrastructure firm Bullish succeeded in attracting global capital by listing on the New York Stock Exchange. Traditional institutional investors such as BlackRock participated in Bullish's IPO. Coinbase also entered the institutional realm through its listing, putting in place accounting, audit and disclosure systems.

Accordingly, there are calls to build a Korean-style stablecoin market with an open and scalable structure led by tech companies, beyond a bank-led model that prioritizes stability. After Naver Financial recently agreed to form a cooperative relationship with Dunamu through a comprehensive share exchange and entered the stablecoin market, Kakao also recently formed a stablecoin task force team. A tech industry official said, "The success of K-stablecoins depends on how much scalability and real-world usability they can secure."

Reporter Ko Eun-yi koko@hankyung.com

Reporter Choi Da-eun max@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)