Mirae Asset: "Naver Financial value is too low"…Dunamu shareholders also dissatisfied with valuation

Summary

- The 1-for-3 share exchange between Naver Financial and Dunamu will go through shareholder briefings and consultation procedures.

- In this deal, the valuation assessment and the exercise of the right to request share purchase have emerged as key issues among investors.

- Major investors such as Mirae Asset, Woori Technology Investment, and Hanwha Investment & Securities are reacting sensitively to stake value and profit realization.

Outline of the companies' '1-for-3 share exchange'…persuading shareholders is the biggest issue

Considering the valuation of the combined entity

Pushing for a mid- to long-term merger with Naver

If the new Naver Financial's corporate value becomes too large

Concerns about dilution of Naver shareholders' stakes

Dunamu faces the burden of share purchase claims

Requires approval from at least two-thirds of shareholders

Monitoring whether Kakao and Woori Technology will exercise their rights

"A big stage has opened where all participants in the capital market will dive into studying 'valuation.'" (an analyst)

The unprecedented big deal between Naver and Dunamu, worth about 20 trillion won, is intertwined with shareholders' complex interests. A fierce, invisible battle among Dunamu shareholders, Naver Financial shareholders, and Naver shareholders over the share exchange ratio and the appropriate valuation is expected to unfold intensely around the Chuseok holiday.

From this week, ahead of official procedures such as shareholder briefings, shareholders are privately preparing to maximize their own interests and gearing up to join the fray. The market also stirred. On the 29th, Naver closed at 274,500 won per share, up 7.02%, marking three consecutive trading-day surges since the big-deal news with Dunamu on the 25th. Dunamu's stock also at one point jumped 17.39% in the over-the-counter market that day, hitting a new annual high (405,000 won).

◇Agree on the exchange ratio and set the valuation

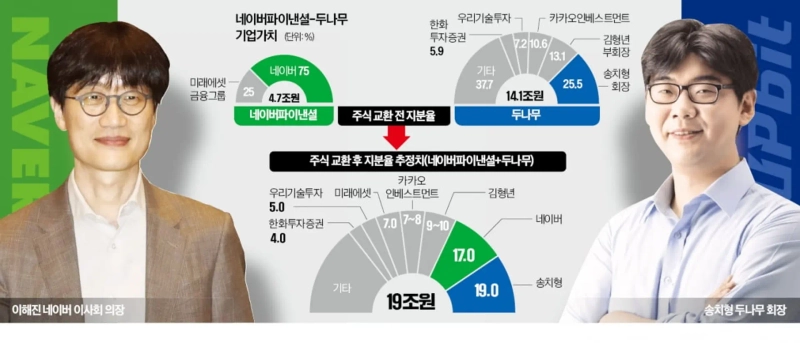

Both sides plan to provisionally fix Naver Financial's corporate value at 4.7 trillion won and Dunamu's corporate value at about 14 trillion won and convey this to their shareholders. The share exchange ratio is around 1-for-3, with Naver Financial issuing three new shares in exchange for one share of existing Dunamu shareholders. Dunamu plans to notify shareholders of this around the Chuseok holiday this week and hold related briefings.

If this were a typical transaction, both companies would try to maximize their corporate values, but given the overall structure of this deal, that may not necessarily be the case. From Naver's perspective, if the integrated corporation's value becomes excessively large when seeking a merger or reattempting a share exchange between Naver and Naver Financial after the share exchange between Naver Financial and Dunamu, Naver shareholders could face greater dilution. From Dunamu's perspective, buying out the shares from shareholders who oppose the share exchange by exercising the right to request share purchase could require enormous funds. Accordingly, Naver and Dunamu reportedly agreed first on the broad 1-for-3 framework and have been negotiating not to recklessly set each company's corporate value.

◇Intense standoff surrounding Dunamu's stock

The fiercest battlefield in this merger is likely to be among Dunamu shareholders. The comprehensive share exchange with Naver Financial is subject to a special resolution, requiring approval from at least two-thirds of shareholders present at the general meeting. Dunamu executives' stakes, including Chairman Song Chi-hyung (25.5%) and Vice Chairman Kim Hyung-nyeon (13.1%), total 38.6%, meaning they need to secure about an additional 27% of allied votes.

Dunamu is expected to first persuade major shareholders such as Kakao Investment (10.6%), Woori Technology Investment (7.2%), and Hanwha Investment & Securities (5.9%), then focus on securing small shareholders as allies. Dunamu is likely to argue to shareholders that, given the uncertainty of an independent listing at present, joining Naver to fully realize synergies and then attempting an IPO in the mid to long term would be preferable.

Considering Dunamu's estimated valuation in the 14 trillion won range, the company is expected to purchase shares from dissenting shareholders at around 400,000 won per share. It is expected to utilize roughly 3 trillion won in cash holdings. However, Dunamu is likely to attach a condition that it will cancel the share exchange if purchase requests above a certain scale are received, so the small shareholders' standoff is expected to be intense. The company understands that many hold shares acquired at around 150,000 won per share and is provisionally estimating the scale of purchase requests.

Expectations around Dunamu's corporate value pushed listed companies Woori Technology Investment and Hanwha Investment & Securities up 20.4% and 17.2%, respectively, that day. Woori Technology Investment acquired a 7.59% stake in Dunamu in 2015 for about 5.6 billion won, and Hanwha Investment & Securities acquired its entire stake in 2021 by injecting its own capital for a total of 58.3 billion won. Given that these stakes alone are now worth about 1 trillion won and 831.9 billion won, respectively, expectations of huge gains were reflected. On the other hand, HYBE's per-share acquisition price was about 580,000 won. In 2021, HYBE acquired a 2.5% stake through a mutual share exchange with Dunamu for about 500 billion won.

◇Mirae Asset's exploding discontent

Mirae Asset Group, the second-largest shareholder of Naver Financial, is dissatisfied. This is because the structure effectively 'notifies' them of a Naver Financial valuation of 4.7 trillion won, while the market had valued Naver Financial up to 13 trillion won (NH Investment & Securities report). Naver's shareholding alone could meet the special resolution requirement at the shareholders' meeting, limiting Mirae Asset's negotiating power. There is analysis that Mirae Asset, which is strongly pushing its stablecoin business, is unlikely to exercise its right to request share purchase in order to realize an internal rate of return (IRR) of around 9.6%.

Cha Jun-ho reporter chacha@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)