Betting on an interest-rate hold…Foreign investors sell 12 trillion in government bonds over four days

Summary

- Foreign investors reportedly net-sold more than 12 trillion won of government bond futures over the past four days.

- It reported that the Bank of Korea's policy rate cut timing may be delayed, and the 3-year government bond yield rose for seven consecutive trading days.

- It stated that recent exchange rate volatility continued foreign selling of government bonds and raised the possibility of sharp swings in domestic capital and foreign exchange markets.

Why is the Korean government bond market being shunned?

Sold government bond futures for seven consecutive days

3-year yield jumps 0.16%P

Selling turned amid a shift in sentiment

Bank of Korea turns hawkish as house prices don't cool

Odds of an October rate hold increase

Exchange rate volatility may have spurred the sell-off

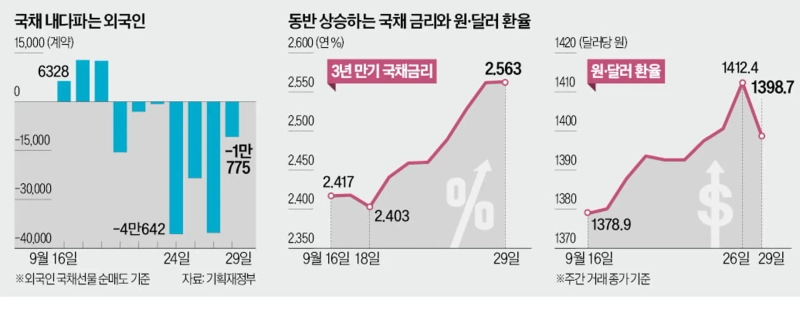

Foreign investors net-sold more than 12 trillion won in government bond futures over the past four days. This is interpreted as reflecting expectations that the Bank of Korea's timing for cutting its policy rate could be delayed significantly due to house price and foreign exchange market instability. The won-dollar rate, which had been surging recently, fell nearly 14 won that day under the impact of dollar weakness. Foreign investors returning to the stock market were also analyzed as a factor pulling the exchange rate down. Depending on domestic and international market developments for the time being, the domestic capital and foreign exchange markets are expected to experience sharp swings.

◇ Seven trading days in a row of 'a flood of sell orders'

According to the Ministry of Economy and Finance on the 29th, foreign investors net-sold government bond futures for seven consecutive trading days from the 19th through that day. Net selling during this period amounted to 123,761 contracts (face value 12,376.1 billion won). On the 24th, foreign net selling of 3-year government bond futures was the fifth-largest on a single-day net-selling basis in history. Even last month, foreign investors were heavily buying Korean government bonds, but they have been leaving the bond market since late this month.

Foreign selling pushed up bond yields. According to the Korea Financial Investment Association, the 3-year government bond yield rose 0.001%percentage point to an annual 2.563% that day. It was the highest in five months since April 2 (annual 2.584%). The 3-year government bond yield rose for seven consecutive trading days from the 19th through that day. It jumped 0.16%percentage point during this period.

The exit of foreign investors from the bond market is interpreted as the result of growing expectations that the Bank of Korea will hold the policy rate next month. Foreigners who had been accumulating bonds expecting price gains from a rate cut are believed to have moved to realize profits.

◇ "Rate cuts could be pushed to next year"

Hwang Gun-il, a member of the Bank of Korea's Monetary Policy Board, said at a press briefing on the 23rd that he would pay more attention to financial stability variables, including house prices and household debt, when deciding the policy rate. Concerns that a rate cut could stoke house prices have led to speculation that the Bank of Korea may delay cutting rates. Kim Jin-wook, a Citi economist, said in a report released that day that uncertainty around U.S.-bound investment funds could push the next rate cut to the first quarter of next year. Kim Sang-hoon, a center chief at KB Securities, said, "With expectations that the Bank of Korea will maintain a hold on the policy rate next year as well, and with the long Chuseok holiday ahead, more foreign investors have been trimming their government bond holdings."

There is also analysis that foreign investors increased bond sales after the won-dollar rate surpassed 1,400 won out of concerns over exchange losses. A high exchange rate is also cited as a major reason the domestic stock market has recently undergone a correction. Ahn Dong-hyun, a professor in the Department of Economics at Seoul National University, explained, "Foreigners invest in government bonds considering not only yields but also currency gains," adding, "With growing exchange rate volatility recently, foreign investors seem to have reduced their invested volumes."

In the Seoul foreign exchange market, the won-dollar rate (3:30 p.m. basis) closed the week at 1,398.70 won, down 13.70 won from the previous trading day. The sharp drop in the exchange rate that day was due to dollar weakness as expectations of a U.S. rate cut revived after the U.S. personal consumption expenditures (PCE) index was released over the weekend.

The dollar index, which shows the dollar's value against the six major currencies, fell 0.44% to 97.948 from the previous trading day. Increased negotiation volumes from exporters ahead of the quarter-end affected the exchange rate. Foreign investors' return to the KOSPI, and news of a settlement in exchange rate talks with the U.S. also contributed to the exchange rate decline. Foreigners net-bought about 440 billion won in the KOSPI market that day.

Reporters Kim Ik-hwan/Kang Jin-kyu lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)