Dunamu·Naver Big Deal and the Perpetual Futures Exchange Craze: Korean Crypto Weekly [INFCL Research]

Summary

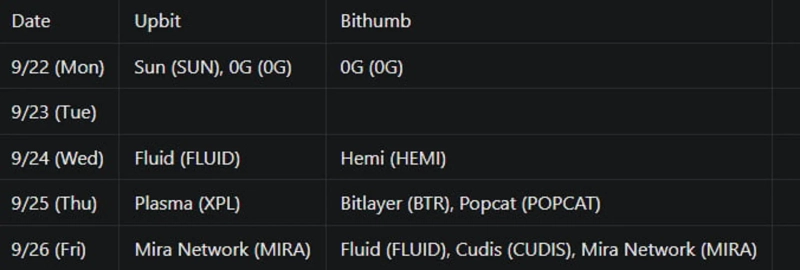

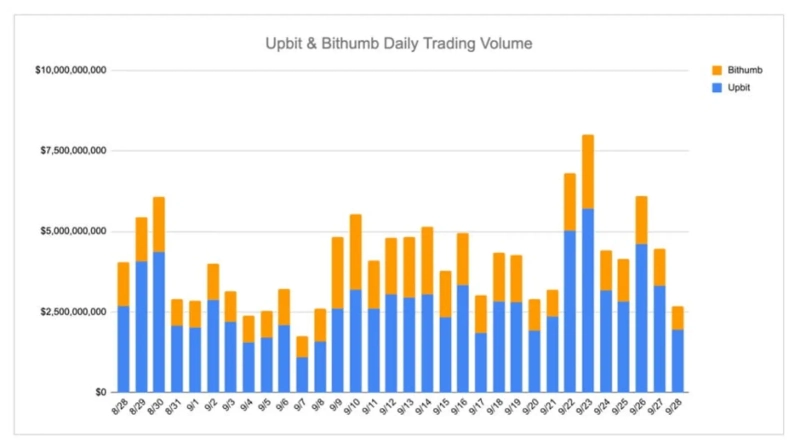

- Last week, Upbit and Bithumb listed several major emerging and mid-cap tokens, significantly increasing trading volume and investor participation.

- Potential partnership and acquisition rumors between Naver and Dunamu have been noted as an important turning point in Korea's digital finance ecosystem.

- Perpetual futures DEXs are spreading rapidly in Korea, but investor caution is also rising due to high leverage risks.

1. Market Overview

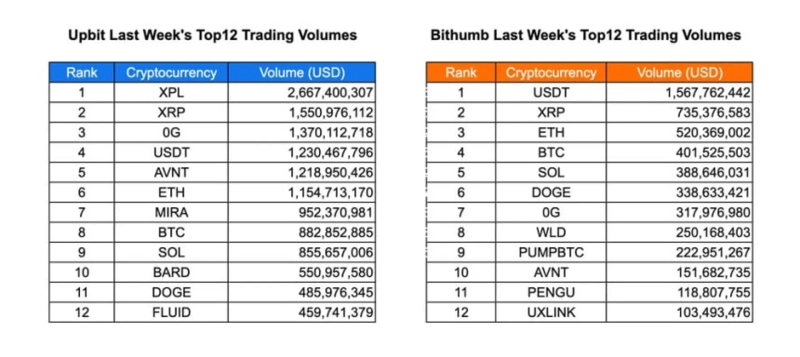

Last week in Korea, Upbit listed Sun, 0G, Fluid, Plasma, and Mira Network, while Bithumb listed 0G, Hemi, Bitlayer, Popcat, Fluid, Cudis, and Mira Network, sparking another listing boom. Trading activity on Upbit was led by XPL (26.7B USD), followed by XRP (15.5B USD) and OG (13.7B USD), and major tokens such as USDT, AVNT, ETH, BTC, and SOL also showed strong volumes. Mid-cap and emerging tokens like MIRA, BARD, DOGE, and FLUID were also active, indicating broad investor participation. On Bithumb, USDT (15.7B USD) recorded the highest trading volume, with XRP, ETH, BTC, and SOL remaining active, and speculative tokens such as WLD, PUMPBTC, AVNT, PENGU, and UXLINK also attracting significant attention.

Price movements reflected various market dynamics. On Upbit, AWE (+47%), KAITO (+28%), and BERA (+19%) led gains, supported by steady rallies in tokens like STG, ZRO, IMX, and DRIFT. On Bithumb, LBL surged 110%, and SNX (+47%) and H (+46%) also posted high returns. The overlap of highly volatile tokens such as AWE, KAITO, STG, and ZRO across both exchanges reinforced strong conviction across the market, while Bithumb’s spikes in LBL and XTER highlighted speculative price surges driving short-term volatility.

2. Exchanges

Last week, major Korean exchanges announced several new listings.

Upbit listed Sun, 0G, Fluid, Plasma, and Mira Network.

Bithumb listed 0G, HEMI, Bitlayer, Popcat, Fluid, Cudis, and Mira Network.

Key marketing strategies and highlights

Mira Network (MIRA)

Mira Network’s marketing strategy serves as a strong case study for narrative building and Korean community engagement.

From a narrative perspective, Mira Network positioned itself as a solution to AI hallucinations—one of the major emerging challenges globally alongside the rise of AI, especially LLMs—both within and beyond the web3 space. By introducing a node validation structure combined with web3 incentive models, Mira Network addressed limitations of web2 systems. This message was effectively communicated to the Korean community through key opinion leaders (KOLs).

This story proved particularly persuasive for three reasons:

AI was a dominant theme globally, not just within crypto.

Mira addressed a real problem users face due to AI hallucinations.

The solution design felt natural and trustworthy rather than forced.

Another important success factor was high engagement from the Korean community. Mira ran a 10-week campaign—considered a long period by crypto standards—while collaborating with key KOL WecryptoTogether (Edward) to run a Korea-specific campaign.

The campaign content was identical, but only Korean users could receive rewards. During this period, participation in "Kaito Yapping" was high, which asked users to post weekly tweets on specific topics and rewarded selected posts with SBTs.

What made this campaign stand out was that participants’ understanding of Mira Network deepened as the campaign progressed. Weekly topics were structured to guide users from learning Mira Network’s basic principles to exploring use cases and marketing strategies. This allowed the campaign to evolve into a community-driven initiative and yielded insights that could be reflected in Mira’s strategy through user participation.

Another interesting observation was the change in participation over time. Initially, the campaign appeared to have a high entry barrier and low participation, but participation more than doubled over time.

While long-term campaigns might seem unsuitable for a fast-changing Web3 environment, Mira’s case shows that the campaign’s sustained nature increased scarcity and urgency as participants realized opportunities diminished over time.

2-2. Volume

Last week, Upbit recorded XPL as the most traded asset with 2.67 billion USD in volume, followed by XRP (1.55 billion USD) and OG (1.37 billion USD). Major large-cap tokens, including USDT (1.23 billion USD), AVNT (1.22 billion USD), and ETH (1.15 billion USD), maintained strong liquidity, while MIRA (950 million USD), BTC (880 million USD), and SOL (860 million USD) were also actively traded. Mid-cap tokens such as BARD, DOGE, and FLUID ranked within the top 12, indicating sustained participation across both blue-chip and emerging assets.

On Bithumb, USDT led volume with 1.57 billion USD, followed by XRP (730 million USD) and ETH (520 million USD). BTC (400 million USD) and SOL (390 million USD) also maintained significant volumes, and DOGE (340 million USD) and OG (320 million USD) drew notable retail investor interest. The inclusion of WLD, PUMPBTC, AVNT, PENGU, and UXLINK among the top 12 tokens highlights Bithumb’s strong demand for newly listed and speculative tokens.

Overall, the data clarifies exchange-specific dynamics: Upbit’s volumes were concentrated in XPL, OG, and AVNT, contributing to liquidity for mid-sized projects, while Bithumb concentrated liquidity on USDT and speculative listings like PUMPBTC and UXLINK. Daily volume charts show steady investor participation across both platforms, with spikes on September 20 and September 23 suggesting increased midweek trading activity.

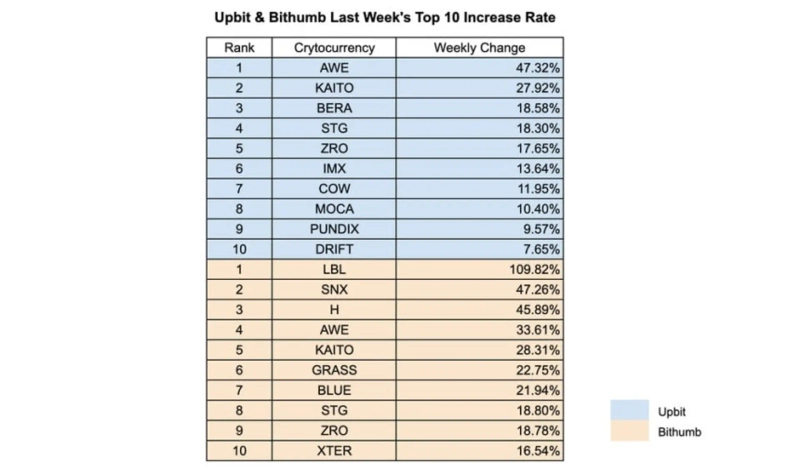

2-3. Top 10 Gainers

Last week on Upbit, AWE led price gains, rising 47.32%, followed by KAITO (27.92%) and BERA (18.58%). STG (18.30%) and ZRO (17.65%) also posted gains above 15%, demonstrating steady momentum in the mid-cap token market. Top 10 tokens including IMX, COW, MOCA, PUNDIX, and DRIFT showed broad investor participation across infrastructure, DeFi, and ecosystem assets.

On Bithumb, LBL surged 109.82%, showing a large gain, while SNX (47.26%) and H (45.89%) also recorded high returns, reflecting strong speculative activity. AWE (33.61%) and KAITO (28.31%) continued their rallies across both exchanges, reinforcing market-wide momentum. Meanwhile, GRASS, BLUE, STG, ZRO, and XTER entered the top 10, indicating heightened interest in both established and new projects.

Overall, this week’s top gainers included a mix of infrastructure tokens, DeFi projects, and niche assets. The overlap of AWE, KAITO, STG, and ZRO across Upbit and Bithumb demonstrates strong cross-exchange confidence, while rapid rises in tokens like LBL emphasize speculative surges driving short-term market dynamics.

3. Korean Community

3-1. Naver×Upbit Rumors

On August 25, Naver announced that its subsidiary Naver Financial was seeking deeper cooperation with Dunamu, the operator of Upbit, on stablecoins, unlisted stock trading, stock swaps, and other areas. The market speculated this could lead to Naver fully acquiring Dunamu, a deal that would be comparable in scale to "Google’s acquisition of Coinbase."

Both parties denied acquisition negotiations were underway, but ongoing cooperation still leaves the door open for an acquisition. A potential partnership between Naver and Upbit is viewed as a significant turning point for Korea’s digital finance ecosystem. Meanwhile, competitors like Bithumb×Toss are accelerating their own stablecoin development, adding intrigue to the competitive landscape.

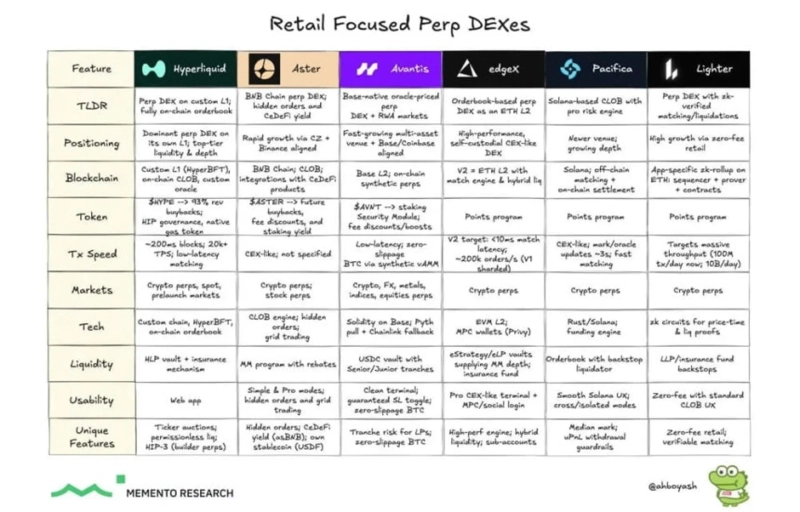

3-2. Perpetual Futures Exchange Craze in Korea

Perpetual DEXs are currently the most popular sector among Korean traders. Fueled by the rise of Hyperliquid and the success of Aster, retail users are actively using platforms such as Lighter, Pacifica, edgeX, and Backpack, often executing at least one trade per project.

The main reason is the belief that early participants will profit from token buybacks funded by protocol fees, which encourages many to enter without hesitation. Nevertheless, this craze raises caution. Some argue the crypto market is overheated and perpetual futures inherently carry high leverage risks, so whales and bots could soon squeeze out small investors. For now, Korea remains swept up in a perpetual DEX boom, with both optimism and skepticism coexisting.

*All content is provided for informational purposes only and is not intended as the basis for investment decisions or as investment advice. The content is not liable for any investment, legal, tax, or other outcomes.

INF Crypto Lab (INFCL) is a consulting firm specialized in blockchain and Web3, offering one-stop services including corporate Web3 strategy development, token economy design, and global market entry. We provide strategy formulation and execution services to major domestic and international securities firms, game companies, platforms, and global Web3 firms, leveraging accumulated know-how and references to drive sustainable growth in the digital asset ecosystem.

This report is independent of media editorial directions, and all responsibility lies with the information providers.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)