This U.S. government shutdown is different…Higher likelihood of prolongation and impact on unemployment

Summary

- Wall Street analysts said this U.S. federal government shutdown is more likely than past ones to be prolonged and to lead to a rise in unemployment.

- They said that if the shutdown drags on, gold prices could approach $4,000, and investments in safe-haven assets like U.S. Treasuries would become more attractive.

- Defense contractors, consulting firms, and airlines that depend on government spending face downward pressure on their stock prices due to the shutdown.

In the past, there was virtually no impact on the stock market

This time, heightened confrontation raises the likelihood of a prolonged shutdown and impact on unemployment

If the shutdown drags on, gold could approach $4,000

Traditionally, Wall Street has ignored Washington's budget fights. Stocks did not fall even during past federal government shutdowns. However, Wall Street analysts say this shutdown is different.

The U.S. federal government entered a shutdown at midnight on the 30th local time in the U.S. Eastern Time Zone, the first in seven years. With the Office of Management and Budget directing agencies to halt all work except for essential duties, public services across the U.S. were paralyzed and hundreds of thousands of government employees were placed on temporary leave.

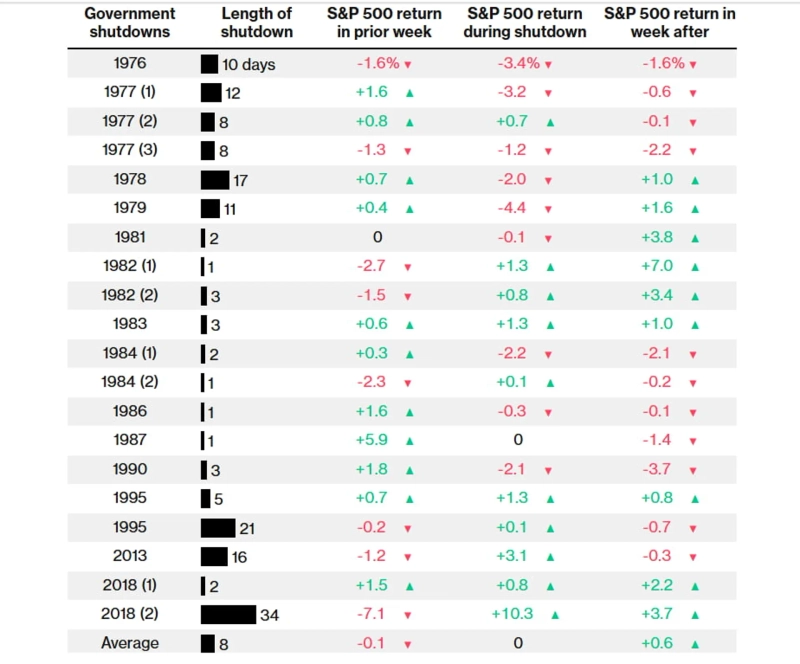

The U.S. market had set expectations based on past shutdowns. According to data compiled by Truist Securities cited by Bloomberg, over the past 50 years during 20 U.S. federal government shutdowns, the S&P 500 index on average neither rose nor fell significantly. In most cases, the White House and Congress resolved shutdowns quickly so they did not drag on politically and economic damage was avoided.

But several foreign outlets note this time is different.

The president is Trump. The clashes between the Trump administration and Democratic congressional leaders have become more intense, increasing the likelihood of a prolonged standoff.

In addition, President Trump has openly declared he will carry out mass firings rather than temporary layoffs of federal employees. Some have even suggested that Trump, who favors firing civil servants, may have been awaiting a shutdown. The federal government shutdown seven years ago also occurred during Trump's first term.

With the U.S. labor situation already appearing fragile, initial unemployment claims are expected to spike temporarily.

If the government shutdown is prolonged and thousands of federal employees are actually laid off, the economic impact could be larger.

Bloomberg Economics estimated that during the shutdown, 640,000 federal employees would be furloughed without pay, pushing the unemployment rate up to 4.7%. If President Trump follows through on threats to permanently fire thousands of civil servants, the unemployment rate could remain elevated even after the shutdown ends. As of August, the U.S. unemployment rate stood at 4.2%.

The disruption from missing government data releases is also significant. This week alone, initial jobless claims, factory orders, and the September nonfarm payrolls report will not be released. The inflation data scheduled for October 15 is also uncertain at present.

All of these data are important factors for Wall Street to gauge the state of U.S. economic growth and interest rate expectations.

Jennifer Timmerman of the Wells Fargo Investment Institute noted in a report that if delayed data releases cloud rate outlooks, short-term volatility is likely to increase.

Steve Sosnick, chief strategist at Interactive Brokers, said, "This shutdown has become so risky even before the event that its impact will be greater than at other times."

Nasdaq-100 and S&P 500 futures, which had been rallying until the previous day, are both showing declines. The Chicago Board Options Exchange (Cboe) volatility index surged to as high as 17.28 points. Gold, which had paused its rally the previous day, again shot up to nearly $3,900 an ounce.

The 10-year Treasury yield rose 1 basis point in European trading to 4.16%, while short-term Treasuries remained flat.

Another factor is that U.S. equities are in a long-term bull market and valuations are higher than during previous overheated periods.

Bloomberg noted that markets had been in a position of muted volatility with investors poised for a year-end rally, but if the shutdown lengthens and volatility rises in other assets such as gold, Treasuries, and the dollar, forced selling could follow.

If the stalemate is prolonged, experts expect gold to reach record highs near $4,000 and retain its appeal as a safe-haven asset thereafter.

Part of the reason for rising gold prices is a weaker dollar. The dollar has also tended to weaken during past shutdowns.

According to ING Bank, further dollar declines could be positive for the Japanese yen and the euro. Long-term Treasuries tended to strengthen during past shutdowns on recession concerns, meaning Treasury yields fell. Bond prices and yields (interest rates) move in opposite directions.

Monica Gera, head of U.S. policy at Morgan Stanley Investment Management, emphasized, "Given the high yields, U.S. Treasuries remain attractive, and if one is sensitive to government shutdown risk, it may be prudent to increase allocation to U.S. Treasuries."

The impact on equity markets varies by sector.

Defense contractors such as RTX, L3Harris Technologies, and AeroVironment saw sharp stock gains this year as federal spending on munitions, drones, and missile defense projects boosted revenue. The same applies to Lockheed Martin and Boeing's aerospace division. Government shutdowns put downward pressure on stocks of companies that rely heavily on government spending.

Gautam Khanna, an analyst at TD Cowen, said, "There is no fundamental impact on the U.S. defense industry, but investor sentiment could weaken." Seaport Global Securities said that if General Dynamics shares fall this week due to the shutdown, it could create a buying opportunity.

Companies that provide consulting and technology services to the U.S. government, such as Booz Allen Hamilton Holdings, Leidos Holdings, and CACI International, could be significantly affected. These companies' revenues were hit during past shutdowns.

Airlines rely on government-sponsored travel for up to 2% of annual revenue. Therefore, if the shutdown is prolonged, it could further hurt an industry already under strain.

Jefferies said that if thousands of federal employees are fired as President Trump has vowed, leisure travel demand is also likely to decline.

Matt Gertken, chief geopolitical strategist at BCA Research, said that if a prolonged shutdown raises unemployment and meaningfully slows growth, investor sentiment toward industrials and financials would deteriorate.

Cyclical industrial giants like Caterpillar and Deere & Co., classified as cyclicals, have rebounded from April lows but still face tariffs and a manufacturing slowdown.

From large banks like JPMorgan Chase to asset managers like Apollo Global Management, financial stocks have shown volatility this year amid concerns about the economic outlook.

According to data collected by Truist Securities, since 1976 there have been 20 instances of U.S. federal government shutdowns over 50 years. Calculating the average change in the S&P 500 index during these periods shows an average change of '0' before and after shutdowns. In other words, on average there was almost no effect. Even during the longest shutdown of 34 days in Trump's first term in 2018, the S&P 500 rose 10%.

Wall Street experts are largely keeping portfolios unchanged this time as well.

Reporter Jeong-A Kim kja@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)