"Keep an eye on five promising U.S. defense stocks"... General Dynamics and others draw attention

Summary

- Bank of America said the U.S. defense sector is attractive for investment and listed General Dynamics, Northrop Grumman, Booz Allen Hamilton Holdings, L3Harris Technologies, and Parsons as promising picks.

- Parsons is building nuclear smuggling detection systems in 18 Indo-Pacific countries under a contract with the U.S. NNSA, and the industry noted increased investment in areas such as UAVs and missile defense systems.

- For major stocks like General Dynamics and Booz Allen Hamilton Holdings, Truist and Wall Street analysts respectively raised price targets, indicating roughly 10–23% upside potential.

Bank of America (BoA) identified five U.S. defense stocks to watch this year. It analyzed that growth potential is large as countries around the world are increasing defense spending.

On the 1st (local time), BoA said, "The markets for military reconnaissance satellites, missile defense systems, and cybersecurity are expected to grow," and rated the U.S. defense sector highly for investment attractiveness. The list of promising stocks included General Dynamics, Northrop Grumman, Parsons, Booz Allen Hamilton Holdings, and L3Harris Technologies.

Parsons, a company providing unmanned aerial vehicle (UAV) and missile countermeasure system solutions, last month signed a contract with the U.S. National Nuclear Security Administration (NNSA) and is building nuclear smuggling detection systems in 18 Indo-Pacific countries. As UAVs and missile defense systems have become important in modern warfare, investment in related areas is increasing, industry analysts say. U.S. securities firm Truist set a price target of $100 for Parsons. It judged that there is about a 17% upside from the current stock price ($85.24).

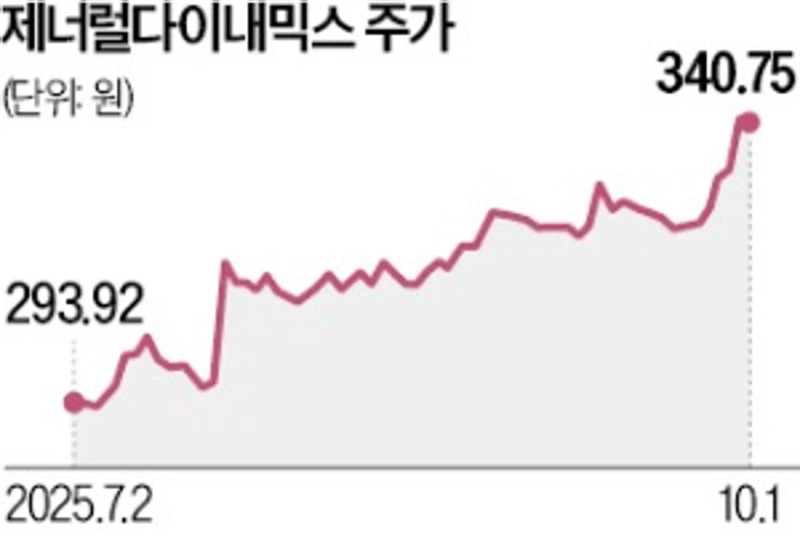

General Dynamics, one of the five largest U.S. defense firms, is also named a promising defense stock. Its stock has surged about 30% so far this year. U.S. investment bank Seaport Global set a target price for General Dynamics at $376, 10% above the current stock price. Wall Street's stock outlook for Booz Allen Hamilton Holdings, which provides consulting services to the U.S. Department of Defense and intelligence agencies, is also positive. The average target price among Wall Street analysts covering the company is $126.9, representing about a 23% upside.

Reporter Eunhyuk Ryu ehryu@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)