Summary

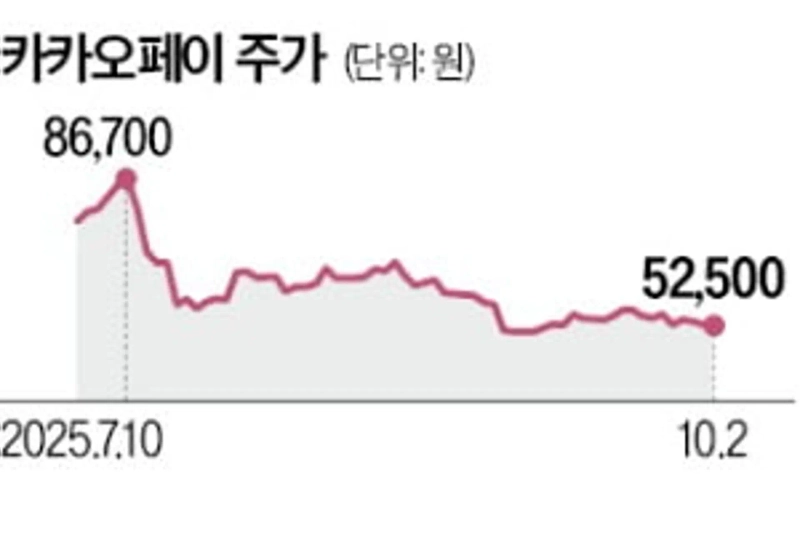

- Kakao Pay's share price plunged more than 53% over the past three months.

- The onslaught of short-selling by foreign investors and controversy over the viability of the Korean won stablecoin business were cited as reasons for the price decline.

- The issuance of overseas exchangeable bonds (EBs) by second-largest shareholder Alipay and overhang concerns could add downward pressure on the stock.

Halved in three months amid foreign investors' offensive

Kakao Pay's share price is going against the broader uptrend. It had been seen as a promising stablecoin candidate, but analysts say the stock has been sliding due to an onslaught of short-selling by foreign investors.

Targeted by short-selling…Kakao Pay 'going against the trend' According to the Korea Exchange on the 3rd, Kakao Pay closed at 52,500 won on the 2nd, down 1.13% from the previous trading day. On the same day the KOSPI surged 2.7%, but Kakao Pay's stock moved in the opposite direction. On June 25, the stock had risen intraday to 114,000 won on expectations related to stablecoins. However, after questions were raised about the viability of the Korean won stablecoin business, it plunged more than 53% in about three months.

Kakao Pay also has the highest ratio of net short positions among stocks listed on the Korea Exchange's main market. As of the 29th of last month, this ratio reached 6.76%. This refers to the proportion of shares sold short and not yet repurchased relative to total outstanding listed shares. A higher ratio indicates more investors expect further declines in the stock.

There is growing concern over an "overhang" (large selling pressure) behind the increase in investors expecting Kakao Pay's stock to fall. Alipay, Kakao Pay's second-largest shareholder, on the 2nd issued overseas exchangeable bonds (EBs) worth roughly 630 billion won using 11,445,638 ordinary shares (an 8.47% stake) as collateral. This is the second time, following a July issuance of EBs worth 280 billion won.

The securities industry expects that if such EB supply is released into the market, it will put additional downward pressure on the stock. Lee Hee-yeon, a researcher at Shinhan Investment, analyzed, "With short-term upside momentum from stablecoin policy gone, concerns over overhang will exert downward pressure on the stock."

Eunhyuk Ryu, reporter ehryu@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)