"Dream of an 'Ethereum sweep'"... Overseas Korean retail investors bet 1 trillion won

Summary

- Domestic investors reportedly net bought about 1.1105 trillion won worth of Bitmine shares, making it the most purchased overseas stock in the second half.

- Bitmine reportedly accumulated Ethereum using funds secured through continuous new share and convertible bond issuances and now holds more than 2%% of total issuance.

- Repeated new share issuance is diluting shareholder stakes, and a shortage of major brokerage analysis reports is cited as an investment burden.

Hot Pick! Overseas Stocks

Ethereum heavy hitter Bitmine

Stock soars 3000% after conversion to investment firm

Holds 2% of Ethereum supply

Could benefit if stablecoin market expands

Overseas Korean retail investors net bought 1.1 trillion won in H2

CB issuance and share sales are investment burdens

Major brokerages have not released reports

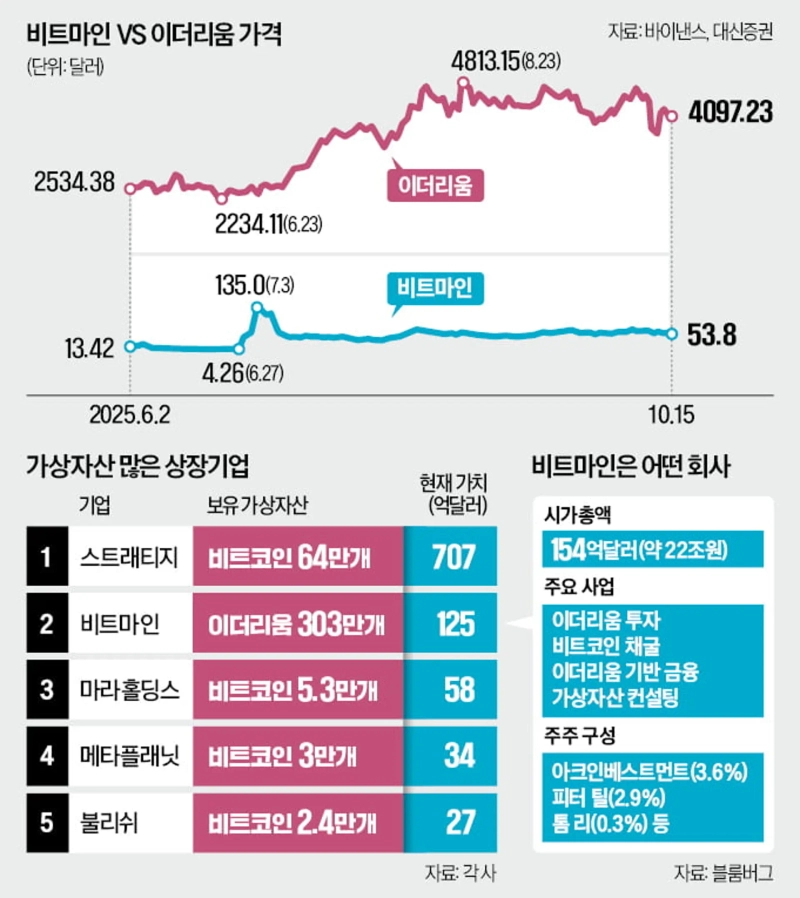

Domestic investors are heavily buying shares of the cryptocurrency investment company Bitmine Immersion Technologies (BMNR). The company’s position as one of the largest holders of Ethereum in the world is drawing attention because Ethereum is being recognized as infrastructure for stablecoin circulation. Frequent paid-in capital increases to buy Ethereum and an excessive corporate value dependence on a specific cryptocurrency are cited as investment burden factors.

◇ Overseas Korean retail investors net bought 1 trillion won in H2

According to the Korea Securities Depository on the 16th, domestic investors have net bought US$287.65 million (about 408.4 billion won) worth of Bitmine shares since last month. Net purchases in the second half amounted to US$782.07 million (about 1.1105 trillion won), making it the most net-bought foreign stock by domestic investors during this period. This surpassed net purchases of mega ETFs such as iShares 0-3 Month U.S. Treasury, Invesco Nasdaq 100, and Invesco QQQ Trust.

Bitmine, which was a small-scale Bitcoin mining company, transformed into an Ethereum investment firm after receiving US$250 million in investment from external investors including PayPal co-founder and Palantir chairman Peter Thiel at the end of June. Over roughly half a month through July 17, it accumulated 300,000 Ethereum, equivalent to US$1 billion at the time. This exceeds the Ethereum holdings of the Ethereum Foundation owned by Vitalik Buterin (220,000).

Rising almost instantly to become the world’s largest corporate holder of Ethereum, Bitmine’s stock price fluctuated wildly. After converting to an Ethereum investment firm on June 30, the stock jumped from US$4.26 to US$135 in four trading days, surging over 3000%. As the investment frenzy cooled due to continuous new share issuance, the price plunged to US$31 at the end of July. Since August, the stock has been recovering alongside rising Ethereum prices. On the 15th (local time) it closed at US$53.8, up 1.66%.

◇ Controls 2% of Ethereum through repeated new share issuance

Bitmine applied the strategy of MicroStrategy, a Bitcoin investment firm, to Ethereum. It is a flywheel strategy of issuing convertible bonds (CBs) or selling new shares in the market and using the cash obtained to buy crypto assets. Endless issuance of new shares continuously dilutes existing shareholders’ stakes, but if the stock, valued based on held assets, rises more than that, profits can be generated.

As of this date, Bitmine has secured more than 2% of total issuance — 3.03 million ETH (about US$12.5 billion). The only company holding crypto assets of greater value is MicroStrategy, which holds 640,000 Bitcoin (about US$76.3 billion).

The goal of Tom Lee, chairman of the board leading Bitmine, is to hold 5% of total Ethereum issuance. Ethereum supports smart contract functionality and various program operations through its blockchain network. Thanks to this, about half of currently issued stablecoins operate on Ethereum infrastructure. Proponents of an Ethereum bullish view, including Lee, argue that as the stablecoin market grows, Ethereum’s value will rise and revenues such as staking fees and loan interest will increase.

In an interview with CNBC, Lee said, "With stablecoin legislation, financial services and crypto assets are being integrated into one, and at the foundation of this ecosystem is Ethereum," adding, "Bitmine's goal is to secure dominance within the Ethereum network."

There are still few major brokerages issuing analysis on Bitmine. According to financial information provider Bloomberg, only one global brokerage, ThinkEquity, has issued an investment opinion on Bitmine this year. ThinkEquity served as an underwriter when Bitmine listed new shares in June. Their target price is US$60.

Reporter Jeon Beom-jin forward@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.