World's No.1 Binance Targets South Korea… Will Upbit·Bithumb's Monopoly Be Broken?

Summary

- The world's largest cryptocurrency exchange Binance completed the Gopax acquisition after about two years and officially entered the Korean market, it reported.

- It said that if Binance's large-scale liquidity and technical infrastructure are applied to Gopax, changes to the Upbit·Bithumb-centered market structure are expected.

- However, an industry source said that the global headquarters' governance and internal control system remaining opaque is a risk factor.

Cryptocurrency exchange competition predicted

Gopax acquisition completed after about two years

Large-scale liquidity and technology transfer possible

User service competition likely to heat up

The world's largest cryptocurrency exchange Binance has completed the acquisition of Gopax after about two years and has officially entered the Korean market. This came after final approval from financial authorities. Attention is focused on whether cracks will appear in the domestic exchange monopoly centered on Upbit and Bithumb.

On the 16th, according to financial authorities, the Financial Intelligence Unit (FIU) accepted Gopax's executive change filing the day before. Accordingly, Binance has effectively secured management control of Gopax.

Binance became a major shareholder in February 2023 by acquiring 67% of Gopax's shares. Gopax submitted an executive change filing to register Binance executives, but the filing was not accepted for more than two years. This was because Binance had legal risks in the U.S. and there were concerns about its anti-money laundering (AML) system. In June 2023, Binance was sued by the U.S. Securities and Exchange Commission (SEC) on charges of providing services to U.S. users illegally and improperly using customer funds. Since then, settlements with U.S. law enforcement and the replacement of the chief executive officer (CEO) have largely alleviated regulatory risks, and analysts say this led to the approval this time.

Gopax is expected to effectively serve as 'Binance Korea.' According to the industry, Gopax is known to plan a phased implementation of stabilizing KRW deposit and withdrawal services and linking to global liquidity.

It is also expected that Binance's promised payments for Gopai deposit compensation will accelerate. Gopai is Gopax's virtual asset deposit and interest payment service. In the 2022 FTX collapse, withdrawals of deposited customers' assets were suspended, causing thousands of investors to incur losses.

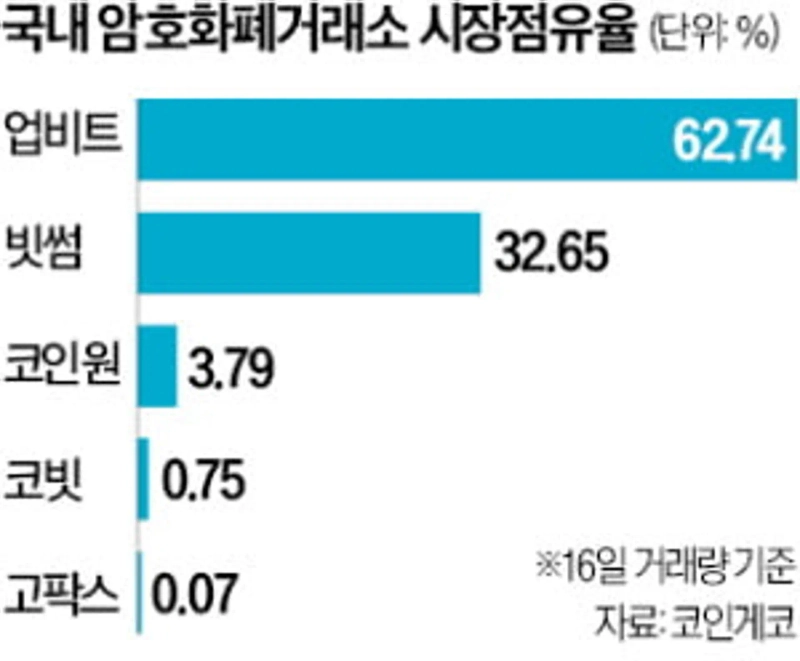

Observers say that if Binance's large-scale liquidity and technical infrastructure are applied to the Gopax platform, it will have a considerable impact on the domestic market as well. Currently, the domestic cryptocurrency exchange market is dominated by Upbit and Bithumb with more than 96%. In particular, Upbit's market share once exceeded 80%. An industry source said, "Binance's participation could trigger competition among domestic exchanges," adding, "however, the global headquarters' governance and internal control system remaining opaque is a risk factor."

Mihyun Jo/Hyungkyo Seo reporters mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.