Korea to Procure Dollars Using U.S. Treasury Fund…Minimizing Shock to Domestic Foreign Exchange Market

Summary

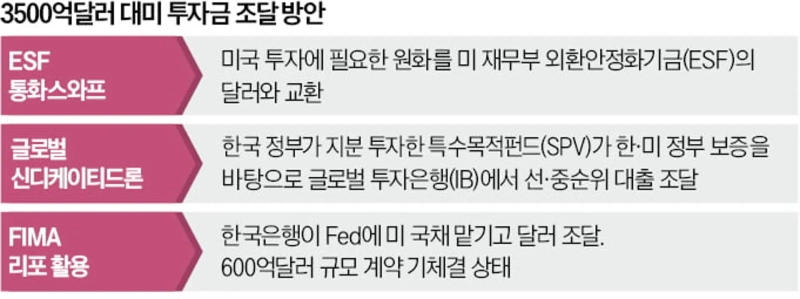

- The Bank of Korea is reportedly seriously considering entering into a currency swap using the U.S. Treasury's Exchange Stabilization Fund (ESF).

- The Korean government is also discussing parallel measures such as raising a global syndicated loan through an SPV (Special Purpose Vehicle) and utilizing the FIMA Repo Facility (temporary repo facility).

- These various dollar procurement measures are being closely negotiated by Korea and the U.S. to minimize shock to the domestic foreign exchange market.

Kim Yong-beom·Kim Jeong-gwan Depart…Finalizing Wording of Investment Agreement with U.S.

Shift from Central Bank Currency Swap

Bank of Korea to Use U.S. Treasury Exchange Stabilization Fund

Won and Dollar Expected to Be Exchanged in a 'Swap' Form

Bessent: "If I Were Fed Chair,

I Would Have Agreed a Currency Swap with Korea"

Likely to Combine Various Procurement Methods

Korean Government to Establish Special Purpose Fund

'Syndicated Loan' Procurement Also Raised

There is growing speculation that South Korea and the U.S. are narrowing their differences over a plan to form a $350 billion (about 500 trillion won) U.S.-bound investment fund while avoiding shocks to Korea's foreign exchange market. Specifically, the Bank of Korea is being strongly considered to enter into a currency swap with the U.S. Treasury. Scott Bessent's remark in a CNBC interview on the 15th (local time) that "if I were the chair of the U.S. central bank (Fed), I would have done a currency swap with Korea" supports this analysis. Other mentioned options include creating a special purpose vehicle (SPV) to raise a global syndicated loan, and utilizing the 'FIMA Repo Facility' that the Bank of Korea and the Fed have agreed on.

◇Will the Bank of Korea and U.S. Treasury Sign a Currency Swap?

According to government sources on the 17th, the government and the Bank of Korea are considering using the won in the process of forming the U.S.-bound investment fund to prevent shocks to the foreign exchange market. One option under consideration is that the Bank of Korea and the U.S. Treasury will use the Exchange Stabilization Fund (ESF) to conclude a currency swap. The U.S. Treasury on the 9th signed a currency swap agreement with Argentina worth $20 billion through the ESF. It is expected that Korea may apply the 'Argentina model' and that the Bank of Korea and the ESF will conclude a swap in which won and dollars are exchanged.

The ESF is a fund established by the U.S. Treasury in 1934 to stabilize the foreign exchange market. With the approval of the U.S. Treasury secretary, it is possible to conclude a currency swap with a foreign central bank.

The Korean government initially pushed for an unlimited currency swap between the central banks of the two countries. However, persuading the Fed, the party to the currency swap, proved difficult, and evaluations indicate they shifted to a Treasury-led currency swap using the ESF.

◇FIMA and Syndicated Loan Procurement Also Raised

However, the prevailing assessment is that it would be difficult to raise the entire $350 billion through the ESF. As of August, the ESF's asset size was only $220.9 billion, and it is impossible to use all of it solely for Korea. Accordingly, the government is reportedly looking into various funding methods in addition to an ESF currency swap.

A global syndicated loan is also one of the likely options under consideration. In this approach, the Korean government and policy banks would set up an SPV, bolster credit through equity investment or subordinated bond purchases, and obtain senior and mezzanine loans from global investment banks (IBs). In that case, it is anticipated they will consult about requesting a U.S. government guarantee to lower the procurement interest rate.

Some have also raised the possibility of using the temporary repo facility introduced between the Bank of Korea and the Fed in December 2021 with a $60 billion limit, or increasing the transaction limit of that facility. This facility allows the Bank of Korea to post U.S. Treasuries it holds as collateral to obtain dollars, securing dollar liquidity without shocking the foreign exchange market. However, the facility was designed for crises like the COVID-19 pandemic and has never been used.

A Bank of Korea official said, "Providing U.S. Treasuries held as foreign reserves as collateral without selling them may appear not to affect the market," adding, "in fact, it is no different from drawing down foreign reserves."

Kim Yong-beom, Koo Yun-cheol, and Kim Jeong-gwan, who visited the U.S. to conclude trade negotiations ahead of the Asia-Pacific Economic Cooperation (APEC) summit at the end of this month, are expected to focus discussions on these funding methods. On the 16th, leaving for his trip at Incheon International Airport, Kim said to reporters, "The U.S. Treasury and Commerce Departments are communicating very closely," and added, "I view (the possibility of concluding negotiations) positively." Secretary Bessent also said, "The negotiations with Korea will be wrapped up within 10 days."

Kim Ik-hwan / Kang Jin-gyu / Jung Young-hyo reporters lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.