Summary

- It reported that U.S. Treasuries are being viewed as safe-haven assets due to the prolonged U.S. federal government shutdown and the re-escalation of U.S.-China trade tensions.

- The 10-year Treasury yield fell to the annual 4% level, increasing the likelihood of further rate cuts and leading to greater investor preference for long-term bonds.

- Major financial firms such as J.P. Morgan Asset Management and TD Securities said that investor funds are moving from short-term to long-term bonds and forecast the possibility of additional rate declines.

10-year yield approaching annual 4% level

As the government shutdown enters its second week

10-year yield fell to 4.026%

Lowest this year … could fall further

Expectations for Fed rate cuts grow

Myron "U.S.-China conflict re-ignites

It's time to cut rates aggressively"

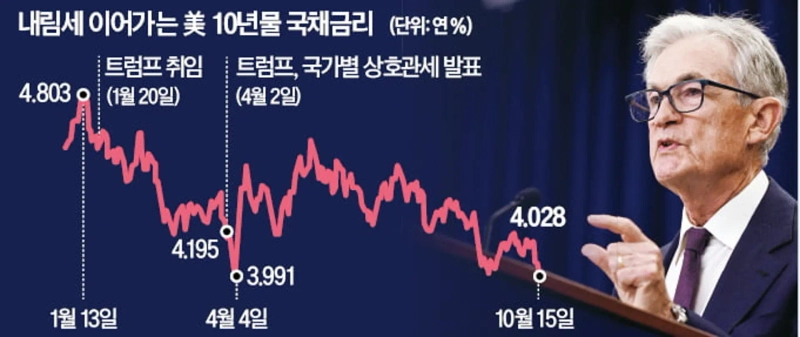

U.S. Treasury prices are rallying. The benchmark 10-year Treasury yield fell to the annual 4% level (bond prices rose), putting entry into the annual 3% range within sight. When President Donald Trump fully launched the tariff war last April, yields broke past 4.5% and there was talk of a 'bond tantrum,' but the mood has changed dramatically. The U.S. federal government shutdown (temporary halt to operations) has continued for over two weeks, raising concerns about an economic slowdown and highlighting the possibility of additional rate cuts by the U.S. central bank (Fed).

◇ Sharp drop in Treasury yields

As of 9:30 p.m. on the 15th (Eastern Time), the U.S. 10-year Treasury yield stood at 4.026%. At one point it fell to 4.017%. It fell 28bp (0.028% points) from the previous day. Current Treasury yields are at their lowest level this year.

Markets are focusing on the prolonged shutdown. In the past, prolonged shutdowns have acted as a factor pulling down long-term Treasury yields. During the more-than-one-month shutdown in 2018, the 10-year U.S. Treasury yield fell by about 0.5% points. Bloomberg reported, "The bond rally (yield decline) at that time began when concerns grew that the shutdown could trigger a recession." The Fed indicated at last month's policy meeting the possibility of two additional rate cuts this year.

Alongside growing talk of a tech stock bubble, highlighted U.S.-China tensions are also cited as a factor behind falling Treasury yields. Recent U.S.-China tensions have sent big tech stocks tumbling, increasing interest in U.S. Treasuries as a safe-haven asset.

Meanwhile, Steven Myron, a Fed board member considered close to Trump, said, "I had been somewhat optimistic about certain aspects of growth, judging that some uncertainty had been resolved by eased U.S.-China trade tensions, but recently China breaking agreements has brought back potential but new uncertainty." He added, "Current monetary policy is at a very restrictive level, and this can make the economy very vulnerable to shocks." Myron had earlier suggested a year-end policy rate of 2.75~3.0%. This implied an additional cut of 1.25% points within the year from the current level.

◇ Bets on '10-year yield in the annual 3% range' increase

Market unease has grown with the Fed's Beige Book, which suggests the labor market is slowing. In the Beige Book released that day, the Fed said, "Over recent weeks employment levels have been generally stable, but overall labor demand appeared subdued."

Bond traders have been placing tens of millions of dollars in bets in the options market on a decline in the 10-year U.S. Treasury yield. According to Bloomberg, demand for December-expiration call options targeting a scenario in which the 10-year yield falls below the annual 4% level surged in the U.S. Treasury options market. In particular, contracts betting that the 10-year yield would fall to 3.95% increased, with daily trading volume reaching 100,000 contracts (about $50 million) last month.

Pimco, the world's largest bond manager, recently told clients the current rates are "high rates" and forecast further rate declines. J.P. Morgan Asset Management, TD Securities and others also reported that investor funds are moving from short-term to long-term bonds.

Reporter Da-yeon Im allopen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.