Summary

- It reported that recently gold prices have repeatedly hit record highs, intensifying investor enthusiasm and deepening the gold bar shortage.

- Some banks and financial institutions have suspended or adjusted sales of various sizes of gold bars, including 1㎏ gold bars.

- It said that as domestic gold prices have risen significantly compared with international rates, investors need to be cautious about the price gap.

Supply Shortages Worsen Amid Surging Popularity

Investor Enthusiasm 'Heats Up' as Gold Prices Keep Rising

Shinhan Bank has suspended sales of 1㎏ gold bars. As prices keep climbing, interest in gold investment has heated up, and the gold bar 'shortage' appears to be deepening.

According to the financial sector on the 21st, Shinhan Bank recently suspended sales of 1㎏ gold bars. This is due to a shortage of supply from supplier LS MnM amid surging demand. The bank plans to sell mainly 37.5g products purchased from the Korea Gold Exchange for the time being.

Gold bars are running out at retailers across the board as their popularity soars. The Korea Minting and Security Printing Corporation temporarily suspended sales of all gold bar products from the 1st. It will halt supply until January 1 next year. As a result, Kookmin, Hana and Woori Banks have suspended sales of small-sized products and are only selling 1㎏ gold bars. NongHyup Bank also stopped selling 37.5g, 187.5g and 375g gold bars procured from the Samsung Gold Exchange as of the 20th. It is only selling 3.75g, 10g, 100g and 1㎏ products purchased from the Korea Gold Exchange.

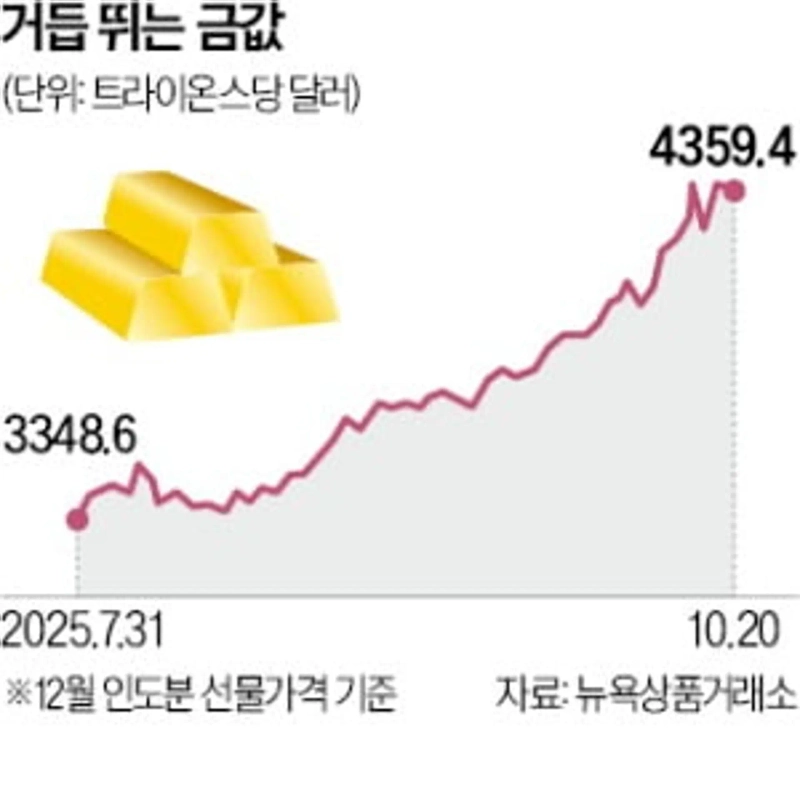

Gold prices have been on a high-flying run, repeatedly hitting record highs. The December-delivery gold futures price exceeded 4,000 dollars per troy ounce on the 7th and continued its upward trend, reaching 4,359.4 dollars on the 20th. Analysts say concerns that the U.S.-China trade conflict could drag on and expectations of falling interest rates are pushing up prices.

Even though gold prices have risen by more than 50% this year alone, the financial sector sees room for further gains. Global investment banks Bank of America and Société Générale forecast that international gold prices could rise to 5,000 dollars next year.

However, many warn that the recent 'abnormal surge', in which domestic prices rise more than overseas, should be watched. According to the Korea Exchange, on the 20th the spot price of gold was 210,000 won per gram, 8.8% higher than the international trading price (192,860 won). On the 16th, the price gap widened to 18%. The Korea Exchange announced to investors last month and again earlier this month that "gold prices ultimately converge to international rates, so caution is necessary."

Reporter Jinseong Kim jskim1028@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)