Will the Santa Rally Come This Year... The Direction of the Current 'Strange' Rally [Bin Nansae's Flawless Wall Street]

Summary

- The U.S. stock market is up 14.8% year-to-date and continues the bull market, but warned that volatility and political uncertainties such as U.S.-China trade talks and the government shutdown remain.

- Wall Street said the system's overall health, the U.S. central bank's rate cuts, and large-scale AI-related capex will support a year-end rally.

- Selective investment in companies with clear fundamentals is important, and caution is advised regarding the recent rally centered on small caps or unprofitable firms.

Late October volatility reasons

Still, "The Santa Rally Is Coming"

How to prepare for the year-end rally

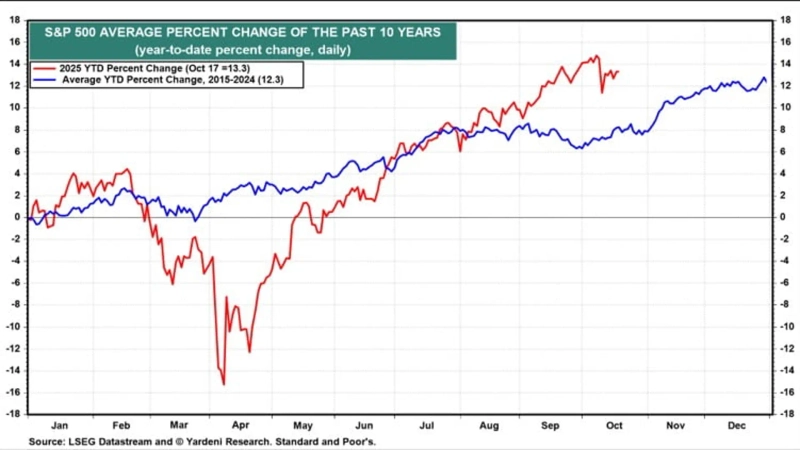

The U.S. stock market has shown a tenacious recovery that makes last week's turmoil seem insignificant. Year-to-date through the 21st (local time), the S&P 500's gain is 14.8%. It has already surpassed the past 10-year average annual return of 12.3%.

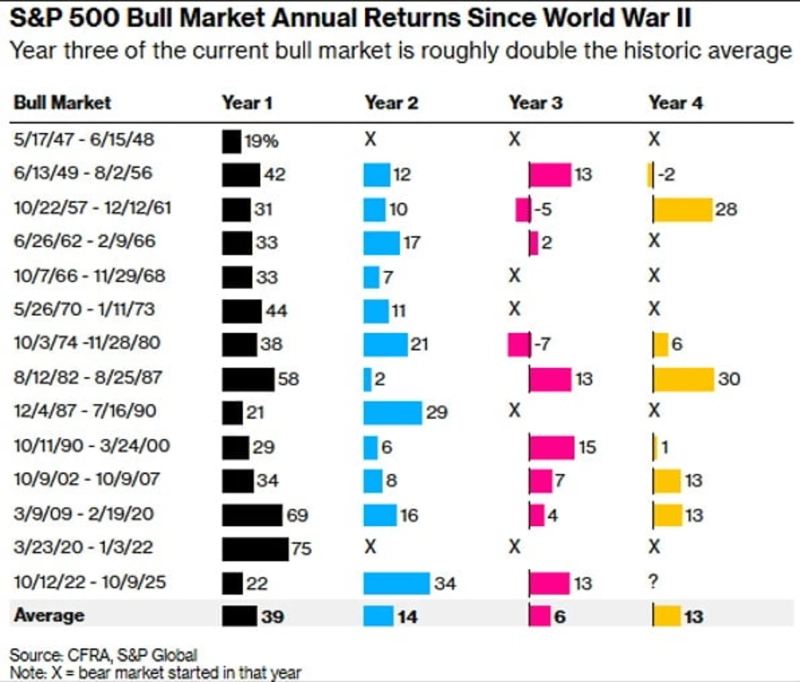

The current bull market that began on October 12, 2022, is now three full years old. Historically, in the eight cases since World War II where bull markets lasted more than three years, the average return in the third year was 6% and in the fourth year 13%.

Having already exceeded the patterns of historical bull markets, investors are increasingly anxious about whether there is room for further gains through a year-end rally. Traditionally, the 'Santa Rally'—a period of strength from November through the year-end—might be seen by some as having started early and already ended, which raises concerns.

Volatility alert not yet cleared

Recent reignition of the U.S.-China trade war, an extended U.S. federal government shutdown, and credit risk and liquidity stress that unsettled markets until last week have made investors more vulnerable to such concerns. Wall Street firms including JP Morgan, Morgan Stanley, and Citadel Securities have echoed that volatility and risk management should be monitored through late October.

① First, political and geopolitical uncertainties such as U.S.-China trade negotiation uncertainty and a prolonged shutdown are not over. Morgan Stanley's chief investment officer Mike Wilson once analyzed that if the U.S. and China failed to reach a deal by the tariff reprieve expiration date (November 10), the S&P 500 could fall by up to 11%. Of course, given U.S. stakes in rare earths and soybeans and China's stakes in semiconductors and Taiwan, the consensus is that some form of compromise will likely be reached. Still, if the scope or strength of any agreement is narrower or weaker than markets expect, some disappointment could occur.

The U.S. government shutdown entering its 20th day is another volatility factor. JP Morgan's global market strategist Dubravko Lakos-Bujas said the longer trade policy and shutdown uncertainty persist, the higher the risk of 'asymmetric downside.' Rather than the shutdown itself, the concern is that if the shutdown continues, when the government reopens the flood of economic data that follows could temporarily increase volatility as markets digest it. As of the 21st, prediction markets are betting that the shutdown could last the maximum period of 41 days or more.

② Last week's regional bank loan delinquencies, the bankruptcy of subprime auto lender Tricolor, and the exposure of FirstBrands—which raised more than $10 billion in private loans before collapsing—have kept investor anxiety about credit market risk from being fully resolved.

Of course, Wall Street's common view is that the likelihood of this spreading into a systemic crisis like the 2008 financial crisis or the Silicon Valley Bank (SVB) episode is very low. However, the private credit market, which grew rapidly to about $2 trillion yet was never properly risk-assessed, is involved, and credit tightening has historically been a major trigger for recessions, so markets remain cautious.

Unprofitable small caps ran harder

③ More importantly, events that awaken credit risk can lead to a revaluation of the risk premium, which has historically been low. JP Morgan said that while the chance of credit risk spreading systemically is low, the market's risk premium could temporarily widen.

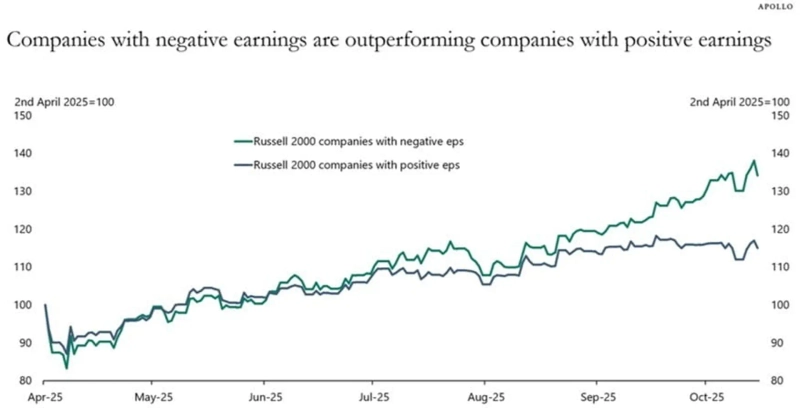

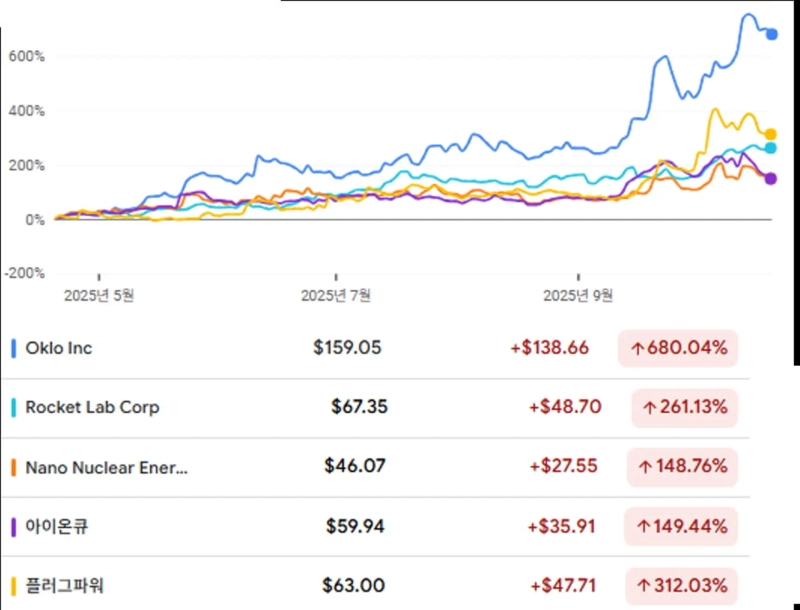

Over the past decade of ultra-low rates and the restart of a rate-cutting cycle, abundant liquidity, and an AI boom, some investors chasing high returns took excessive risks with 'blind optimism.' This episode could bring them back to reality and trigger a reassessment of risky assets. In fact, since April through recently, small-cap Russell 2000 firms showed a 'strange' rally where unprofitable companies' stock prices rose much faster than profitable ones. Also, 'low-quality' companies in the bottom 20% by return on equity have outperformed high-quality companies by roughly 20% year-to-date.

This is interpreted as more investments following policy factors, political ties, liquidity, and narratives than corporate fundamentals. Of course, in an era and policy environment where industrial transformation is an issue, capturing policy signals and investing in companies that will lead future industries—taking risks—can be a virtue for investors. But the blurring line between well-founded foresight and speculative 'blind optimism' calls for caution.

A representative case is Fermi (FRMI), which listed earlier this month and nearly reached a $13 billion market cap. The company, which is pursuing power generation and grid construction for AI data centers, has no meaningful revenue or binding contracts yet, but its stock surged after listing. Attention was drawn to AI, nuclear, and power themes, and the fact that Rick Perry, former Energy Secretary and a close ally of President Trump, is a co-founder. The company's stock recently plunged 30% over five days.

Such a revaluation of the risk premium is a process of market positioning becoming healthier. However, in the short term, compressed valuations can reduce upside potential and increase volatility.

Bull market intact, Santa rally is coming

Despite these short-term risk factors, Wall Street ultimately expects the structural bull market to continue and a year-end rally to unfold.

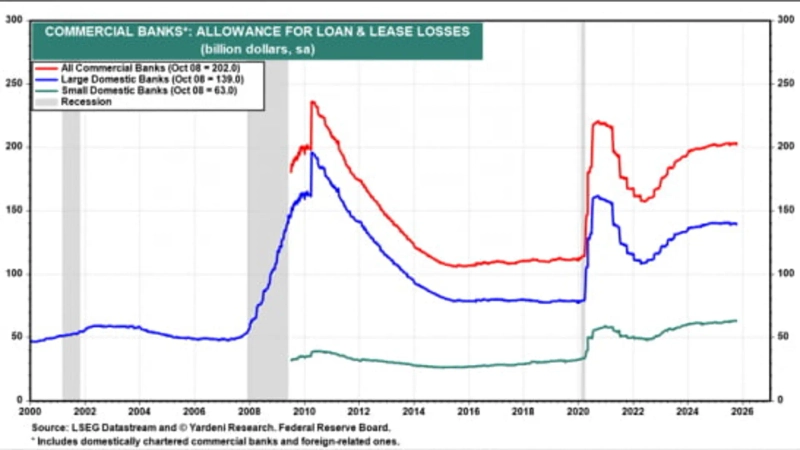

① Despite concerns about regional bank loan problems and private lending, there are no signs yet that the system's overall health is impaired. Yardeni Research points out that unlike past recessions, U.S. banks' loan-loss provisions are at relatively stable levels.

② Above all, the current environment is one in which the U.S. central bank (Fed) is cutting rates and has signaled an end to quantitative tightening. This indicates the Fed's willingness to respond to market cracks and liquidity stress.

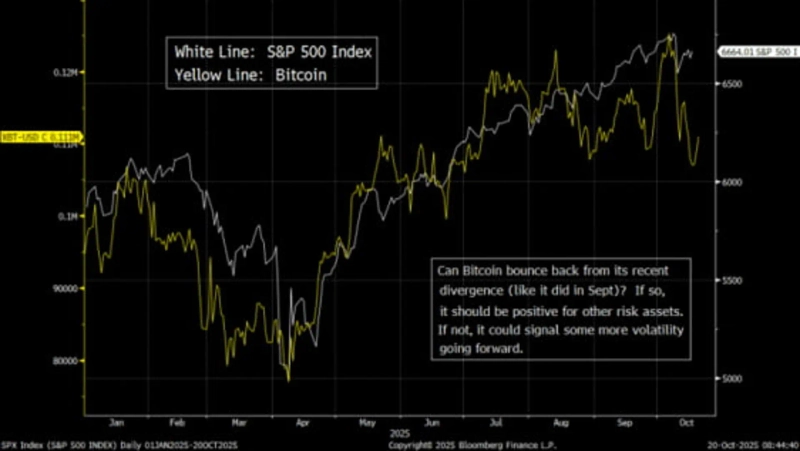

Miller Tabak's chief market strategist says investors should closely watch whether Bitcoin rebounds as a gauge of the next direction of the stock market, because Bitcoin is a good indicator of net liquidity in the system. If Bitcoin rebounds as it did in September and narrows its divergence with the S&P 500, it can be interpreted as system liquidity recovering and a favorable signal for risk assets. Conversely, if Bitcoin's rebound is delayed, equity market volatility could last longer.

③ The Trump administration's tax cuts and expanded investment tax benefits, along with rate cuts, also support stock prices. In particular, if rate cuts and tax relief take full effect next year, firms with high debt ratios or weak profitability could see improvement. Goldman Sachs recently analyzed that the outperformance of unprofitable companies in the market also reflects investors' anticipatory pricing of a more accommodative macro environment.

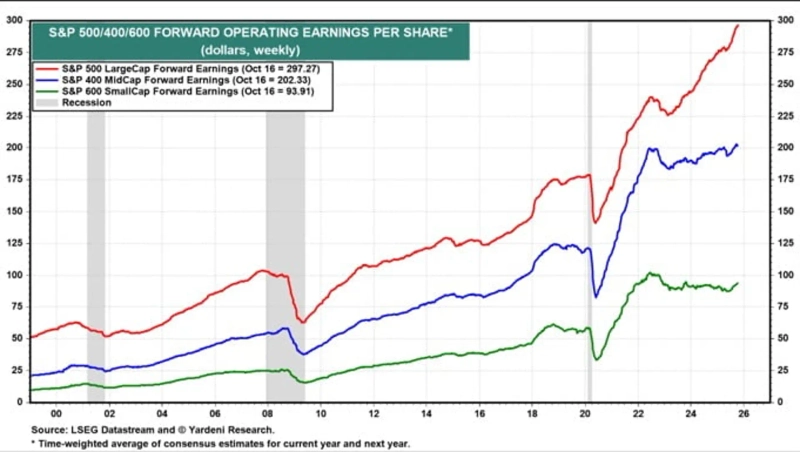

④ Strong earnings resilience of U.S. companies is also important. S&P 500 companies are expected to beat market expectations in the third quarter as well. The current consensus for Q3 S&P 500 EPS growth is 6.7%, while Citadel Securities expects 7.5%, Yardeni Research 10%, and Oppenheimer around 15%.

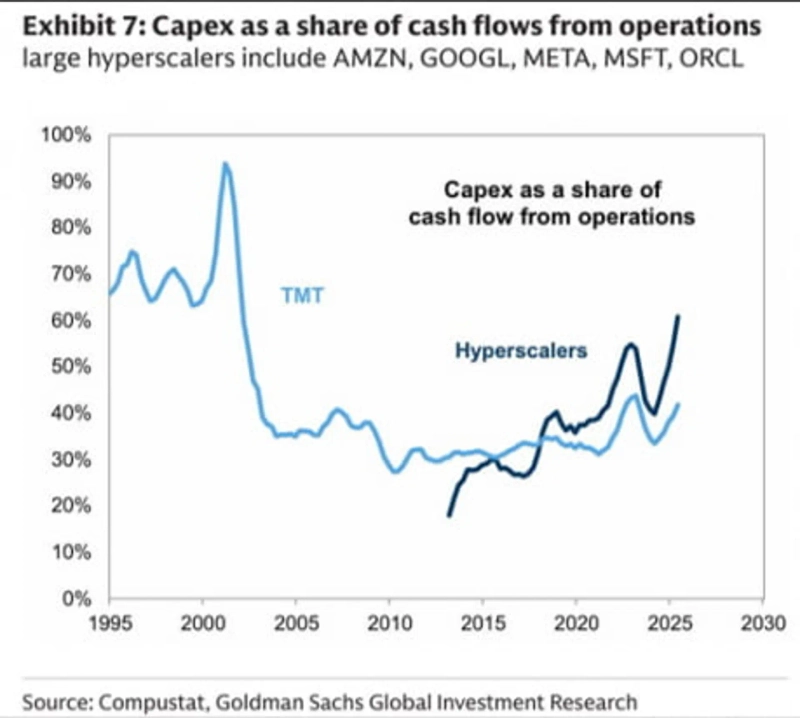

⑤ A strong investment cycle led by AI is also key. JP Morgan forecasts next year's capital expenditure growth for 30 AI companies at 35–40% and emphasized that "within a multi-year AI spending cycle, EPS growth above long-term trends is possible next year." Goldman Sachs likewise expects S&P 500 companies' cash spending to rise 11% year-over-year to $4.4 trillion next year due to an AI capex boom. This could boost economic vitality. In addition to AI, capital spending is surging in aerospace, defense, manufacturing, biotech, and automation.

How to prepare for the year-end rally

Ultimately, Wall Street's consensus is that if the volatile period through late October to early November is navigated well, the year-end rally can resume.

Scott Rubner, head of equity strategy at Citadel Securities, notes that over the past 100 years the S&P 500's 4Q low tended to occur on October 26 and the Nasdaq 100's on October 27, with rebounds in November–December. Rubner believes that seasonal patterns may repeat and that volatility and short-term declines through the end of October could be buying opportunities.

Goldman Sachs managing director Bobby Molavi said, "There are signs of froth in the market, but the major pillars supporting the current long-term bull market—especially the large capital expenditure boom ignited by AI—are clear," and added that "fighting the massive flow of capital until the long-term winners and losers of AI are decided is pointless."

So what might the year-end rally look like? Rubner expects a catch-up rotation in November–December, with the 493 S&P stocks excluding the Magnificent Seven outperforming, value stocks over growth, and relatively lagging areas such as markets outside the U.S. and emerging markets catching up. This year, momentum trade leaders such as gold/silver, rare earths, nuclear, quantum computing, neo-cloud and external data center-related names have already shown relative weakness.

Selective investing focused on fundamentally strong names is expected to be more important. Small caps with slow earnings recovery or unprofitable firms still warrant caution. The S&P 400 midcaps' and S&P 600 small caps' forward EPS trends remain weaker than large caps.

New York=Bin Nansae correspondent binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)