Editor's PiCK

Bitcoin volatility increases…This year forecast $150,000–$170,000

공유하기

- Regarding this year's Bitcoin price outlook, global investment banks reported diverging views, forecasting rises to $170,000 or falls to $40,000.

- Rate cuts, exchange-traded fund (ETF) inflows, and global macro variables are expected to be key factors for Bitcoin's price.

- Experts said structural analysis of liquidity, policy, and technological changes that drive shifts in the virtual asset market structure is essential for investment decisions.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Virtual asset investment guide

Last year's Bitcoin market 'rollercoaster'

Weakness amid slowing pace of rate cuts

This year sees both optimism and caution

JPMorgan "Could reach $170,000 this year"

"Favorable changes in virtual asset regulation"

Concerns over expanding technical and macro risks

Some argue a "drop to $40,000" is possible

Last year the Bitcoin market experienced a daily rollercoaster. Expectations were high from the start of the year that the U.S. government would buy Bitcoin and other assets as strategic holdings, but the market mostly remained sideways due to factors like the global tariff war.

Bitcoin price swings are expected to continue this year. Within the industry, optimistic views predicting a breakthrough above $170,000 and cautious views forecasting short-term corrections coexist. Whether major central banks cut interest rates, approvals of spot exchange-traded funds (ETFs), and corporate capital inflows are cited as key variables that will determine Bitcoin's price direction.

Domestic and overseas Bitcoin prices 'pause'

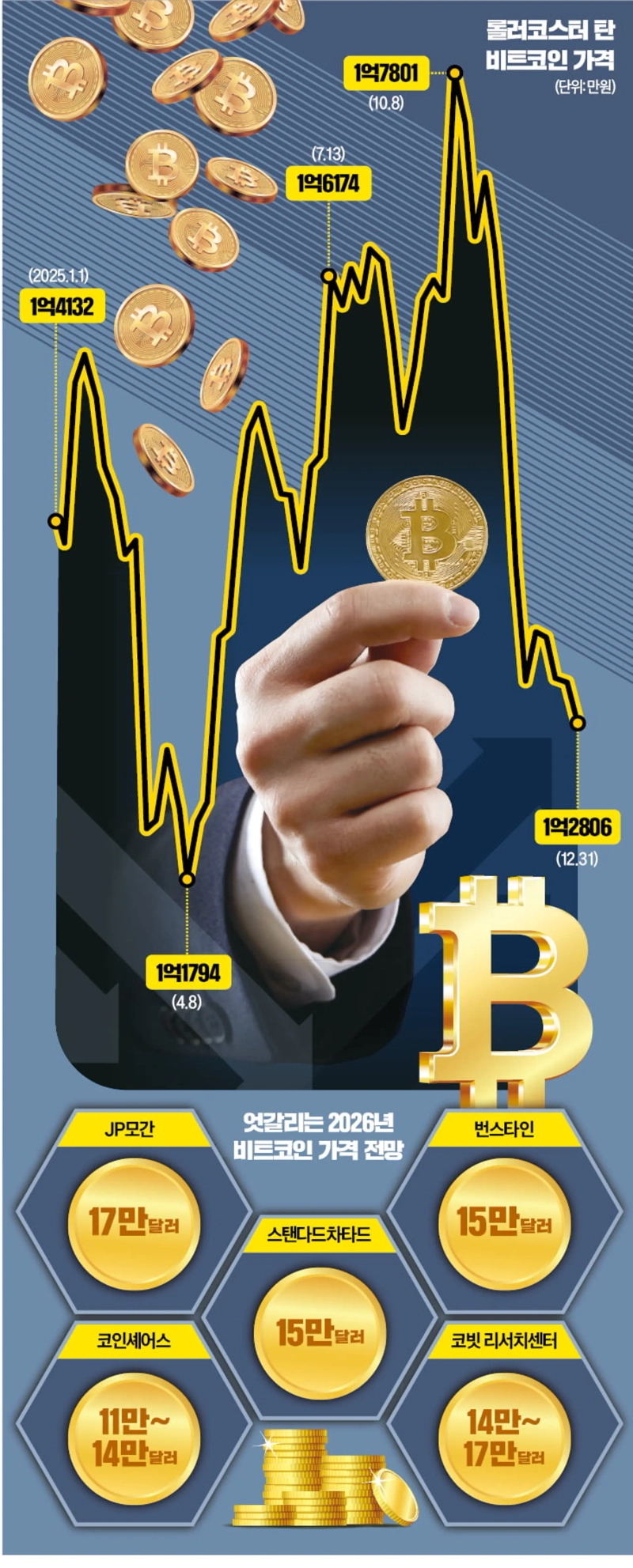

According to domestic cryptocurrency exchange Upbit on the 1st, the Bitcoin price remained in the high 120 million-won range until the end of last month. Compared with the record high on October 8 last year (178.01 million won), the price fell by more than 20%. The annual recurring Bitcoin "Santa rally" (a phenomenon where prices rise around Christmas) also appears to have disappeared.

In overseas markets, Bitcoin prices are also on the decline. According to CoinMarketCap, Bitcoin traded below $90,000 by the end of last year. It turned to a year-to-date decline for the first time in three years since 2022. At the beginning of last year it had been holding around $100,000. It then fell to the $76,000 range as the global tariff war intensified. Concentrated buying by institutional investors pushed it above $120,000 in July last year, but it has recently failed to escape weakness.

The altcoin market is no different. Ethereum, a representative altcoin, traded around $3,000 last month. Compared with the beginning of last year, it is down by more than 10%.

What increased Bitcoin's price volatility was major central banks such as those of the U.S. and Japan beginning to actively adjust the pace of rate cuts. Even after the Federal Open Market Committee (FOMC) lowered the benchmark interest rate by 0.2 percentage points to 3.50–3.75%, Bitcoin prices remained flat. This is interpreted as due to the FOMC statement containing a hawkish signal—"it will review the range and timing of additional benchmark rate adjustments."

There are also views that global macro variables now have a greater impact on Bitcoin prices than in the past. This is because institutional investors' expansion into virtual asset investments and the approval of spot ETFs have accelerated integration into the mainstream financial system. Analysts argue that a complex macro environment is having a larger influence on price than Bitcoin's own supply and demand.

Bitcoin price volatility remains high this year

With increased volatility, Bitcoin price forecasts for this year are also uncertain. Global investment bank JPMorgan said Bitcoin could rise to $170,000. Compared with gold, a representative safe-haven asset, it judged that the current price level is still undervalued. JPMorgan explained, "It is true that the regulatory environment for virtual assets has become more favorable, and the view of Bitcoin as a 'store of value' is increasing."

However, cases of downward revisions due to growing global uncertainty are also continuing. Global investment bank Bernstein had expected Bitcoin to reach $200,000 but lowered its target to $150,000. Global investment bank Standard Chartered also lowered its target from $300,000 to $150,000.

Some raised the possibility of a sharp drop in Bitcoin prices. Virtual asset expert Luke Gromen warned, "Bitcoin prices could fall to around $40,000 amid expanding technical and macro risks."

Experts cited major central banks' policy directions and whether funds flow in through ETFs as key indicators for gauging Bitcoin's price direction this year. Although pessimism about Bitcoin has spread, some analyses suggest it could turn upward again due to effects such as expanded liquidity provision by central banks and reduced ETF outflows.

Kim Min-seung, head of the Korbit Research Center, said, "Structural analysis to understand how changes in liquidity, policy, and technology will reshape the virtual asset market structure is essential."

Reporter Jang Hyun-ju blacksea@hankyung.com