Editor's PiCK

Draft US Senate crypto bill could classify major altcoins such as XRP and Solana as 'non-ancillary assets'

공유하기

Summary

- It reported that a draft US Senate digital-asset market-structure bill includes a provision to classify certain tokens as non-ancillary assets.

- It said that, as of Jan. 1, 2026, tokens serving as underlying assets for exchange-listed ETPs/ETFs could be deemed non-ancillary assets, exempting them from additional disclosure obligations.

- Accordingly, major altcoins such as XRP and Solana (SOL) could be treated the same as Bitcoin (BTC) and Ether (ETH), though it noted the text remains a discussion draft.

A draft market-structure bill for digital assets currently being discussed in the US Senate is said to include a provision that would classify certain tokens as non-ancillary assets. If finalized, the provision could open the door for major altcoins to be granted the same regulatory status as Bitcoin (BTC) and Ether (ETH).

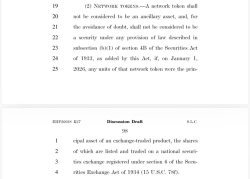

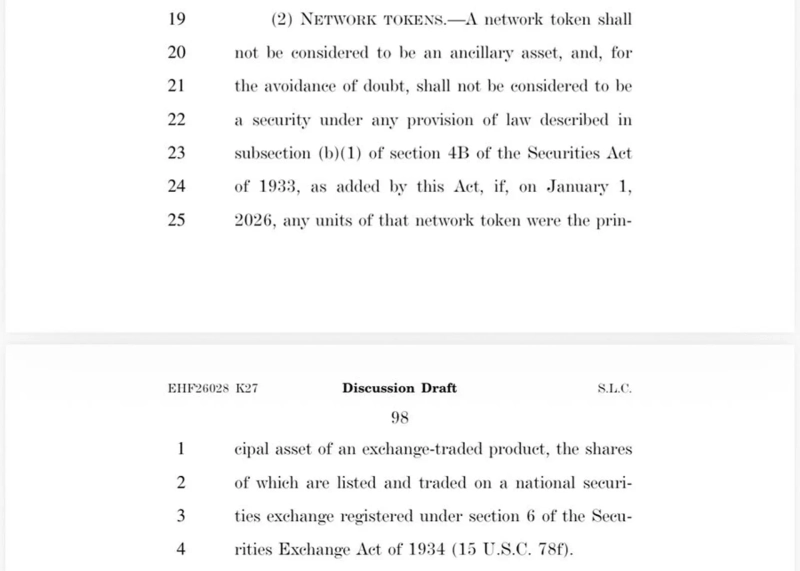

According to Eleanor Terrett, host of CryptoAmerica, the draft under discussion includes language stating that, as of Jan. 1, 2026, tokens that are included as underlying assets of exchange-traded products (ETPs, including ETFs) listed on US securities exchanges would be deemed non-ancillary assets. In that case, those tokens would not be subject to separate disclosure obligations required for other digital assets.

The draft says that tokens that are listed on a national securities exchange and are a “major underlying asset” of an ETF registered under Section 6 of the Securities Exchange Act would be excluded from additional disclosure requirements. As a result, market participants interpret that XRP, Solana (SOL), Litecoin (LTC), Hedera (HBAR), Dogecoin (DOGE) and Chainlink (LINK) could be treated the same as Bitcoin (BTC) and Ether (ETH) from the bill’s effective date.

The market sees that, if the provision is confirmed, some altcoins could largely move beyond disputes over whether they are securities and speed up their entry into the regulated mainstream. Still, because the document is a discussion draft rather than a finalized text, the language could change during review by the Senate Banking Committee and subsequent revisions.