Editor's PiCK

US spot Ethereum ETF sees $5.27 million net inflow a day earlier, turning back to net inflows for the first time in four sessions

공유하기

Summary

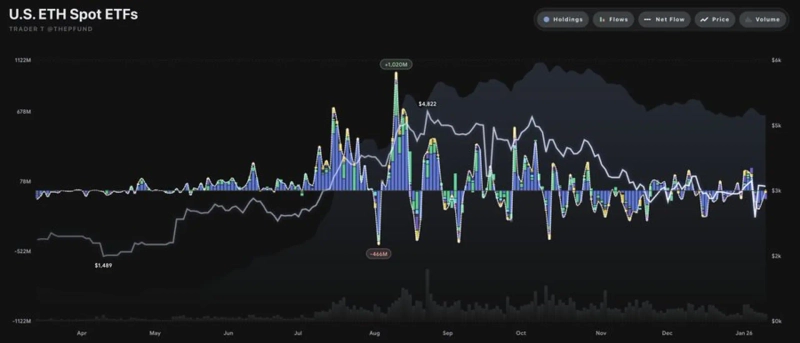

- It said total daily net inflows into US spot Ethereum ETFs came to $5.27 million.

- It noted that BlackRock’s ETHA saw net outflows of $79.65 million, the largest withdrawal.

- It added that net inflows into Grayscale’s ETHE, the Grayscale Mini ETH, and 21Shares’ CETH supported the overall trend.

The US spot Ethereum exchange-traded fund (ETF) market posted a modest net inflow on a daily basis, but fund flows diverged by issuer, mirroring the pattern seen in Bitcoin ETFs.

According to Trader T on the 13th (local time), total daily net inflows into US spot Ethereum (ETH) ETFs came to $5.27 million (about 7.8 billion won) a day earlier. While some large products saw net outflows, inflows into Grayscale-linked products offset them.

By issuer, BlackRock’s ETHA recorded the largest exodus, with net outflows of $79.65 million. In contrast, Grayscale’s ETHE took in $50.67 million, and the Grayscale Mini ETH product also logged net inflows of $29.28 million, supporting the overall trend. 21Shares’ CETH likewise posted net inflows of $4.97 million. The remaining products saw no net inflows or outflows.