Summary

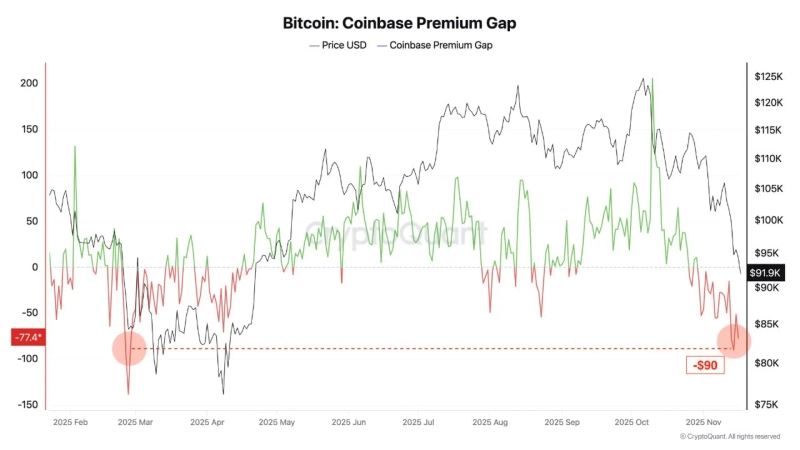

- It reported that in the Bitcoin market the Coinbase premium gap fell to –$90, marking the lowest level so far this year.

- The decline of this indicator suggests that the buying pressure of institutional investors has weakened and market leadership has shifted to retail investors.

- It analyzed that if the premium remains in negative territory, price correction could be prolonged, and whether institutional demand recovers will be key to a trend reversal.

In the Bitcoin market, the Coinbase premium gap fell to –$90, and analysis says institutional buying has weakened and market leadership has shifted to retail investors.

On the 18th (local time), Coinbase author Darkfost said, "The Bitcoin Coinbase premium gap fell to –$90, marking the lowest level so far this year. This figure is the lowest since the period in February when it fell to –$138, at which time institutional investors' buying also sharply weakened."

The Coinbase premium is an indicator that shows the difference between the Bitcoin spot price on Coinbase Pro, which has a high proportion of institutional and professional traders, and Binance, which has an overwhelming number of retail investors. When the premium stays positive it indicates net buying inflows from institutions, but if it falls deeply into negative territory it suggests market leadership has shifted to retail investors. The fact that this indicator has currently fallen to around –$90 can be interpreted to mean that institutions are not engaging in aggressive buying, such as reducing market exposure or increasing hedging levels.

The author analyzed, "With the Coinbase premium remaining in negative territory, the market atmosphere is such that volatility-sensitive retail investors are driving price movements. Accordingly, selling pressure may also be more easily amplified." He added, "If the premium remains in negative territory for a prolonged period, the price correction could be prolonged, and whether institutional demand recovers will be a key factor in judging a trend reversal."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)