Editor's PiCK

Solana surges 7% amid 'ETF rush'…"Secures rebound momentum"

Summary

- It reported that Solana surged more than 7% in a day, driven by ETF launches and inflows of buying pressure.

- The Solana spot ETF in the U.S. has recorded net inflows for 16 consecutive trading days, with cumulative net inflows reaching 420,400,000 dollars.

- There is a view that if 145–170 dollars is breached, further gains are possible, and there is also the potential for about an 80% additional upside to 250 dollars.

Solana, forms a bottom at 130 dollars and rebounds

Buying inflows and new ETF launches influence

"Possible entry into the 170–200 dollar range"

Amid continued adjustments in the cryptocurrency market, Solana (SOL) showed strong resilience, surging about 7% in a single day.

On the 19th (local time), according to CoinMarketCap, Solana rose more than 7% from the previous day, recovering from a low of 129 dollars the day before to around 140 dollars. Buying pressure entered both the spot·futures markets simultaneously, which was cited as the key driver of the rise.

According to on-chain data platform CoinGlass, Solana's futures open interest (OI) was calculated at 7,300,000,000 dollars, a 5% increase over 24 hours. The 8-hour perpetual funding rate also reversed from -0.0001% to 0.0059%. This indicates that demand for long (buy) positions in the futures market is increasing again.

In the spot market, CVD, which represents cumulative buy volume, is also rising, confirming inflows of low-price buying demand. Cointelegraph assessed, "The fact that spot and futures are jointly leading the rise corresponds to a healthy recovery trend."

Institutional demand expansion also bolstered the uptrend. This week, Fidelity and Canary Capital launched Solana spot ETFs one after another, bringing the total number of SOL ETFs in the United States to five. In particular, Fidelity is the largest asset manager among the participating institutions, and analysts say that full-scale competition for institutional capital inflows has begun.

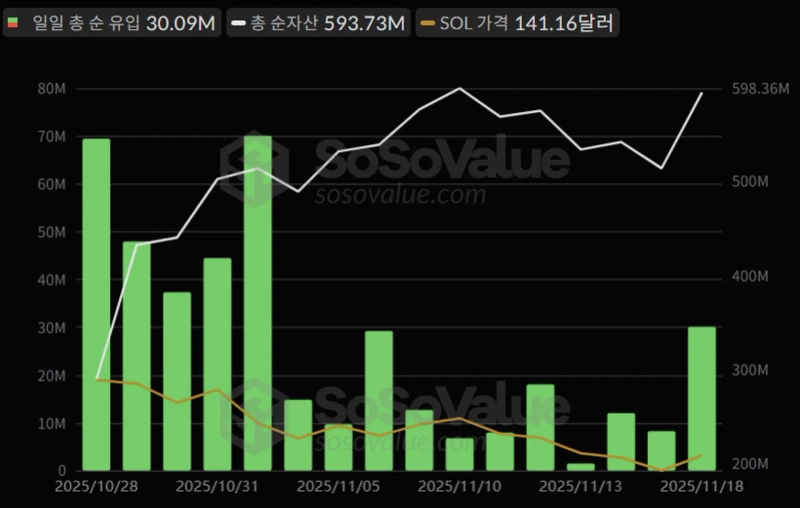

In fact, fund flows are also positive. According to SosoValue's data, the U.S. Solana spot ETF has recorded net inflows for 16 consecutive trading days since launch. On the previous day (17th), an additional 30,090,000 dollars flowed in, and cumulative net inflows reached 420,400,000 dollars.

The short-term price outlook is also favorable. Cointelegraph said, "If the low is confirmed, there is about an 80% additional upside to 250 dollars," and added, "The current mid-160 dollars is a major resistance area, and breaking through this area would likely lead to a trend reversal." However, it also cautioned that "if it fails to surpass that area, there remains the possibility of adjustments resuming."

CoinGape said, "Solana is rebounding after finding strong support at 129 dollars," and predicted, "If it breaks through 145 dollars, recovery to 170 dollars is possible, and thereafter the rise could extend to 200 dollars." FXStreet also evaluated, "Solana has secured rebound momentum at the 130 dollar level," adding, "Whether it breaks the 150 dollar resistance will determine the short-term trend."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)