Summary

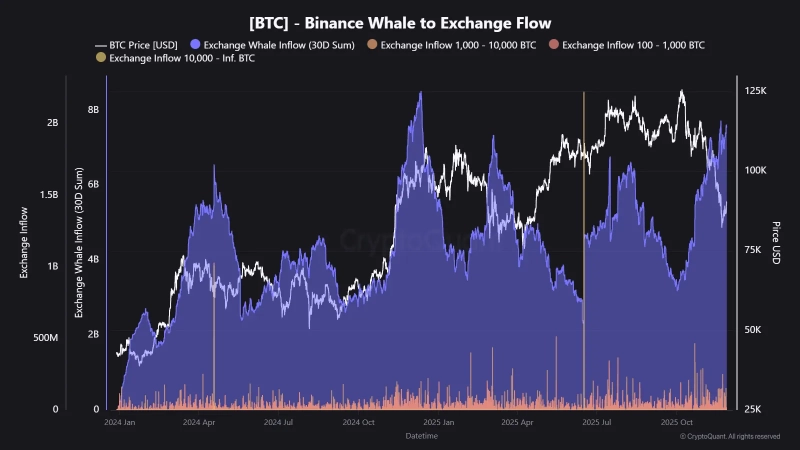

- It reported that whale (large investor) funds flowing into Binance over the past month reached $7.5 billion, the highest level this year.

- Maartunn, a CryptoQuant contributor, analyzed that whale funds mainly move to exchanges for profit-taking or bear-market risk management.

- He said the increase in whales' transfers to exchanges is not a signal of stabilized selling pressure, and that the risk zone has not yet been resolved.

Over the past month, whale (large investor) funds flowing into the world's largest cryptocurrency exchange Binance have reached a year-to-date high.

Maartunn, a CryptoQuant contributor, said on the 28th (local time) through CryptoQuant, "Whale funds flowing into Binance over the past 30 days totaled $7.5 billion (about 11 trillion won)," adding, "It's the highest level so far this year." Maartunn said, "Binance is the largest exchange and a key liquidity provider," and "whales tend to move funds when the market becomes unstable or when the (Bitcoin) price approaches key levels."

Maartunn noted that recent whale fund flows are similar to March this year. He said, "At that time Bitcoin fell from about $102,000 to the low $70,000s," and analyzed, "Whales mainly moved funds to exchanges for profit-taking or to manage bear-market risk." He added, "Even now, the 30-day inflow continues to increase, so it is still difficult to say that selling pressure has stabilized."

He also mentioned future volatility. Maartunn said, "(Whale fund flows) mean that the risk zone has not been completely resolved," and stated, "Large sums moving to exchanges act as a 'pressure indicator,' but are not a signal that clearly indicates the timing of a market reversal." He continued, "In previous similar phases, it took about a month for the market to form a local bottom."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)