Editor's PiCK

CZ "Bitcoin, a future asset that has proven real-world use"… Peter Schiff "Just a decentralized pyramid" direct clash [BBW2025]

Summary

- Changpeng Zhao emphasized Bitcoin's real-world use cases and scalability, stating it has functional value compared to existing financial systems.

- Peter Schiff highlighted gold's intrinsic value, industrial demand, and permanence, pointing out Bitcoin's structural weaknesses.

- The debate saw both sides directly clash over whether tokenized gold or Bitcoin will dominate the future financial paradigm.

Changpeng Zhao vs Peter Schiff

Bitcoin real-world use and scalability debate in Dubai

Schiff emphasized physical demand and permanence of gold, pointing out Bitcoin's structural weaknesses

Tokenized gold vs Bitcoin, direct clash over the future financial paradigm

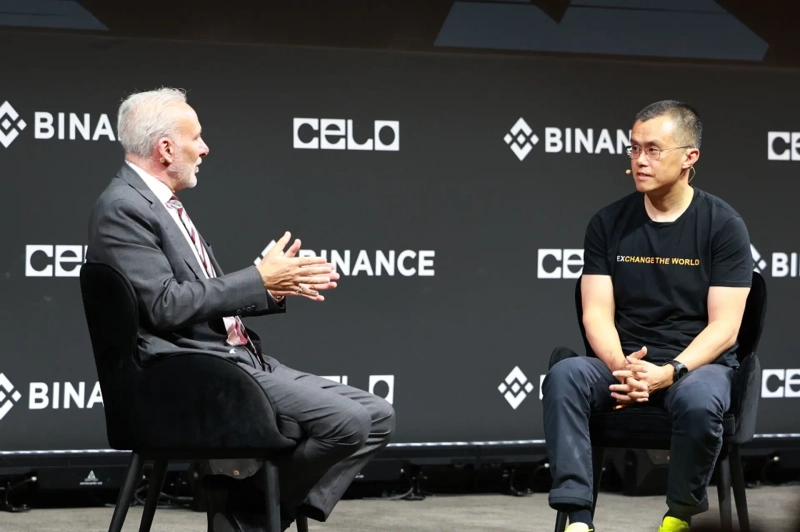

Changpeng Zhao (CZ), founder of global crypto exchange Binance, and Peter Schiff, the most famous gold-standard advocate on Wall Street and CEO of Euro Pacific Capital, held a public debate "Bitcoin vs Gold" on the main stage of Binance Blockchain Week 2025 at the Coca-Cola Arena in Dubai on the 4th (local time). The two revealed fundamental differences in perspective over Bitcoin's real-world use value, industrial demand for gold, and their roles in the future financial structure.

"Bitcoin is already being used in practice"… CZ emphasizes value and scalability

Changpeng Zhao began the debate by picking up a physical gold bar. He emphasized Bitcoin's advantage in mobility and scalability, saying, "Gold is an asset that is difficult to move across borders, but Bitcoin can be transferred in a matter of seconds." He went on, "The claim that Bitcoin has no value because it has no physical form misunderstands the value of the digital age," explaining, "It's similar to internet services having value despite lacking physical form."

Zhao also highlighted real-world use cases of Bitcoin. "One user in Africa used to take three days to pay a utility bill, but now it can be resolved in three minutes," he said, arguing, "Bitcoin serves as a practical alternative in regions unreachable by existing financial systems." These examples were presented as evidence that Bitcoin has functional value beyond being a mere price asset.

Zhao compared Bitcoin to gold tokenization projects, arguing, "Tokenized gold ultimately requires trusting a third party, but Bitcoin's trust is established solely by network consensus." He added, "A user base that has grown to hundreds of millions shows Bitcoin's practical scalability," emphasizing, "It has already secured network effects that gold cannot provide."

"Bitcoin is a record with no substance"… Schiff highlights gold's intrinsic value and demand structure

Peter Schiff strongly criticized Bitcoin's lack of substance. He stated, "Even if you transfer Bitcoin, nothing physically moves and only records change," and emphasized, "By contrast, gold is a material-based asset with real-world demand in electricity, semiconductors, and medical fields." He cited scarcity and permanence, saying, "Gold does not corrode and maintains the same utility for thousands of years."

He also mentioned central bank buying flows. "Gold is used as a reserve asset to defend the value of national currencies," he said, "and unlike Bitcoin, it has structural demand." Schiff claimed, "Bitcoin fell 40% against gold over four years," arguing that the price trend reflects a lack of value.

The debate over payment use continued. Schiff said, "Even if Bitcoin is used for payments, it ultimately needs to be sold and converted into fiat currency," calling it "a speculative asset, not a currency." He evaluated, "Bitcoin is structured to rely solely on expectations of price increases and is closer to a decentralized form of a pyramid."

'The future of usability and trust'… Tokenized gold vs Bitcoin clash

The discussion expanded to what positions gold and Bitcoin will hold in future financial systems. Zhao said, "Bitcoin is a new financial structure that can transfer assets without third-party trust," predicting, "What matters to users is not the internal technology but speed, efficiency, and accessibility. The digital-native generation is beginning to accept Bitcoin as a more intuitive asset than physical gold."

Schiff argued that tokenized gold is more suitable for future monetary structures. He countered, "Gold-backed tokens provide a clear asset base in the ownership of physical gold," and said, "In terms of stability and predictability, digital gold will surpass Bitcoin." He added, "Crypto can be issued infinitely, but gold is physically supply-limited."

Zhao rebutted Schiff's point, saying, "Bitcoin is an asset with a fixed issuance amount," and emphasized, "The current scale of the user base and global transfer efficiency are levels gold cannot match," stressing, "Bitcoin is not merely a substitute but a new form of foundational financial technology."

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)