CoreWeave pursues $2 billion convertible bonds…secures funds to expand AI infrastructure

Summary

- CoreWeave said it is issuing $2 billion in convertible bonds to expand AI data centers and secure liquidity.

- It said the convertible bond will be paired with a capped-call structure to minimize shareholder equity dilution and increase financial flexibility.

- After the convertible bond news, CoreWeave's stock price fell more than 9% and reflected short-term investor concerns.

AI infrastructure company CoreWeave is raising $2 billion through convertible bonds maturing in 2031 to strengthen its AI data center expansion strategy. The company appears to have chosen a balanced growth strategy by securing liquidity and financial flexibility while implementing a structure that limits dilution of existing shareholders' stakes that could occur upon future conversion.

On the 8th (local time), CoreWeave announced it will privately place $2 billion in convertible bonds and offer investors an option to purchase an additional $300 million. The convertible bonds are structured so that the company can repay in cash, stock, or a combination of both at its option.

The company also employed a capped-call structure alongside the convertible bond issuance. This is interpreted as a hedging strategy that effectively raises the conversion price to reduce potential share dilution upon future conversion, a measure intended to protect existing shareholders while securing flexibility in financial strategy.

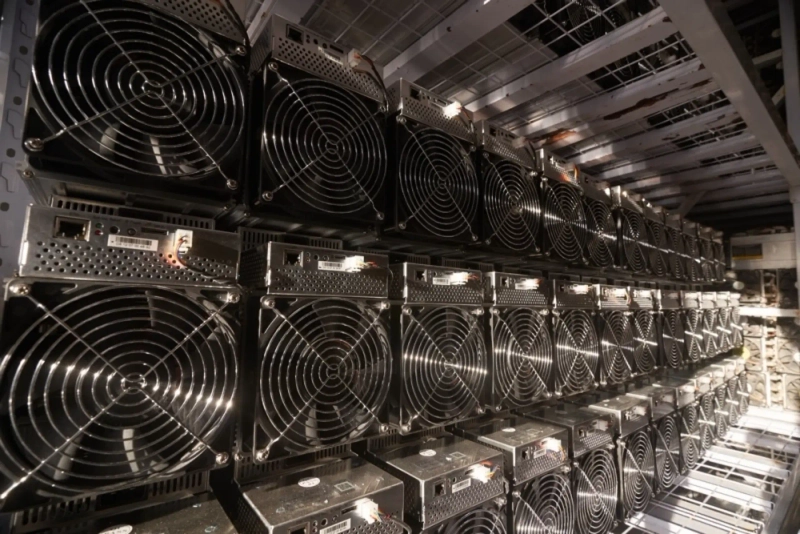

CoreWeave started in 2017 as an Ethereum mining company, shifted to cloud and high-performance computing (HPC) services in 2019, and has since built a data center network optimized for GPU-based AI computing. It is reported to operate more than 33 AI-focused data centers, and it did not disclose the specific uses of the funds raised.

Meanwhile, CoreWeave's stock fell more than 9% immediately after the convertible bond issuance news, reflecting short-term investor concerns.

CoreWeave recently pursued a $9 billion acquisition of Core Scientific, but the deal was canceled due to shareholder opposition. The company explained that the acquisition attempt was a strategic decision to secure approximately 1.3 gigawatts of power infrastructure owned by Core Scientific, not a move to return to the cryptocurrency business. CoreWeave had pursued the acquisition for more than a year since its initial proposal in June 2024, and it is reported that a rise in Core Scientific's stock price, which raised the required acquisition price, also affected the ultimate cancellation.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)