Saylor: "A national-level Bitcoin-backed digital bank model could attract more than $20 trillion in capital"

Summary

- Michael Saylor said that adopting a national-level Bitcoin-backed digital bank model could enable the inflow of more than $20 trillion in capital.

- Saylor said that combining high-yield, low-volatility digital deposits with a Bitcoin overcollateralization structure could result in large capital movements.

- Experts raised doubts about the model's stability due to Bitcoin's volatility and liquidity risks.

Michael Saylor, CEO of Strategy, which holds Bitcoin at scale, argued that a national-level Bitcoin-collateralized digital banking system should be established. He said that if regulated banks can offer deposit products with high yields and low volatility, capital on the order of tens of trillions of dollars could move.

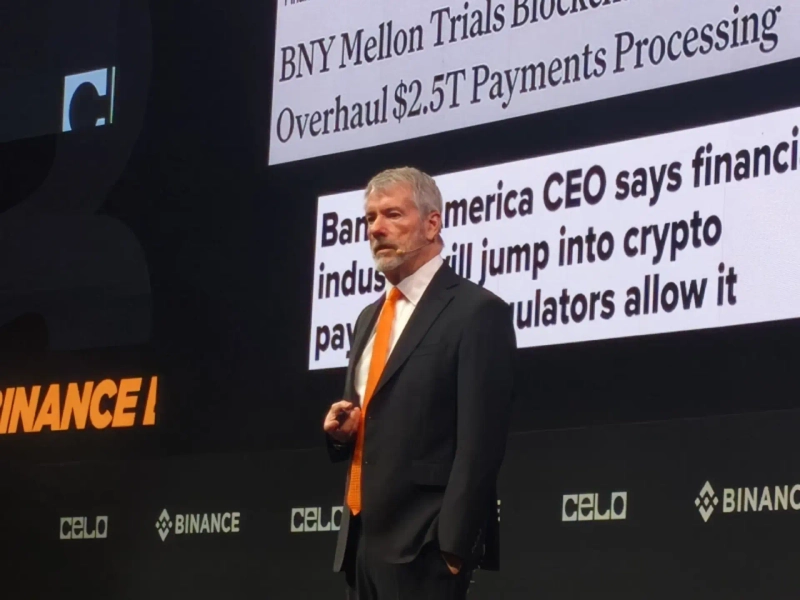

According to Cointelegraph on the 8th (local time), Saylor said at a Bitcoin MENA event in Abu Dhabi that governments could hold Bitcoin in an overcollateralized form (over-collateral) and combine it with tokenized credit products to offer regulated high-yield digital deposit accounts. He cited the fact that bank deposit rates in major countries such as Japan, Europe, and Switzerland are effectively close to zero, and that money market fund yields are only about 150bp in the eurozone and about 400bp in the United States.

Saylor also pointed out that investors move into the corporate bond market instead of bank deposits because deposit yields are excessively low.

He proposed a structure combining about 80% digital credit products, 20% fiat currency, and an additional 10% buffer capital to reduce volatility. He analyzed that if such a product were offered by regulated banks, depositors would be highly likely to shift large amounts of capital in search of higher yields. Saylor said the structure could be stably managed by sovereign wealth fund–type financial institutions based on roughly 5:1 overcollateralization.

Saylor argued that if a country adopts this model, it could attract between $20 trillion and $50 trillion in capital and become the "world's digital banking capital."

The remarks came shortly after Strategy announced it had newly purchased 10,624 BTC for about $962.7 million. The company's Bitcoin holdings total 660,624, representing approximately $49.35 billion on a purchase-price basis. The average purchase price is estimated at $74,696.

Some say Saylor's proposed Bitcoin-based high-yield deposit model is similar in structure to Strategy's STRC preferred share product launched in July. STRC is a money-market-type product that provides variable-rate dividends and offers about 10% yield, and its market size has expanded to about $2.9 billion. The product is designed to maintain stable pricing based on a Bitcoin-related financial operations structure.

However, Bitcoin's high short-term volatility has been pointed out as a key factor questioning the stability of high-yield collateral models. Recently, Bitcoin has been trading at around $90,700, down about 9% over the past year, and about 28% lower than the $126,080 recorded on October 6. On the other hand, the cumulative five-year gain is 1155%.

There are also skeptical views from experts. Josh Mann, a former Salomon Brothers bond and derivatives trader, pointed out that the STRC model is vulnerable to liquidity squeezes, saying that while regulated banking systems have long maintained the stability of demand deposits, tokenized products are difficult to defend against bank-run risks solely through interest rate adjustments.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)