Editor's PiCK

Bitcoin ahead of FOMC, $90,000 watershed…Is a rebound signal emerging? [Kang Min-seung's Trade Now]

Summary

- Experts said Bitcoin is seeking direction in the $90,000–$92,000 resistance zone, and that the FOMC rate decision and dot plot are expected to be a short-term turning point.

- Net outflows from spot exchange-traded funds (ETFs) and a liquidity slowdown are supporting the weak trend, and it was analyzed that a long-term accumulation trend is being maintained despite short-term sentiment deterioration.

- If Bitcoin maintains support at $90,000 the mid-term uptrend could continue, but if it falls the mid-term trend could be broken depending on whether it breaches $80,000.

Bitcoin (BTC) is continuing to move uneasily amid policy uncertainty ahead of the U.S. Federal Open Market Committee (FOMC) regular meeting in December. The virtual assets (cryptocurrencies) market is showing relative weakness due to net outflows from spot exchange-traded funds (ETFs) and a slowdown in liquidity.

Experts say Bitcoin has entered a range where it is seeking direction between $90,000 and $92,000 resistance. While the view that the mid-term trend remains valid if the $90,000 support holds is dominant, it is expected that the FOMC rate decision and the dot plot will be a short-term turning point.

As of 18:05 on the 9th, on Binance USDT markets Bitcoin was trading at $90,365, down 1.59% from the previous day (based on Upbit: 134,310,000 won). At the same time, the kimchi premium (the price difference between overseas exchanges and domestic exchanges) was 1.23%.

BOJ signals rate normalization · FOMC caution…Risk assets show mixed directions

Global stock markets are showing a gradual rebound, while the virtual assets (cryptocurrencies) market is relatively weak. The Bank of Japan's signal of possible rate normalization and policy uncertainty ahead of this week's U.S. FOMC meeting have combined so that risk assets overall have not formed a clear trend.

Recent U.S. inflation indicators did not dramatically shake the direction of rate policy. The U.S. Commerce Department's September Personal Consumption Expenditures (PCE) price index rose 2.8% year-on-year, marking the highest level in 1 year and 6 months, but was generally considered to have remained within expected ranges. However, some point out that uncertainty for this FOMC is higher than in the past because the federal government shutdown (temporary suspension of operations) lengthened statistical gaps.

Earlier, the Bank of Japan (BOJ) hinted at the possibility of a December rate hike, increasing volatility in global financial markets. Although the immediate shock has calmed, if Japan moves away from easing and enters a rate normalization phase, global liquidity structure could change. Japan's rate decision is scheduled for the 19th.

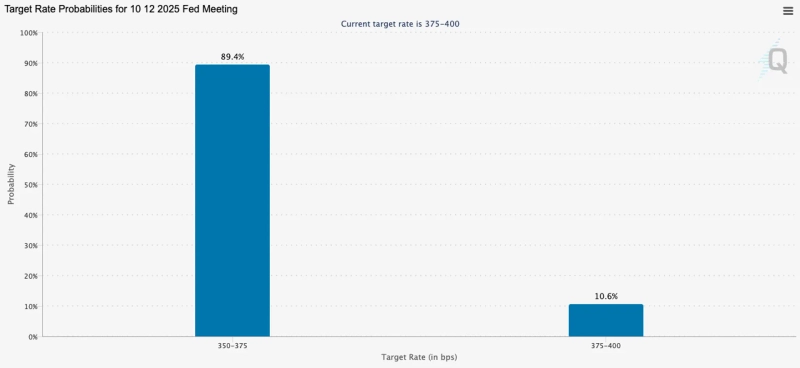

Market attention is converging on the December FOMC regular meeting. On Wall Street, the key variables are expected to be how quickly next year's rate cuts are presented in the dot plot to be released at this meeting and whether Chair Powell will mention the possibility of additional rate cuts. According to the Chicago Mercantile Exchange (CME) FedWatch, the market prices an 89.4% probability that the Fed will cut the policy rate by 0.25 percentage points on the 10th (Korean time: 04:00 on the 11th).

Meanwhile, the market is also focused on the next Fed chair appointment. Kevin Hassett, chair of the White House National Economic Council (NEC), who is cited as a leading candidate, has repeatedly emphasized the need for rate cuts. In addition, moves by the Trump administration to expand influence by seeking to change selection criteria for regional Federal Reserve presidents have been spotted, leading to expectations that future monetary policy could tilt toward easing.

ETF net outflows, liquidity slowdown…MSCI delisting risk adds pressure

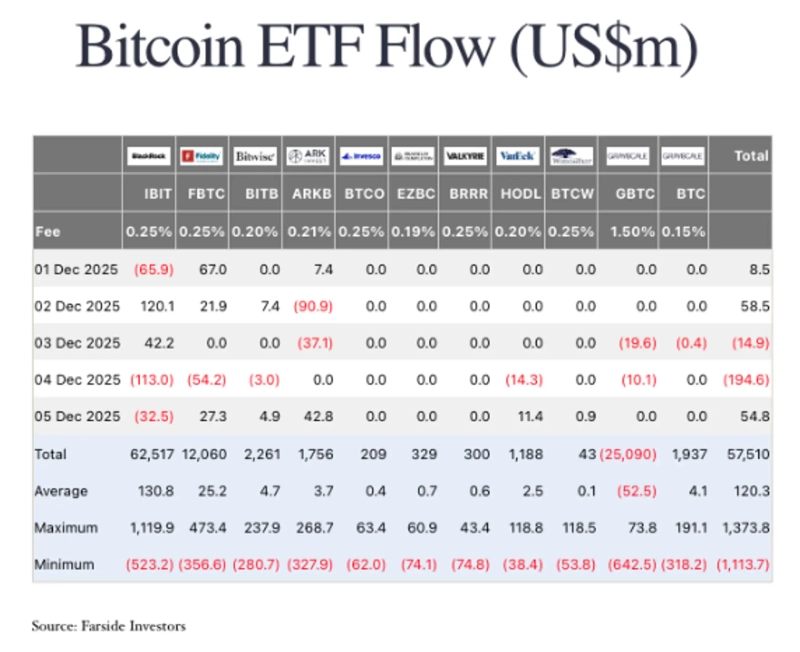

Spot Bitcoin exchange-traded funds (ETFs) saw net outflows of $87.7 million last week (1–5), and clear buying momentum has not been confirmed. Strategy's possible MSCI index exclusion acted as a short-term burden, while global asset manager Vanguard allowing trading of virtual asset ETFs was interpreted as a positive signal.

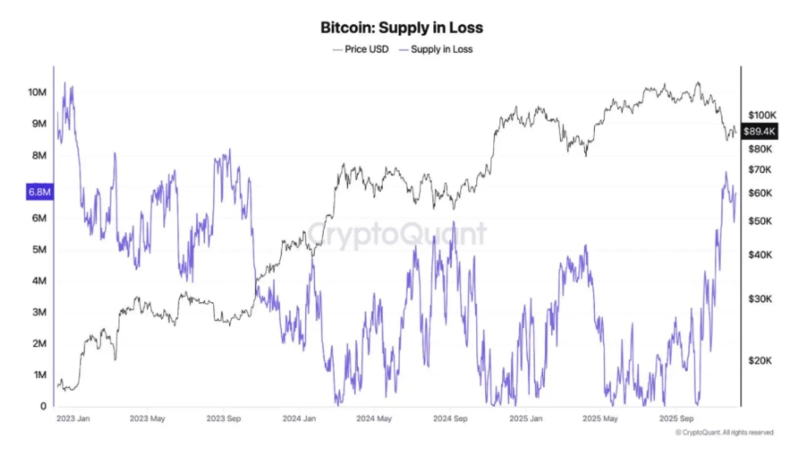

Global crypto exchange Bitfinex said in a weekly report that "unlike equities, Bitcoin's relative weakness is prominent and it still remains in the $84,000–$91,000 range. About 7,000,000 BTC remain at unrealized losses, indicating the market has not recovered clear reversal momentum." It added, "With weakening spot demand, ETF net outflows continue, and even in rising periods 'selling into strength' predominates over accumulation."

Market liquidity is also rapidly thinning ahead of year-end. Singapore-based QCP Capital said in a research note on the 8th that "Bitcoin showed excessive volatility between $88,000 and $92,000 last weekend," and "liquidity has weakened to the extent that prices move significantly on small orders." On the other hand, supply of Bitcoin on exchanges is declining. About 25,000 BTC have been net withdrawn over the past two weeks, and ETF and corporate holdings have for the first time exceeded exchange reserves. Despite short-term sentiment deterioration, it is argued that a long-term accumulation trend is being maintained.

Moreover, selling pressure from long-term holders (LTH) is gradually easing. On-chain analytics firm Glassnode reported that LTH holdings fell from 14,760,000 BTC in July to 14,330,000 BTC last month, marking the lowest level since March this year. This declining trend coincides with the time Bitcoin formed a bottom near $80,000 and is interpreted as linked to the subsequent rebound toward the $90,000 level.

Meanwhile, on Wall Street warnings are mounting that Strategy could be removed from the MSCI index. The investment industry says that if excluded from the index, tens of billions of dollars in selling pressure could occur, including about $2.8 billion in passive funds. On exclusion, automatic selling by index-tracking funds could reduce liquidity and worsen financing conditions. This burden could also add pressure to the financial structures of companies that hold coins as 'Digital Asset Treasury (DAT)'. The final decision is scheduled to be announced on January 15 next year.

Earlier, Pong Li, CEO of Strategy, said on the 29th of last month that "if Strategy's mNAV (market-value-to-net-asset ratio) falls below 1x, we may sell Bitcoin to secure preferred dividend payments," but added that "this would be close to a last resort." According to the company's filing that day, Strategy's mNAV is estimated to be about 1.17.

$90,000 resistance/support battle…Short-term direction will be decided by the FOMC

Bitcoin faced stronger selling pressure around $92,500, breaking the short-term rebound, while it is reconfirming support around $90,000. Experts say that despite short-term corrections, the mid-term trend is maintained as long as the $80,000 support holds.

Aayushi Jindal, a researcher at NewsBTC, analyzed that "the $91,200–$92,000 zone is acting as short-term resistance for Bitcoin, and breaking this zone could revive upward momentum." He added, "Conversely, if the $90,000 support breaks, it could retreat to $89,500 and then $88,800," and warned, "if it falls below $86,500, the downside could widen further."

Katie Stockton, founder of Fairlead Strategies, said, "The current correction in Bitcoin is more than 30% from the October peak and is approaching oversold territory," and diagnosed that "the recent decline is excessive, so a short-term retracement signal may be detected." She said, "If a short-term reversal signal appears, Bitcoin could hold the long-term support of $80,600," but added that "with global risk-off sentiment strengthened, short-term volatility may be hard to calm quickly."

Bob Mason, an analyst at FXPro, also evaluated that "recent corrections have pushed Bitcoin below the 50-day and 200-day supports, but fundamentals still suggest a potential rebound." He said, "If Bitcoin breaks above the $94,447 resistance, the psychological pivot of $100,000 could reopen," but warned that "if $80,000 fails, the mid-term bullish trend could be broken."

He added, "If the Fed announces a dovish (monetary easing–leaning) rate cut and next year's dot plot presents a dovish outlook, Bitcoin is more likely to attempt a recovery to $100,000."

Minseung Kang, BloomingBit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)